Repay your loan

About repaying your loan

Repayment of your Square loan starts on the repayment start date specified in your loan agreement. A fixed percentage of your business’s daily card sales is automatically deducted and applied toward your loan balance until your loan is repaid in full.

We take your business’s Square payment processing volume, account history, and payment frequency into account when determining loan offers. Square loans are designed to be paid back within 12 months if your business’s payment processing does not change based on our initial estimations.

If there hasn’t been any changes to your business and you maintain regular processing volume through Square, making your minimum payments on time shouldn’t be an issue. We encourage you to review the minimum loan payment requirements so you know what to expect if your business’s card sales change during repayment.

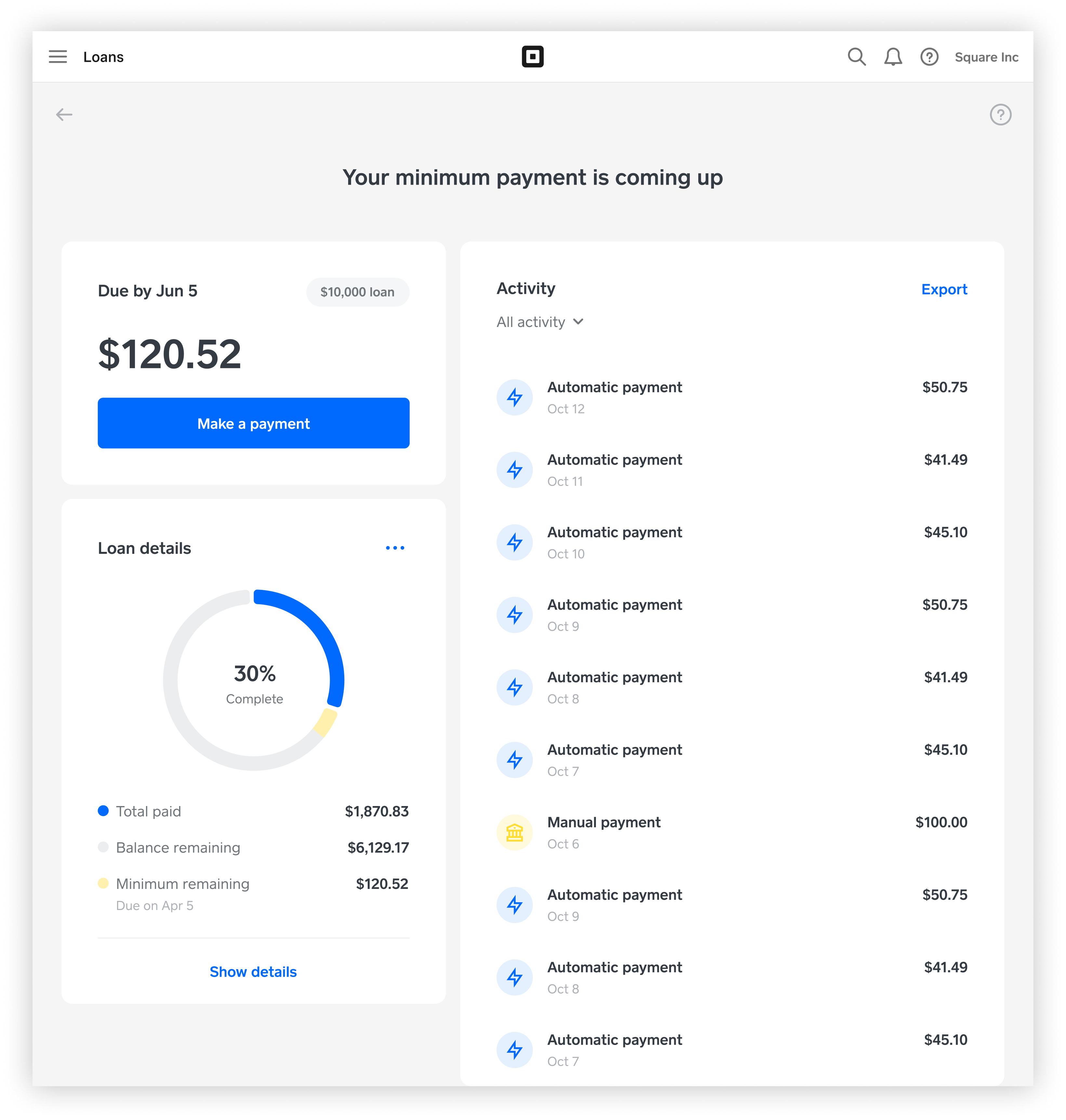

Numbers are for illustrative purposes only

Before you begin

Keep the following in mind regarding the repayment of your loan:

There are no ongoing loan interest charges. You’ll pay one fixed loan fee to borrow the loan, which is the difference between the total owed amount and the initial loan amount. This is not an interest rate, and the fixed fee will never change regardless of how quickly or slowly the loan is repaid.

Your repayment rate is determined on your business’s card processing, your offer size, and other business factors. It’s designed to help your business stay on track with paying back the loan within a year. You can adjust the repayment rate of your offer by changing the loan offer amount prior to applying for the loan. Your repayment rate applies in addition to Square’s processing fees for these transactions.

Making a payment will not disable your repayment rate, and this rate can’t be adjusted once your loan is accepted. The repayment rate will continue to be applied until the loan is repaid in full.

If your daily sales don’t cover the minimum payment, Square will debit the remaining minimum payment from your Square-linked bank account.

You can make additional payments to your loan at any time at no additional cost. The cost of your loan does not change by making prepayments.

Loan maturity is 18 months from origination, which is the date your loan is due in full. If you make the minimum payment of 1/18th of your initial loan balance every 60 days, you’ll only pay down half your total loan balance in 18 months. You’ll owe the remaining balance upon the loan maturity date. At that point, Square will debit your linked bank account for the remaining balance.

The loan fee that is added on top of your Square Loan is GST exclusive. This rate applies to your total card sales, including tips and taxes. It does not include processing fees.

All payments are final and will not be refunded. If a payment is submitted the same day that you are debited for your minimum payment, the debited funds will be applied to the past due balance and the payment you initiated will be applied to your remaining loan balance.

After you’ve finished paying off your loan, the Square loans team will discharge the secured interest. If you have completed paying off your loan, yet find that the secured interest has not been discharged, contact the Square Loans Team with a request to remove the registered secured interest. We only file secured interests on loan amounts above $75,000.

Submit a loan payment

Sign in to Square Dashboard and go to Money > Loans.

You’ll see an overview of prior payments, how much you have left to cover of your current balance, and a breakdown of each payment.

Click Make a payment and provide the desired payment amount.

Review and confirm your payment.

When you submit a prepayment, Square may first apply any pending funds from your card sales and then debit any remaining amount from your linked bank account. A debit will only be initiated if the pending funds don’t cover the entire prepayment.

If you fully prepay your loan, your business’s loan eligibility will be re-evaluated. We can’t guarantee that you’ll receive a new offer after you make an additional payment or pay off your loan.

It can take up to 10 business days for payment confirmation and for your account to be evaluated for new loan offers, during which time you will not have any loan offers visible in Square Dashboard. If you had a Square loan offer prior to paying off your loan, submitting a prepayment will expire any existing offers.

If you need a loan payoff statement, contact the Square Loans Team so this can be provided to you.

Add multiple business locations or accounts to repay a loan

Upon loan approval, the loan is tied to the specific account location that applied for the loan. If you have multiple locations, you may have the option to add additional Square locations as payers towards the loan. The repayment rate will apply to the other locations’ daily card sales and sales you process at your locations will go towards paying down the loan balance.

Additionally, each individual Square account is tied to a unique email address. If your business begins to take payments while logged into another Square account, your card sales on that account don’t automatically go towards the repayment of your loan. If you want to continue processing on another Square account, you may have the option of adding that account as a payer toward your loan.

If you would like us to link more of your locations or accounts to your loan, contact the Square Loans Team.

Apply for financial hardship

Financial hardship encompasses situations where individuals or businesses are unable to meet financial obligations or face significant adverse events affecting operations. Common events that may cause financial hardship include:

Cash flow constraints

Unexpected expenses

Death of a family member

Illness or injury to yourself or to your family member

A decrease in business activity

Domestic violence

Divorce or separation with your partner

Natural disaster

If any of the events listed above apply to yourself or any other reasons that may cause financial hardship, contact the Square Loans Team as soon as possible so we can get a better understanding of your situation.

Applying for financial hardship at Square doesn’t affect your credit rating, and there are no fees or costs when applying aside from the fee you already agreed to on your loan.

If you are still not satisfied with Square’s response, you can file a complaint via our Complaints Policy.

Credit reference and refinance

You can contact the Square Loans Team if you’d like a payoff statement. You can also sign in to Square Dashboard to view your outstanding balance.