View your loan reports

About loan reporting

Reports for your loan show your daily card sales, loan payments and outstanding loan balance and are available in the Loans tab of Square Dashboard.

Before you begin

You'll receive a daily email showing a detailed payment summary and your outstanding balance.

Square does not provide tax advice and this information is not intended to be tax advice. This information is intended to be a general guide to the subject matter. For more information on how Square Loans affect your tax reporting, please consult with a tax adviser.

Square Loans don't impact your credit score, either negatively or positively, and credit references aren't provided. We can provide a letter of completion after full repayment of your loan upon request, but you won’t see an impact on your credit score. If you'd like to request a letter of completion, please contact the Square Loans Team.

With a Square loan, payments are a fixed percentage of your business's daily sales and will vary with the amount your business processes daily. This repayment percentage is not an interest rate, and there are no ongoing interest charges for your loan.

Square loan payments are first deducted from your Square balance, and any remaining amount will be debited from your linked bank account.

View and download your loan repayment history

- Sign in to Square Dashboard and click Money > Loans.

- Click the loan you want to view > All activity.

- Select the date range you’d like to view or enter custom dates.

- A summary of your loan payments will populate for the date range selected.

- Sign in to Square Dashboard and click Money > Balance.

- Select Transfer Reports and click the date-selector tool to choose the date range you’d like to view.

- Click Export.

Correlate loan reports with sales reports

The cut-off time for your loans report is specified in your email, while the cut-off time for your sales report is 12:00 am - 12:00 am the following day. Your sales and withholdings will reflect on each respective report based on these cut-off times.

If you want to sync up the cut-off times for your reports, you can adjust the sales report time window. To do so:

Sign in to Square Dashboard and click Reporting > Transactions.

Change the All Day filter to Custom and specify your report in hours to the cut off time specified in your Loans Report.

Change All Payment Methods to Card. If you have Afterpay transactions, select All Payment Methods but deduct any cash payments received.

Use the date selector to refine a date range, then select a report to view. Click the middle of the date selector to see a full calendar view.

Select the location associated with your loan under Locations.

Transactions that settle on or around the loans report cutoff time may still show in the following day’s loan report.

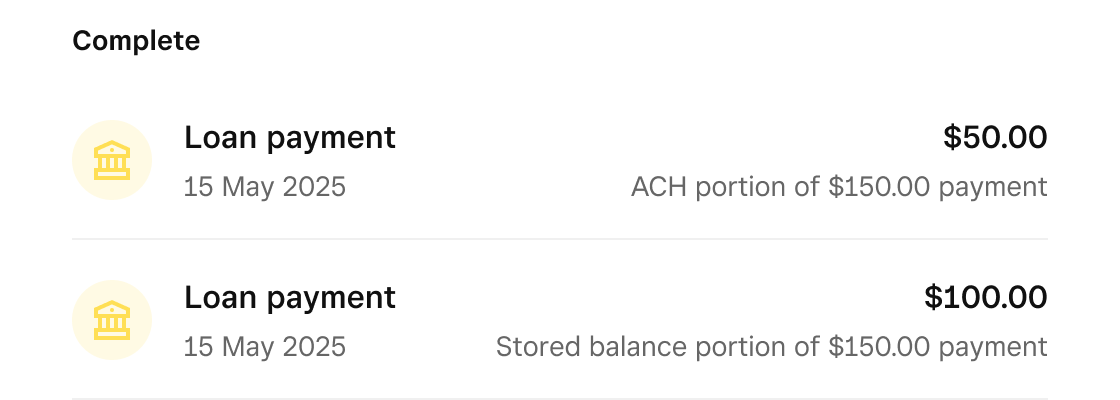

Additionally, Square loan payments are first deducted from your Square balance, and any remaining amount will be debited from your linked bank account. You may see two activities in your for a single loan payment if it was deducted partially from both your balance and your linked bank account:

$100 on 15 May 2025 from the Square balance

$50 on 15 May 2025 from the linked bank account

Review fixed loan fees

The total cost of the loan is a fixed fee, which is the difference between total owed and loan amount. The actual loan amounts and payback percentages vary for each loan through Square. Here’s an example:

Square loan offer amount that was deposited to your account: $10,000

Fixed fee: $1,200

Total amount owed: $11,200

Percentage of your business’s daily card sales that go towards payment: 11%

Following the example above, Square would collect 11% of your business’s daily card payments until you’ve repaid $11,200 in full.