Revisar y cargar documentos para la solicitud de préstamo

Acerca de la documentación para la solicitud de préstamo

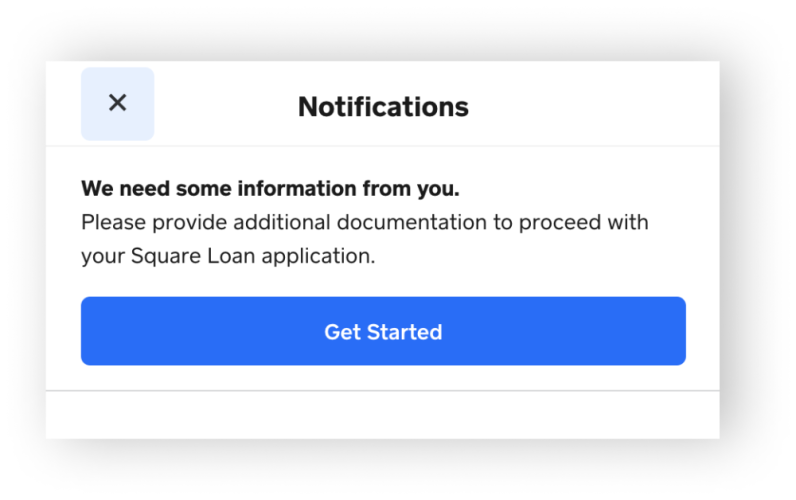

Al solicitar un Préstamo Square, el nombre de tu negocio y la información del contribuyente se utilizarán para verificarte a ti y a tu negocio. Se te notificará sobre el estado de tu solicitud dentro de uno a tres días hábiles. Si no recibes una decisión dentro de este plazo, es posible que se requiera información adicional para verificar los datos personales o comerciales. Si es así, nos pondremos en contacto contigo a través de tu Panel de Datos Square y por correo electrónico para proporcionarte documentación adicional.

Antes de comenzar

Si se solicita documentación adicional para tu solicitud de préstamo, la información es necesaria para que tu solicitud avance. Tu solicitud de préstamo no puede ser revisada si la solicitud está incompleta.

Completa la solicitud en su totalidad de la mejor manera posible. Si la información enviada no es suficiente, nos pondremos en contacto contigo por correo electrónico y el Panel de Datos Square con detalles adicionales.

Los Préstamos Square están suscritos y emitidos por Square Financial Services, un banco industrial con sede en Utah, Member FDIC.

Revisar documentos de solicitud aceptados

Si no logramos verificar tu nombre legal, número de seguro social o fecha de nacimiento, es posible que solicitemos lo siguiente:

- Una identificación emitida por el gobierno, como licencia de conducir o pasaporte

- Tarjeta de seguro social

- Una declaración de impuestos personal reciente

- Carta con el número de identificación personal del contribuyente (ITIN) del IRS

Si no tienes una identificación con foto emitida por el gobierno para verificar tu fecha de nacimiento, puedes enviar uno de los siguientes documentos:

- Acta de nacimiento

- Carta ITIN

- Certificado de naturalización estadounidense (Formulario N-550)

- Documento de autorización de empleo (I-668B o I-766)

- Cartilla militar

- Identificación con foto emitida por una tribu nativa

- Tarjetas de viajero de confianza del DHS

Si no puedes enviar una copia de tu tarjeta de seguro social, puedes enviar uno de los siguientes documentos junto con tu identificación emitida por el gobierno:

- La declaración de impuestos personal más reciente

- Carta con el número de identificación personal de contribuyente (ITIN) del IRS

- Formulario de impuestos W-2

- Documentos de baja militar

- Carta de beneficios de desempleo

Asegúrate de que el documento muestre claramente tu nombre legal completo y tu número de seguro social.

Al solicitar un Préstamo Square, debes proporcionar tu TIN para fines de verificación del negocio. Proporciona la siguiente documentación según tu tipo de negocio:

- Propietario único: Número de seguro social (SSN) o número de identificación personal de contribuyente (ITIN).

- Empresa de responsabilidad limitada, sociedad, corporación tipo C o tipo S: Número de identificación del empleador (EIN).

- Sociedad de responsabilidad limitada (LLC) de un solo miembro: El número de seguro social del propietario del negocio o el número de identificación del empleador (EIN) del negocio.

Si no logramos verificar el nombre legal de tu negocio o el número de identificación de contribuyente (TIN), es posible que te solicitemos uno de los siguientes documentos:

- El Formulario SS-4 de tu negocio emitido por el gobierno o carta de confirmación del EIN

- Tu declaración personal de impuestos más reciente en la que se confirme el nombre del negocio y el número de identificación de contribuyente (TIN)

- Documentos de la Secretaría del Estado con el TIN de tu negocio

Si no encuentras la carta de confirmación del Formulario SS-4, llama al IRS y comunícate con la Business and Specialty Tax Line (línea para negocios y especialidades) al (800) 829-4933. Para más recomendaciones, visita IRS en línea.

Si eres una Sociedad de responsabilidad limitada (LLC) de un solo miembro y no tienes un EIN, aclara tu tipo de entidad en la solicitud de información y envía una copia de tu Anexo C más reciente (Formulario 1040).

Si eres propietario único, el nombre de tu negocio es el mismo que tu nombre y apellido, y tu TIN es tu número de seguro social. Algunos propietarios únicos también pueden registrar el nombre comercial (haciendo negocios como). Si tienes un nombre comercial, se te pedirá que lo proporciones en la aplicación. Puedes encontrar tu tipo de entidad comercial en tus declaraciones de impuestos.

Dependiendo de tu tipo de negocio, es posible que sea necesario verificar a los propietarios beneficiarios o gerentes comerciales que forman parte de tu negocio. Si no se puede verificar la información proporcionada sobre alguno de los beneficiarios o gerentes comerciales de la lista, se puede solicitar uno o más de los siguientes documentos:

- Tarjeta de seguro social

- Una declaración de impuestos personal reciente

- Pasaporte

- Carta con el número de identificación personal del contribuyente (ITIN) del IRS

Si se necesita información adicional sobre tu negocio, puedes enviar uno de los siguientes documentos:

- Actas constitutivas de la sociedad

- Declaración de impuestos

- Actas de organización

- Registro del negocio en la Secretaría del Estado

- Licencia comercial

Si eres un único propietario, es posible que se te solicite que envíes una copia de una identificación emitida por el gobierno y tu tarjeta de seguro social.

Si no podemos verificar la dirección del negocio, es posible que se solicite una factura de los servicios públicos de tu negocio. El documento debe incluir el nombre del solicitante o nombre del negocio y un domicilio completo (dirección, ciudad, estado y código ZIP).

Si no puedes proporcionar una factura de servicios públicos, puedes presentar una declaración de impuestos del negocio, un contrato de arrendamiento, un estado de cuenta bancaria, una factura, documentos judiciales como una citación de servicio de jurado, una identificación tribal o cualquier otro documento emitido por el gobierno.

No podemos aceptar apartados de correo ni direcciones internacionales.

Si se solicitan documentos adicionales para verificar tu cuenta bancaria vinculada a Square, puedes enviar una copia de tu estado de cuenta bancaria más reciente que muestre tu nombre completo, los últimos tres dígitos de tu cuenta bancaria y las transacciones bancarias actuales.

Si abriste recientemente una nueva cuenta bancaria, puedes enviar una carta o documento de confirmación que muestre la apertura de la cuenta y que muestre el nombre de la empresa, el nombre del propietario de la cuenta y el número de cuenta.

Si eres único propietario, el nombre del propietario de la cuenta bancaria debe coincidir con el nombre del solicitante del préstamo.

Si te solicitamos información adicional sobre una transacción, puedes presentar uno de los siguientes documentos:

- Factura

- Contrato de servicio

- Orden de compra

- Formulario de autorización de tarjeta de crédito firmado

- Recibo detallado

- Comprobante de venta

- Correspondencia por correo electrónico con el comprador

Si no cuentas con ninguno de estos documentos, proporciona una descripción detallada de los productos o los servicios vendidos.

Una declaración de financiamiento del Código Comercial Uniforme (UCC, por su sigla en inglés) es un aviso de que un prestamista tiene en garantía prendaria uno o más de tus activos. Si se te solicita que proporciones información adicional sobre un gravamen de UCC, te proporcionaremos la fecha, el número de registro y el nombre de la parte asegurada. Si te solicitamos información adicional sobre un gravamen de UCC, podrás presentar uno de los siguientes documentos:

- Estados de cuenta de los pagos en los que se indique el estado actual del préstamo o la obligación subyacente

- Una carta de la parte garantizada que manifieste que el comercio está al día con el pago.

- Una carta del beneficiario del gravamen en la que se exprese que el préstamo se cubrió.

- Una declaración de rescisión del UCC (UCC-3).

Las instituciones a veces usarán un tercero para presentar, rastrear y mantener posiciones de gravamen como agente registrado de la institución. Corporation Services Company es un representante externo común. Si no estás seguro de en nombre de qué institución está actuando el tercero, lo más recomendable es comunicarte directamente con el tercero.

Cargar documentos para la solicitud

- Inicia sesión en el Panel de Datos Square y ve a Banca > Préstamos.

- Haz clic en Iniciar para cargar los artículos solicitados.