Review and upload loan application documents

About loan application documentation

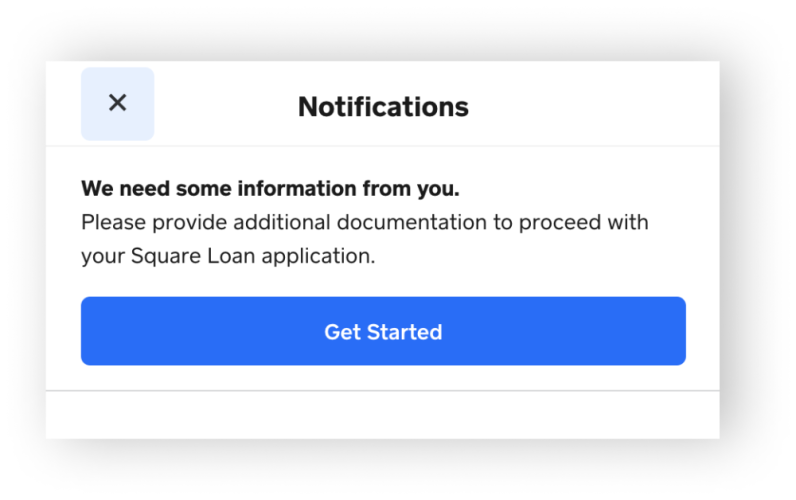

When applying for a Square loan, your business name and identity will be used to verify you and your business. However, additional information may be required to verify personal or business details. If so, you’ll be contacted through your Square Dashboard and via email to provide additional documentation.

You’ll be notified of your application status within one to three business days. If you don’t receive a decision within this timeframe, we may still need additional information from you. Check your Square Dashboard and email inbox for any notifications asking you to provide additional information.

Before you begin

If additional documentation is requested for your loan application, your loan application won’t be reviewed if the request is incomplete.

Complete the request in full to the best of your ability by the date specified in your email notification. If the submitted information isn’t sufficient, you will be contacted via email and your Square Dashboard with additional details.

You have until the date specified in the email notification to complete the information request. If you don’t provide all of the requested information on time, your application will be canceled.

Uploaded documents must be in PDF, JPEG, JPG, TIFF or PNG file format and under 25 MB in file size each.

Review accepted application documents

- If additional documents to verify your Square-linked bank account are requested, you can submit a copy of your most recent bank statement that shows your full name, the last three digits of your bank account, and current bank transactions.

- If you recently opened a new bank account, you can submit a confirmation letter or document showing the opening of the account that shows the business name, account owner name, and account number.

- If you are a sole trader, the bank account owner’s name must match the name of the loan applicant.

Transaction information

If additional information about a transaction is requested, you can submit one of the following:

- Invoice

- Service contract

- Purchase order

- Signed payment card authorisation form

- Detailed receipt

- Bill of sale

- Email correspondence with the buyer

If you do not have any of the above, please provide a detailed description of the goods and/or services sold.

A financing statement is a notice that a lender has a security interest in one or more of your assets and has registered the interest on the Personal Property Security Register (PPSR). If you’re asked to provide additional information about a registered secured interest, a Square Loans team member will provide you with the date, filing number and the name of the secured party.

If we are requesting additional information about a registered secured interest, you may submit one of the following:

- Payment statements indicating the current status of the underlying loan or obligation.

- A letter from the secured party stating that the merchant is current on repayment.

- A letter from the secured party that the loan has been satisfied.

- A filed PPSR discharge statement or a letter from the secured party that the interest has been discharged.

Sometimes institutions may not successfully discharge a previous registered secured interest on the PPSR. If you’re unsure, best practice is to reach out directly to the secured party for confirmation.

Upload application documents

We support documents uploaded using iOS and Android devices using a supported web browser such as Safari or Google Chrome. If you cannot upload documents using your mobile, try a computer.

- Sign in to Square Dashboard and go to Money > Loans

- Click Add information to upload the requested items.

You can also submit your documents from the Account & Settings tab:

- Sign in to Square Dashboard and go to Settings > Account & Settings > Information requests.

- Click View to upload the request items.