Canadians are going “card first” when it comes to making payments. If you’re among the 85 percent of small businesses that are currently not accepting card payments and don’t think you’re losing out on sales, take a look at our survey results, which found that over two-thirds of Canadians (69 percent) said they would be more likely to buy from a local business if they can pay by card.

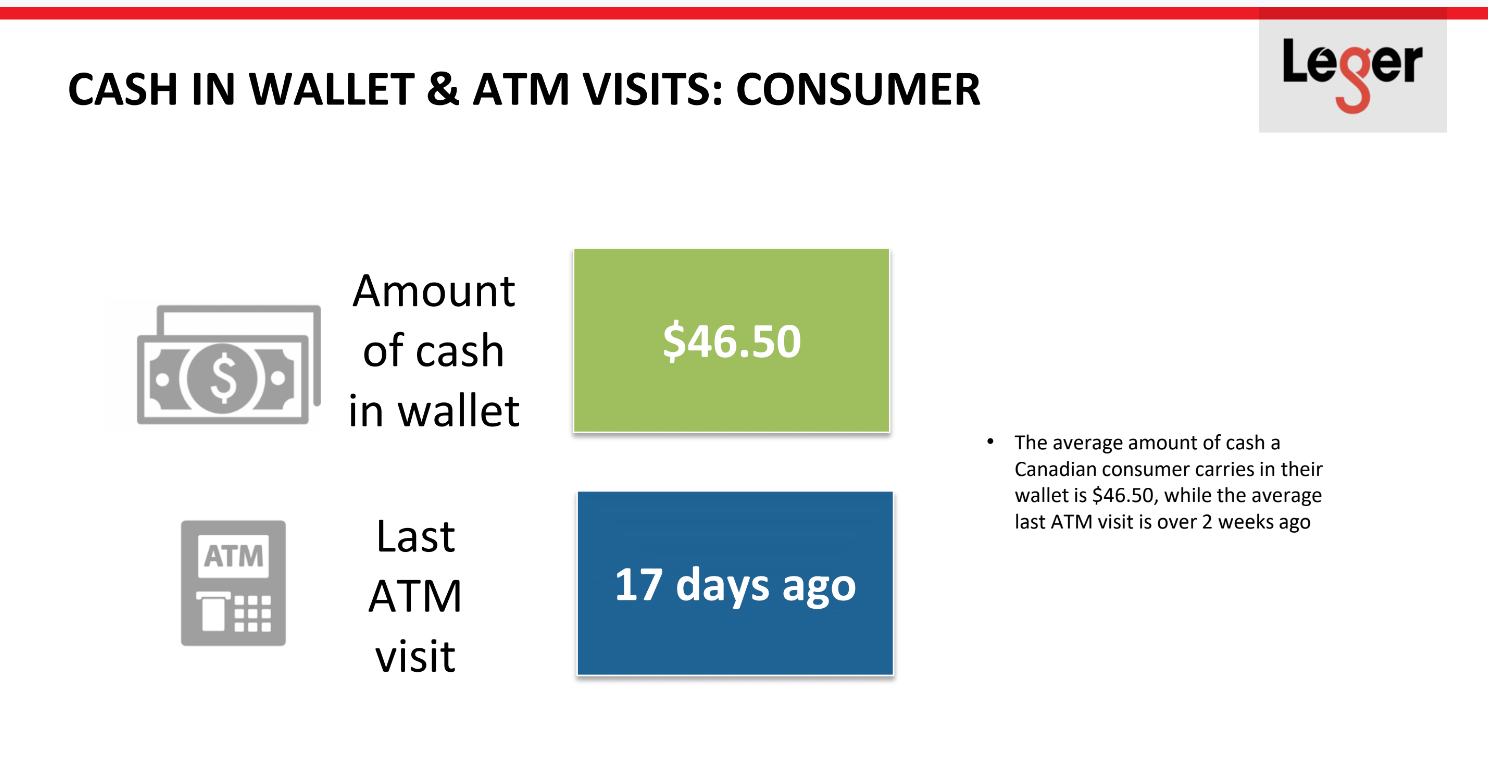

Our survey spoke to 1,566 Canadian consumers* and we found that an overwhelming 79 percent of Canadians are now card-first buyers, who typically try to pay with a debit or credit card first when making purchases. Further, two in five Canadians (41 percent) describe themselves as card-only buyers, who never use cash to pay for their purchases. In fact, three out of four Canadians (75 percent) are carrying less cash than in the past, with an average of $46.50 in their wallets right now, and admit they haven’t visited a bank or an ATM to withdraw cash in more than two weeks (17 days to be exact).

Consumers in Manitoba and Saskatchewan avoid bank runs for cash the most, having not visited a bank or an ATM to withdraw money in 22 days, which is almost a week longer than the average Canadian, whose last visit was just over two weeks ago. Consumers in Alberta have the lightest wallets in the country, carrying only an average of $38.40 right now, compared to $46.50 carried by other Canadians. Being forced to pay by cash is a greater source of annoyance for Quebec consumers, with more frustration among the Québécois than across Canada (71 percent versus 64 percent, respectively).

Here are some of the standout study findings:

-

The vast majority of cash- and/or cheque-only small businesses (89 percent) believe people are carrying less cash today than a few years ago, yet only about half of small businesses (48 percent) believe cards are their buyers’ most preferred way to pay.

-

Two-thirds of Canadians (67 percent) think cash- and/or cheque-only businesses are old-fashioned, almost half (47 percent) avoid them, and an equal number (47 percent) haven’t made a purchase because they weren’t able to pay by card.

-

While only 40 percent of cash- and/or cheque-only businesses wonder if they’re inconveniencing their customers by not accepting cards, the majority (64 percent) of Canadians are frustrated when they want to pay by card but have to pay with cash.

-

The overwhelming majority of card-accepting small businesses (89 percent) started taking card payments to allow customers to pay how they want, and almost two-thirds (68 percent) were motivated to do so in order to increase their potential sales.

-

Three out of four small businesses (75 percent) think people increasingly want to pay with cards. While the majority of small businesses (74 percent) believe they will always accept cash, nearly a quarter (22 percent) is intrigued by the idea of not accepting cash at all.

A report by Canada’s central bank indicates that while nearly all large businesses accept cards, only two-thirds of small or medium-size businesses (SMBs) do. In the same report, it is noted that SMBs that offer food have the highest acceptance of cards. Some local fast-casual restaurant leaders across the country are showing Canadian consumers and businesses across industries that cashless sales could be the future.

“We first thought about operating cashless six months ago, when a series of break-ins accelerated our decision,” said Square seller Barbora Samieian, owner of salad shop Field & Social in Vancouver. “Going cashless wasn’t a huge transition for us, as more than 90 percent of our customers preferred paying by card. The response has been overwhelmingly positive from both our customers and staff, with many saying they also see it as the way of the future.”

Discover how Square can help your small business easily accept card payments and even be cash-free to make the most of this “card is king” trend.

*This study, conducted by Leger, was composed of an omnibus survey with consumers and a phone survey with small businesses. The online omnibus survey of 1,566 Canadians was completed between March 5 and 8, 2018, using Leger’s online panel, LegerWeb. The margin of error for this study was +/-2.5 percent 19 times out of 20. Telephone interviews with 316 Canadian small business (30 or fewer employees) owners and employees that at least sometimes accept customer payments in person (and have influence on what forms of payment to accept from customers) were completed between March 7 and 22, 2018. The margin of error for this study was +/-5.5 percent 19 times out of 20.