Square and Afterpay's State of Retail Report

Concerns around inflation remain top of mind, with consumers reeling from its lingering impacts and overall spending less on retail goods. Despite these headwinds, the retail industry continued to moderately grow in the first quarter of 2023 based on Square and Afterpay data in the U.S.

As consumers continue to wonder whether a recession is on the horizon, it’s clear that changing consumer preferences and habits are creating areas of opportunity for retailers as well as noticeable declines in once popular categories. Square and Afterpay have paired data¹ from purchases made by millions of shoppers with sales from hundreds of thousands of retail sellers to help the industry identify today’s most influential consumer spending behaviors. These findings reveal new consumer trends and other opportunities that businesses can leverage as they wade through the dynamic macroeconomic climate.

The move away from pure play retailers and a diversification of revenue streams

To stay ahead of the competition, retailers need to evolve into multihyphenate businesses and offer more than just their core offerings. The restaurant industry is already successfully employing this strategy with an average of 20% of restaurant revenue coming from products and services. By finding other profitable revenue streams, businesses are able to make up for lost sales and find new ways to retain customers. For example, the hiring of baristas, servers, and bartenders at retail locations has outpaced overall hiring growth by 8x².

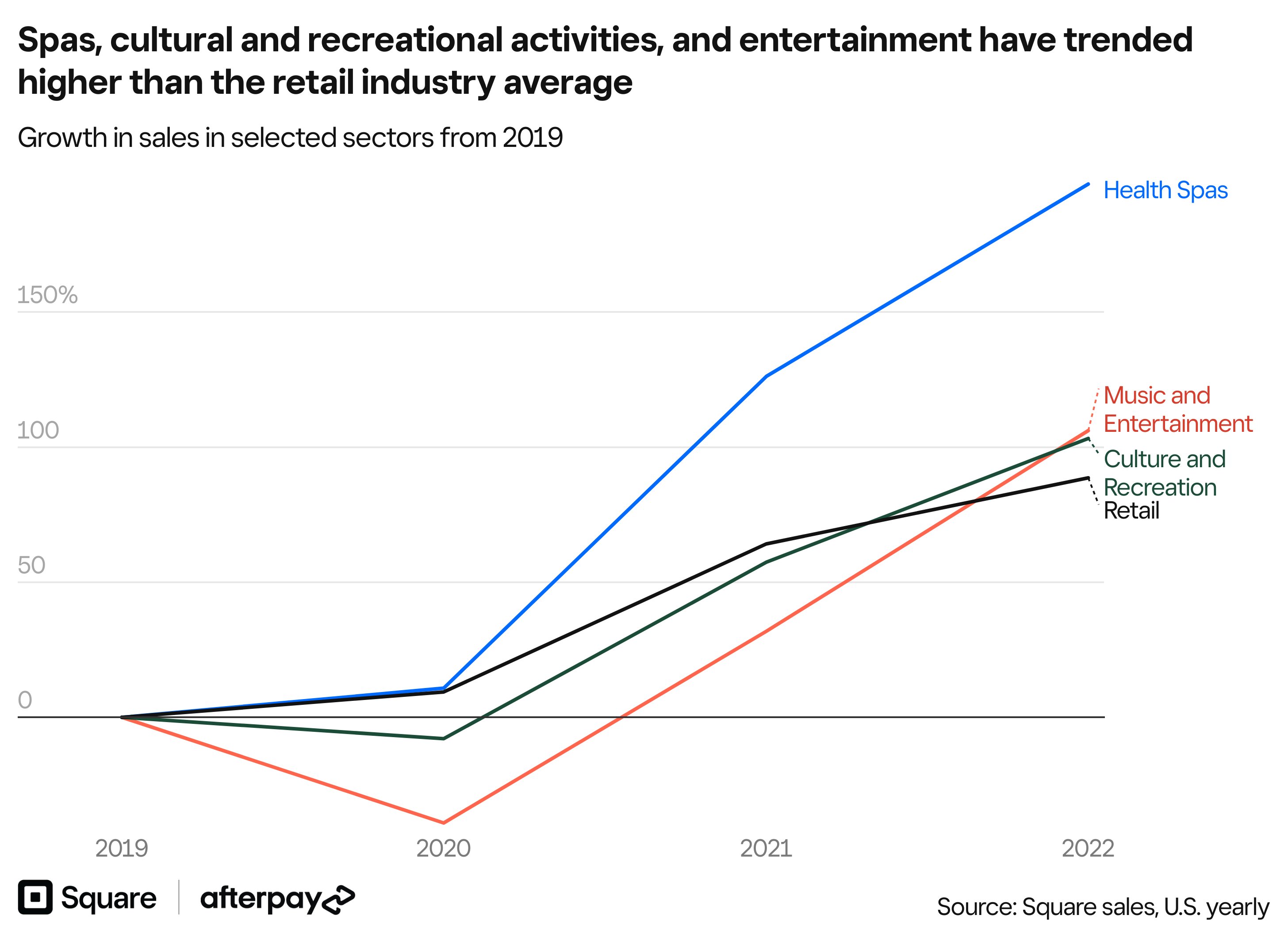

Consumer spending on services, such as spas, cultural and recreational activities, and entertainment, have trended higher than the retail industry average, showcasing the unique opportunities for retailers to cross-pollinate existing products with new experiences, especially when seeking solutions to increase foot traffic in stores.

Many retailers are also leaning into brand or influencer collaborations, which are an easier way to leverage the success and customer base of complementary brands. Fashion and beauty brands are already seeing value with this tactic through limited-edition product collections, which can be an effective way to generate hype for the brands, tap into new markets, and reach new customers.

Popular shopping channels

Next-generation consumers want to shop from brands that meet them wherever they are, giving rise to the popularity of omnichannel shopping. Retail customers spent 21%³ more per order on pre-orders than on the average online retail purchase through Square Online. Unsurprisingly, in-store shopping has also bounced back to pre-pandemic levels. This can be attributed in part to the growing number of influencers leveraging their social platforms to encourage younger consumers to visit new stores, especially those businesses with enticing experiences and features unique to a location.

Mobile commerce has also become a popular shopping channel for younger consumers. In the past year, 2 in 3⁴ Afterpay online transactions from millennials and Gen Zers were made on mobile devices, with the volume of Afterpay transactions up 196% since 2020. Besides mobile for shopping, the next-gen consumers are heavily leveraging their mobile devices as their primary customer support tool. More than 84 million⁵ messages have been sent between sellers and buyers through conversational commerce platform Square Messages, with inquiries ranging from how to pick up an order to cost of services.

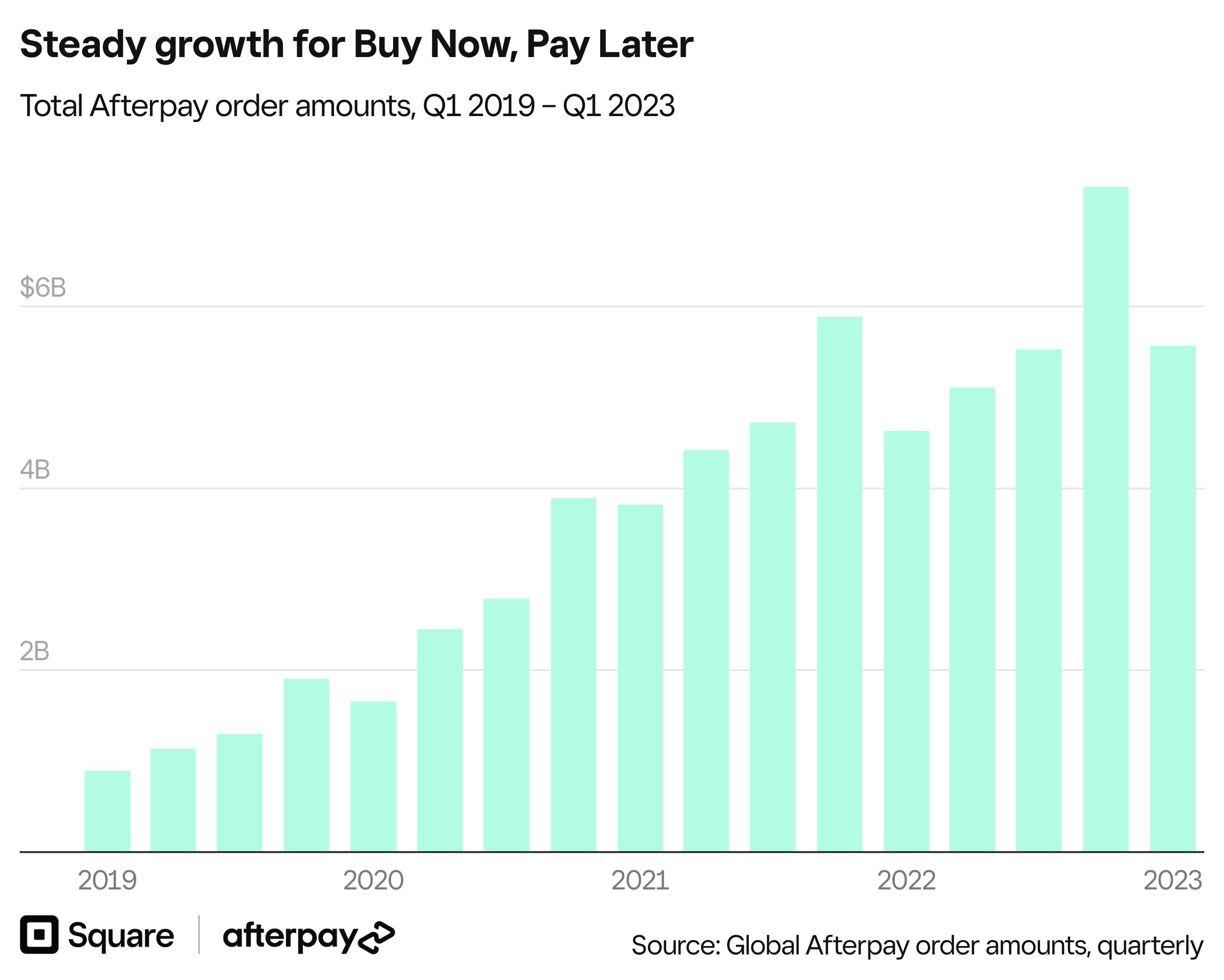

Buy Now, Pay Later (BNPL) goes mainstream

BNPL adoption is going mainstream, with sales increasing year-on-year and growth up across all age groups. While Gen Zers and millennials continue to lead the charge as the primary BNPL users, older shoppers are also choosing to use Afterpay to budget for their lifestyle and make everyday purchases. As of March 2023, the number of Afterpay orders made by Gen Xers and boomers increased 16% and 12%, respectively.

Consumer spending trends

It can be easy to jump into selling short-lived trends that aren’t profitable due to the fear of falling behind competitors. In order to meet shifting consumer demands while managing an appropriate amount of inventory, opportunities lie in the bifurcation of the luxury landscape as well as for more purpose driven categories.

State of luxury market

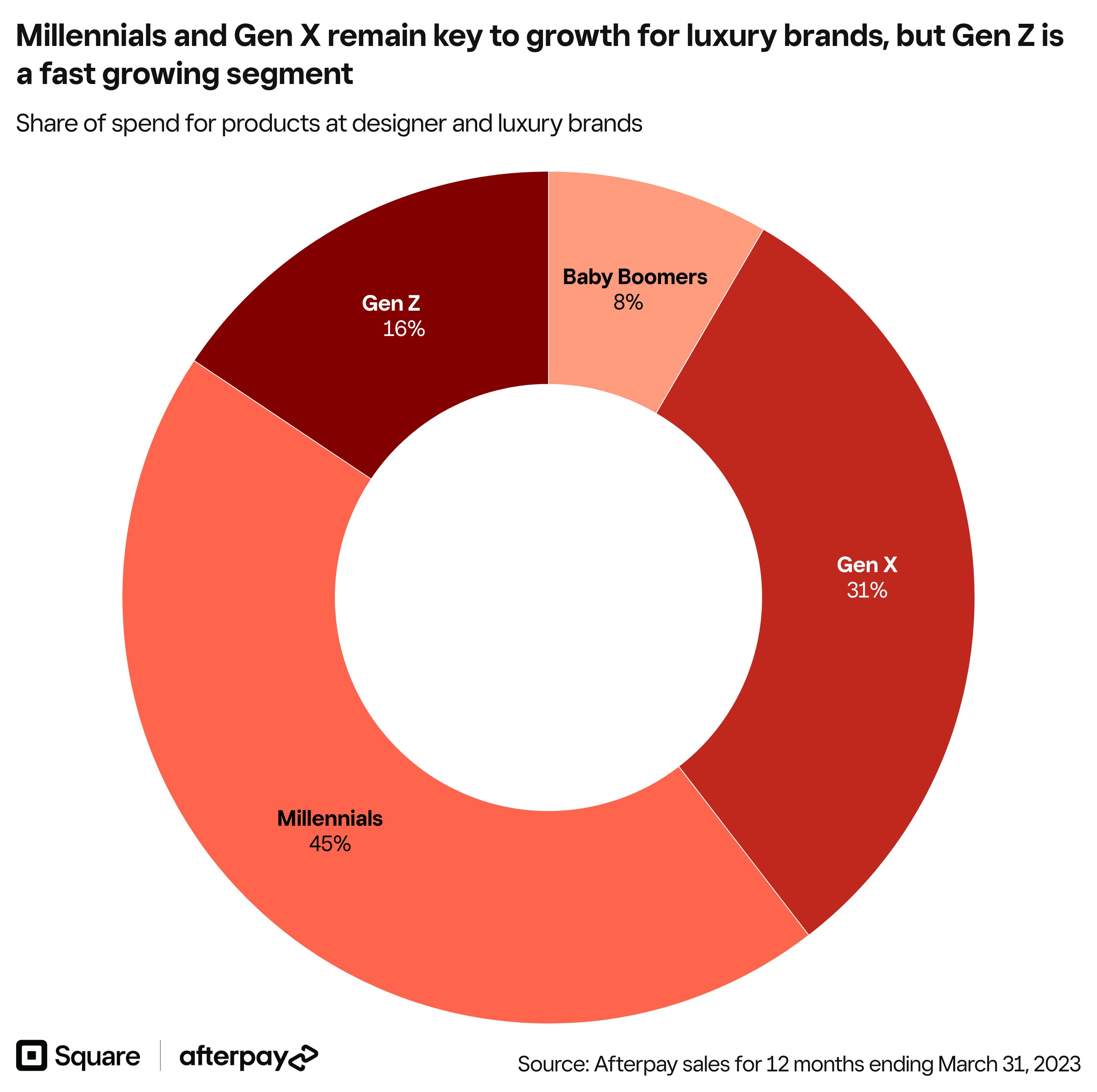

From 2021 through Q1 2023, the number of designer merchants on the Afterpay shopping app has doubled⁶ as high-end businesses look to accommodate the demands of younger shoppers who prefer a flexible payment method. As of the last 12 months ending March 31, 2023, millennials’ share of spend on luxury items through Afterpay is 45%, which is down from 56% in 2019. Meanwhile, Gen Z is a growing segment; their share of spend on luxury items is 16%, up from 13% in 2019.

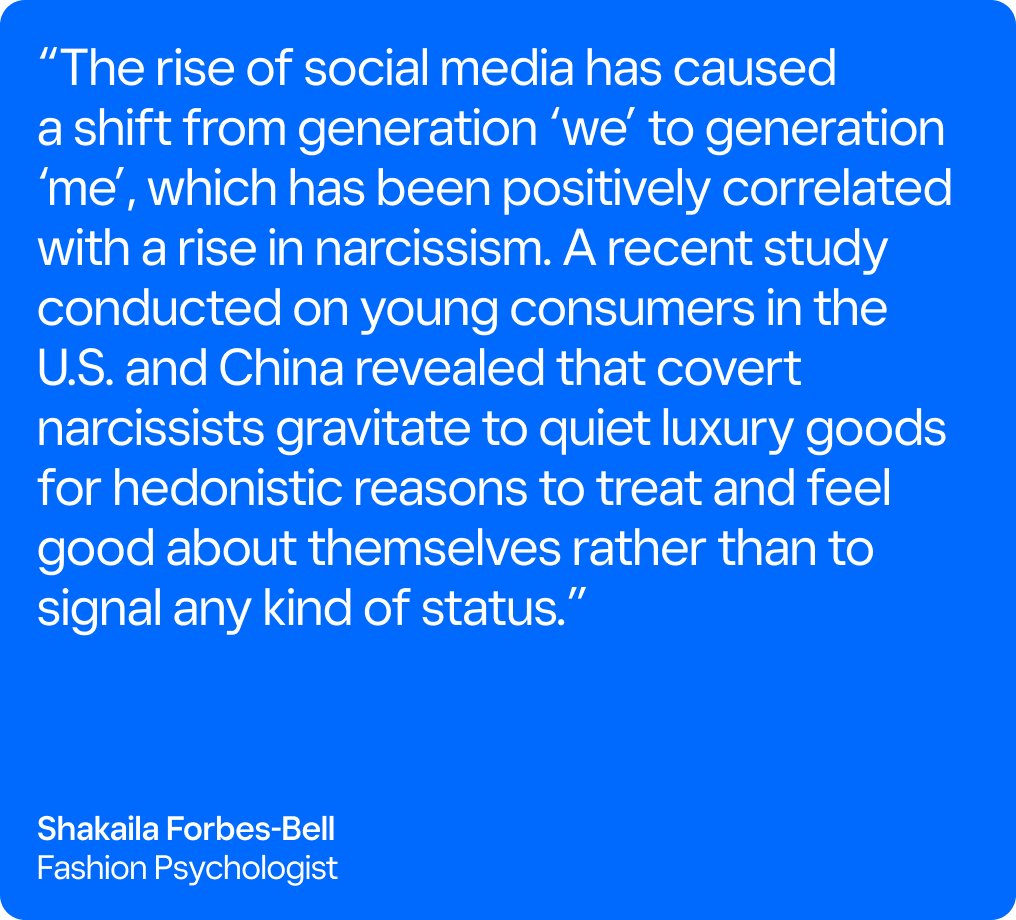

Quiet luxury

One factor contributing to the growth of the luxury market is the quiet luxury trend, which has taken off as a result of a return to the office and a desire for sophisticated staple items. Square data shows a yearly uptick in sales for workwear products such as dress shirts (+19%), oversized blazers (+44%), and dress sneakers (+40%)⁷. By capitalizing on this trend and focusing on timeless staple items that never go out of style, retail businesses can maintain their profitability as consumers look to pad their wallets (and closets) over the long run.

A pull back on resale goods

The secondhand market is showing signs of a slow down, evident across in-store and online sales. However, this trend does not negate consumer desire to shop sustainably. Merchants looking to jump into this space through secondhand rental programs should consider offering a range of premium brands with timeless pieces to choose from.

Conscious consumerism

Younger Americans are driving conscious consumerism, choosing to spend their money to back eco-friendly products made of high-quality materials. Gen Z and millennials currently make up the majority of sustainable product sales, with 69% of share of spend as of Q1 2023. To continue to attract these customers, merchants need to be intentional about running their businesses in an environmentally conscious way without being seen as performative.

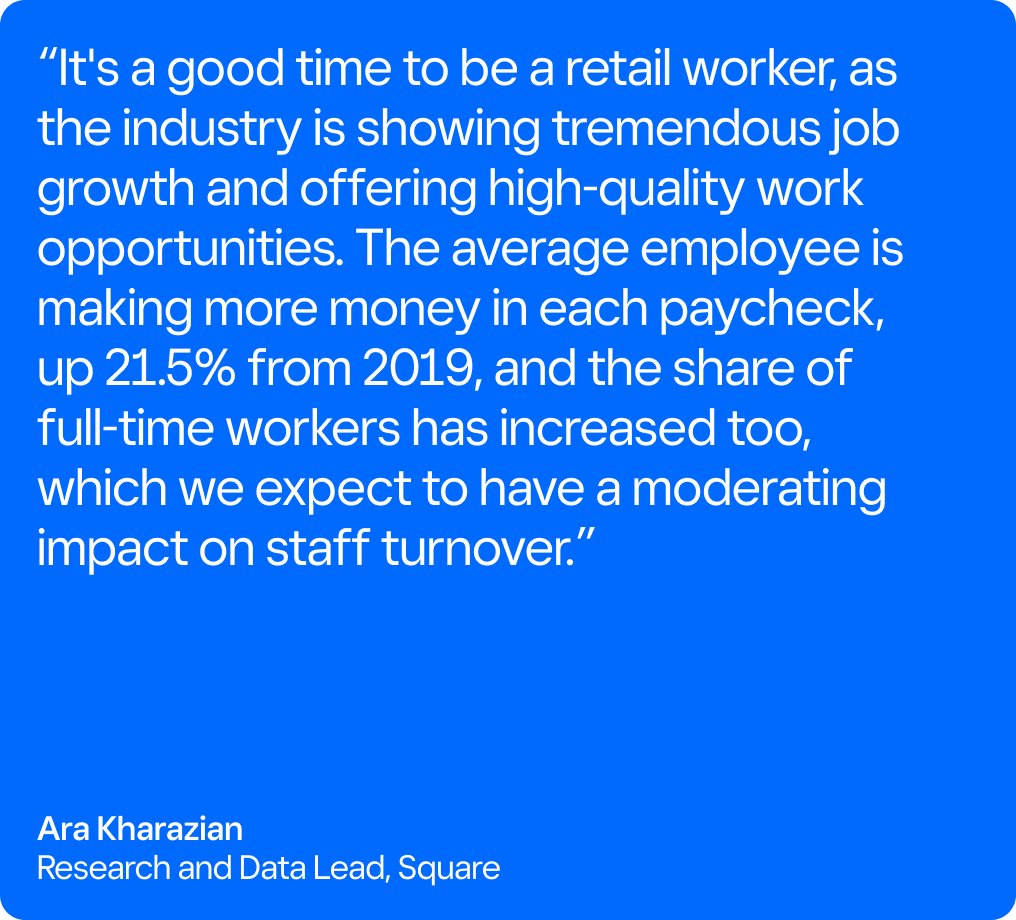

Retail staffing and wages

Over the past few years, the retail industry has experienced significant headwinds when it comes to staffing their businesses, particularly in the aftermath of the COVID-19 pandemic. The demand for quality staff continues to grow, which has left many businesses with open positions and challenges retaining top talent.

Elevated wage growth reflects a need to retain top talent

Wages for retail workers have increased significantly in recent years. According to Square data, the nationwide average wage for a retail worker as of the first quarter of 2023 is $11.89 per hour, which is up 22% from the first quarter of 2019 when the average wage was $9.78 per hour, representing a 5% compounded annual growth rate. While wages vary greatly by location and experience, growth in the nationwide average may indicate increased demand for talent.

While the most recent data from Square indicates that wage growth is moderating, business owners should evaluate wages regularly to ensure they are competitive with the market. Wages are well above previous levels and are unlikely to decrease outright.

Staff sizes show moderate growth

Square data also indicates that the average staff size in retail businesses has also increased modestly, by 11.4% between the first quarter of 2019 and the first quarter of 2023. In 2019, the average staff size was 3.8 workers per location, while in 2023 it increased to 4.3.

The average worker is posting more hours

Retail workers are working more hours than they did in 2019. Per Square data, the average employee is working 80 hours per month as of the first quarter of 2023, up 8.6% from 74 hours per month in Q1 2019.

Holiday preparations

The holidays are one of the most challenging and lucrative times of the year for any retail business, making it critical to start preparing six to eight months in advance and ensuring your business is set up for success. While the average staff size has increased by 11%⁹ since 2019, according to Square data, optimizing staff availability has remained an area of opportunity for retail businesses. In order to maximize staff impact during the holiday season, sellers should lean into AI-powered tools that can automate their back-end processes. Team management software, for example, can improve workflows and empower your employees to focus on more strategic and creative tasks that will move the needle for your business.

To improve your customer relations, an automated messaging tool can expedite frequently asked queries and marketing software can automate personalized customer communications. Square Marketing can help drive traffic and repeat customers to your online and physical stores. Automated solutions can not only make your business operations more efficient, but can also play a role in saving your employees from burn out typically experienced during the holiday grind.

To cut through the noise during the holiday season, create an exceptional shopping experience through curated in-person events, brand or influencer collaborations, selling memberships and subscriptions, personalized suggestions to expedite online pre-orders and easily pick up in store, or opening up a branded coffee or smoothie bar. These elements can elevate your brand discoverability for new customers and create a lasting impression for existing ones.

Source: Square and Afterpay analysis of transactions from 2019 to 2023. All monetary metrics are displayed in USD. All data presented are unaudited and subject to adjustment.

1. Square and Afterpay data analyzed between 2019 to 2023 ending in Q1

2. Square data analyzed between July 1, 2022 - September 30, 2022

3. Square data analyzed during Q1 2023

4. Afterpay data analyzed between Q2 2022 to Q1 2023

5. Square data analyzed between March 31, 2021 to March 31, 2023

6. Afterpay data analyzed between 2019 to Q1 2023

7. Square data analyzing Q1 2022 compared to Q1 2023

8. Square data analyzing Q1 2019 compared to Q1 2023

9. Square data analyzing Q1 2019 compared to Q1 2023