Square Updates First Quarter and Full Year 2020 Guidance for its Convertible Notes Offering

SAN FRANCISCO, CA – March 5, 2020 – Square, Inc. (NYSE: SQ) today announced updates to its first quarter and full year 2020 guidance to reflect the impact of its issuance of $1.0 billion in aggregate principal amount of 0.125% convertible senior notes due 2025 (“Notes”).

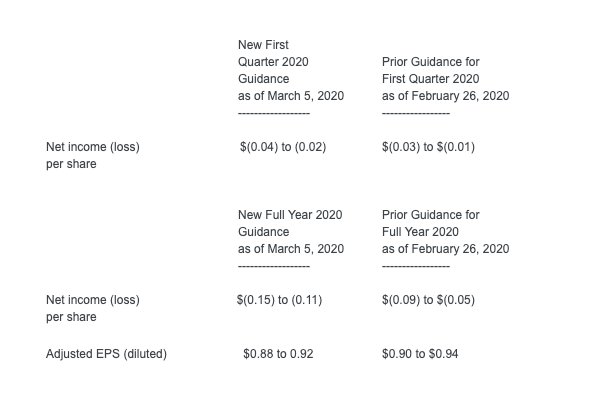

The revisions to Square’s first quarter and full year 2020 guidance, which was previously announced on February 26, 2020, are only a result of the Notes issued by Square on March 5, 2020. As a result of the issuance of the Notes, Square is revising its guidance for net income (loss) per share and Adjusted Net Income Per Share (Adjusted EPS) to reflect the estimated increase in interest expense. Square is also revising its guidance for net income (loss) per share to reflect the estimated amortization of debt discount and issuance costs associated with the issuance.

As a reminder, Square will release financial results for the first quarter of 2020 on May 6, 2020, after market close.

- Note: Square also granted the initial purchasers of the Notes a 30-day option to purchase up to an additional $150 million aggregate principal amount of the Notes solely to cover over-allotments, if any. When updating its first quarter and full-year guidance for the transaction, Square has assumed this entire amount of additional Notes will be issued.

- We have not reconciled Adjusted EPS guidance to its GAAP equivalent as a result of the uncertainty regarding, and the potential variability of, reconciling items such as share-based compensation expense and weighted-average fully diluted shares outstanding. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalent is not available without unreasonable effort. It is important to note that the actual amount of such reconciling items would have a significant impact if they were included in our Adjusted EPS.

About Square, Inc.

Square, Inc. (NYSE: SQ) revolutionized payments in 2009 with Square Reader, making it possible for anyone to accept card payments using a smartphone or tablet. Today, we build tools to empower businesses and individuals to participate in the economy. Sellers use Square to reach buyers online and in-person, manage their business, and access financing. And individuals use Cash App to spend, send, store, and invest money. Square has offices in the United States, Canada, Japan, Australia, Ireland, and the UK.

SAFE HARBOR STATEMENT

This press release contains forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance and expected financial results for future periods of Square, Inc. and its consolidated subsidiaries (the Company). In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this press release Investors are cautioned not to place undue reliance on these statements.

Risks that contribute to the uncertain nature of the forward-looking statements include, among others, the impact of the Company’s convertible senior note offering, including the conditional conversion feature of the notes and the accounting method for convertible debt securities that may be settled in cash; the Company’s ability to deal with the substantial and increasingly intense competition in its industry; the Company’s ability to ensure the interoperability of its technology with that of third parties; changes to the rules and practices of payment card networks and acquiring processors; the impact of acquisitions or divestitures, strategic investments, joint ventures, or entries into new businesses; the effect of extensive regulation and oversight related to the Company’s business in a variety of areas; the effect of management changes and business initiatives; adoption of the Company’s products and services in international markets; and changes in political, business, and economic conditions; as well as other risks listed or described from time to time in the Company’s filings with the Securities and Exchange Commission (the SEC), including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter.

KEY OPERATING METRICS AND NON-GAAP FINANCIAL MEASURES

To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (GAAP), we consider certain operating and financial measures that are not prepared in accordance with GAAP, including Adjusted EPS. We believe this metric is useful to facilitate period-to-period comparisons of our business and to facilitate comparisons of our performance to that of other payments solution providers. In this press release, we are updating our previously announced guidance as to Adjusted EPS.

Adjusted EPS is a non-GAAP financial measure that represents our net loss per share, adjusted to eliminate the effect of share-based compensation expenses, amortization of intangible assets, amortization of debt discount and issuance costs in connection with our offering of convertible senior notes in the first quarter of 2017, in the second quarter of 2018, and the first quarter of 2020, the gain or loss on the sale of property and equipment, and impairment of intangible assets, as applicable. We also exclude certain costs associated with business acquisitions that are not normal recurring operating expenses, including amounts paid to redeem acquirees’ unvested stock-based compensation awards, and legal, accounting and due diligence costs, and we add back the impact of the acquired deferred revenue adjustment, which was written down to fair value in purchase accounting. Basic Adjusted EPS is computed by dividing the Adjusted Net Income (Loss) by the weighted-average number of shares of common stock outstanding during the period. Diluted Adjusted EPS is computed by dividing Adjusted Net Income by the weighted-average number of shares of common stock outstanding, adjusted for the dilutive effect of all potential shares of common stock.

We have included Adjusted EPS because it is a key measure used by our management to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that Adjusted EPS provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. In addition, it provides a useful measure for period-to-period comparisons of our business, as it removes the effect of certain non-cash items and certain variable charges. Adjusted EPS has limitations as a financial measure, should be considered as supplemental in nature, and is not meant as a substitute for the related financial information prepared in accordance with GAAP.

This non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. This non-GAAP financial measure is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to similarly titled measures presented by other companies.

Media Contact:

press@squareup.com

Investor Relations Contact:

ir@squareup.com