Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

EFTPOS payments coded for speed and security

Count on Square to process any payment that comes your way.

2021 – 2023 Most Satisfied Customers, Merchant Services Award Winner

Accept the most popular forms of payment

Take Apple Pay, Google Pay and all major credit and debit cards, including eftpos. Square can help.

Everything you need for EFTPOS, from hardware to software

Explore Square POS and hardware designed for seamless integration.

Square Terminal

Square Terminal is your all-in-one portable EFTPOS machine for payments and receipts. Take it where your customers are.

Square Reader

Accept chip + PIN cards, contactless cards and digital wallets. Connect wirelessly, accept payments quickly.

Square Stand

Elevate your countertop with a powerful iPad point of sale that’s intuitive and integrated – no card readers required.

Square Register

Built to be faster with more convenient features, this complete point of sale offers two displays plus built-in payments.

Accept contactless payments with just your iPhone or Android phone

Transparent pricing means no surprises at the end of the month

There’s one rate per payment method. No hidden fees. With Square, you only pay processing fees for what you process.

-

In Person

-

Online

-

Manually Entered

In person

1.6%

per transaction on Square Terminal and Square Register

1.9%

per transaction on Square Reader, Square Stand, Tap to Pay on iPhone and Tap to Pay on Android

6% + 30 cents

per Afterpay transaction (excl. GST)

Surcharging available²

Contactless payments

Mobile payments

Chip + PIN payments

Afterpay in-person payments

In person

1.6%

per transaction on Square Terminal and Square Register

1.9%

per transaction on Square Reader, Square Stand, Tap to Pay on iPhone and Tap to Pay on Android

6% + 30 cents

per Afterpay transaction (excl. GST)

Surcharging available²

Contactless payments

Mobile payments

Chip + PIN payments

Afterpay in-person payments

Online

2.2%

per online transaction

6% + 30 cents

per Afterpay transaction (excl. GST)

Surcharging available²

Square Online payments

Square Payment Links

Online API payments

Afterpay online payments

Square Invoices

Manually entered

2.2%

per remote transaction

6% + 30 cents

per Afterpay transaction (excl. GST)

Surcharging available²

Keyed-in transactions

Card on file

Square Virtual Terminal payments

Afterpay remote payments

Square Invoices

Please note: Different pricing may apply with certain products and/or subscription plans.

Process more than $250,000 per year?

Get custom pricing. We can tailor rates to your business needs depending on payment volume, average transaction size and more.

What sellers love about Square

Instant transfers

Move money to your external bank account instantly for a 1.5% fee. ¹ You can also transfer money for free. Standard transfers arrive in your bank account as soon as the next day.

Automatic surcharging

Recoup card processing fees with zero-cost EFTPOS. Use the surcharging feature to pass on your processing fees automatically for each transaction.²

Offline payments

Internet down? Take card payments when your service is temporarily unavailable. Offline payments are processed automatically when you reconnect within 24 hours. 3

No hidden fees for payments

There are no added costs on top of our processing fee. No monthly fees for payments, no leasing fees, no long-term contracts and no early termination fees. Once you purchase your Square hardware, everything’s included in the flat rate. 4

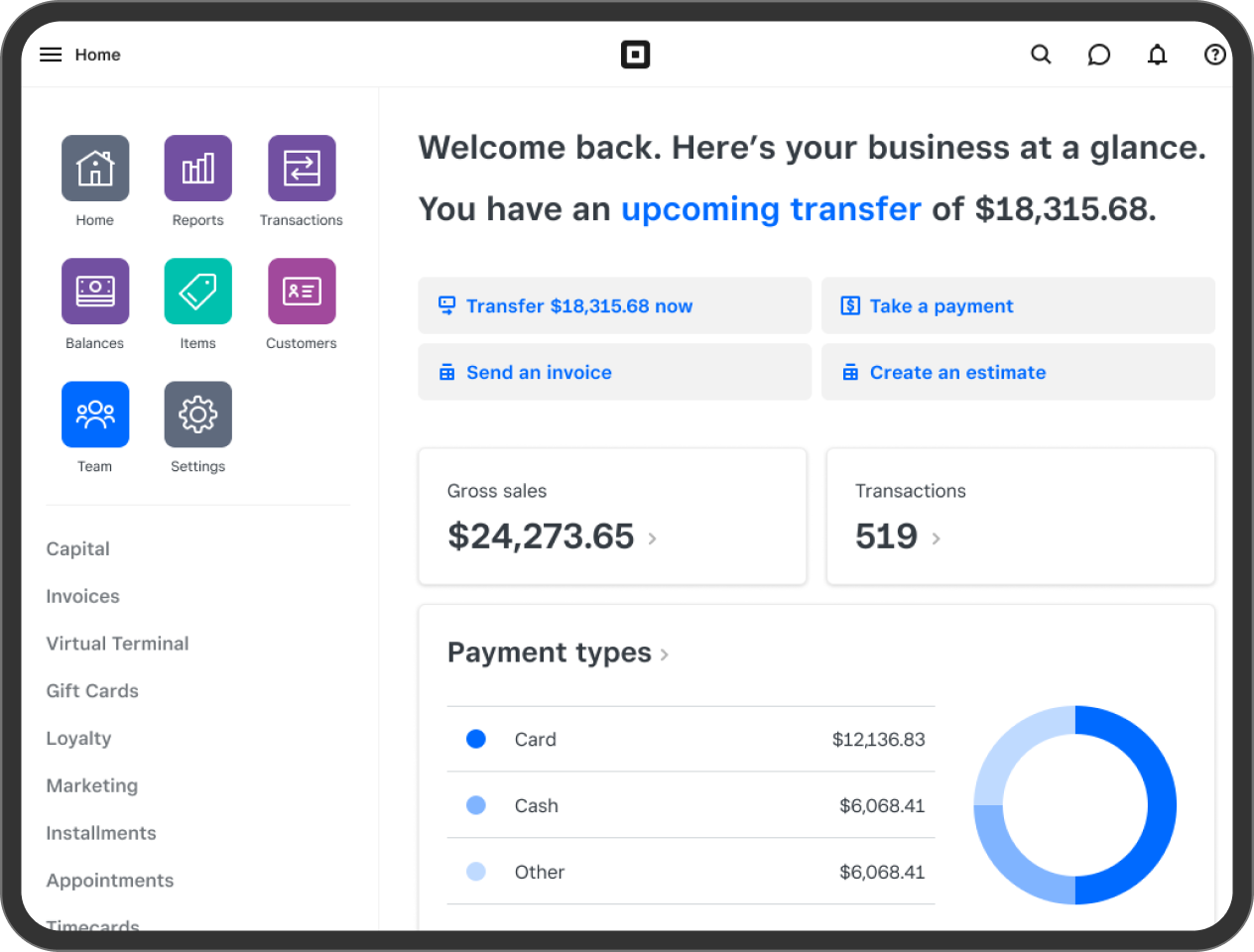

Run smarter with real-time insights and payment features

-

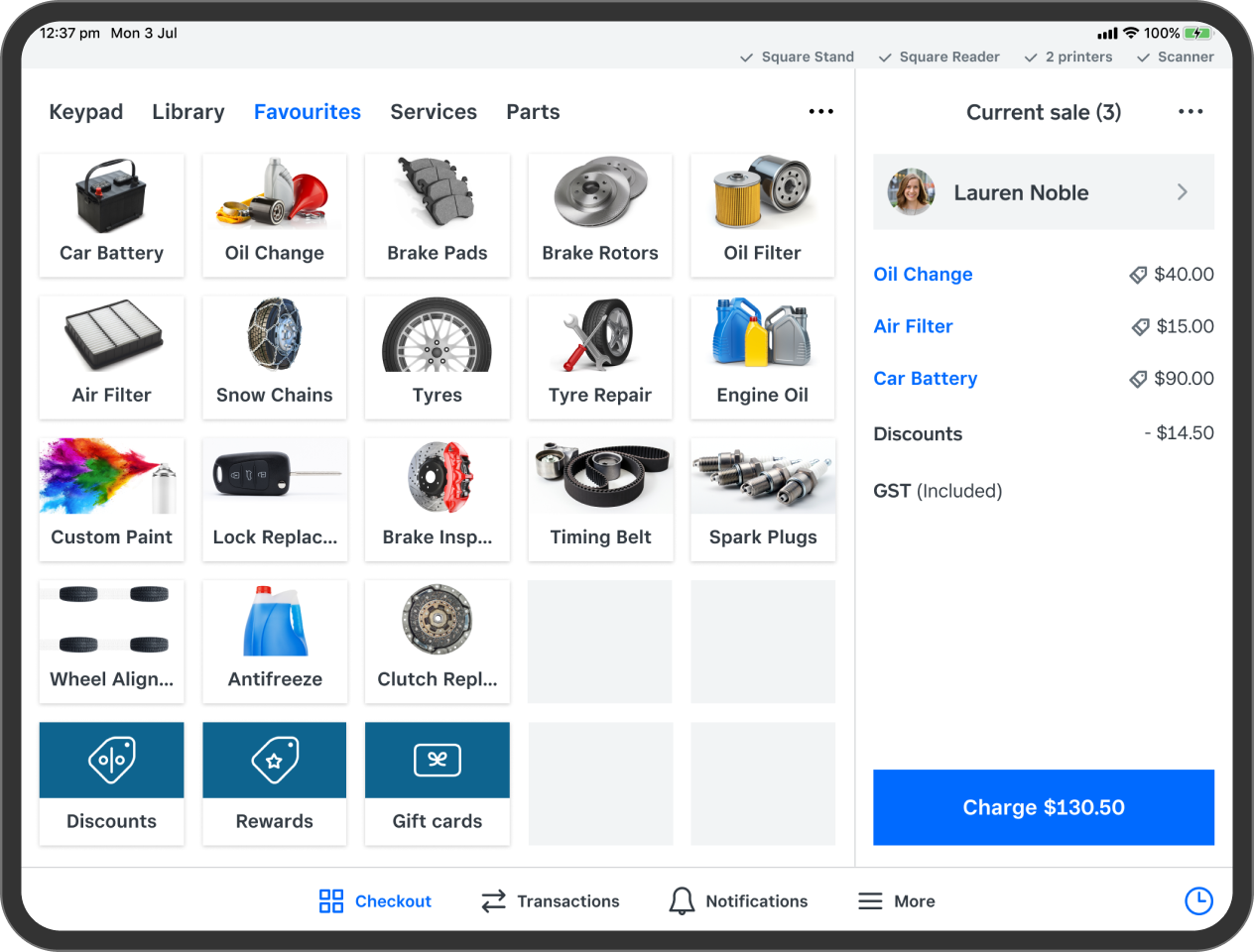

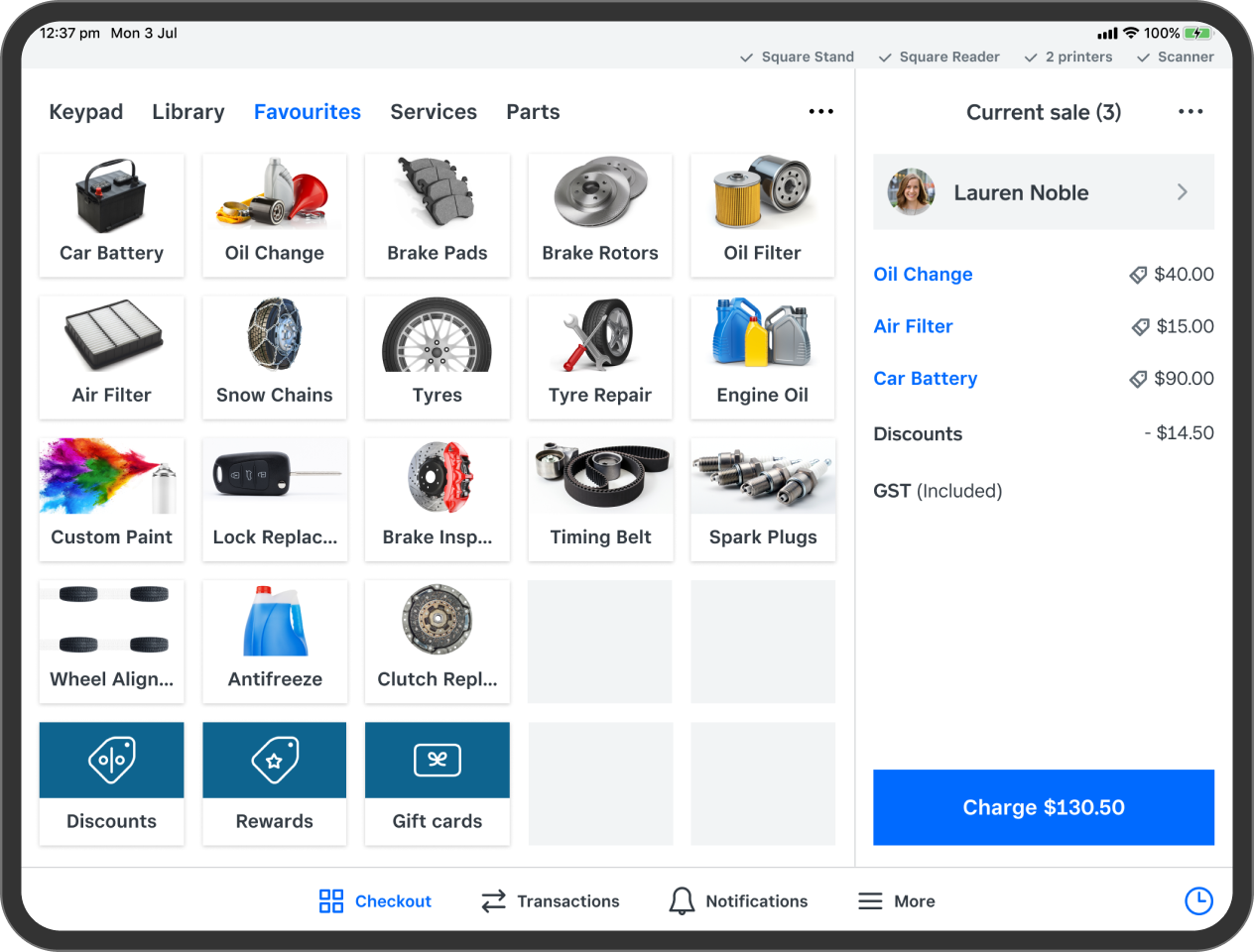

Track all your sales with the free Square Point of Sale app. Plus send invoices, manage employees and more.

-

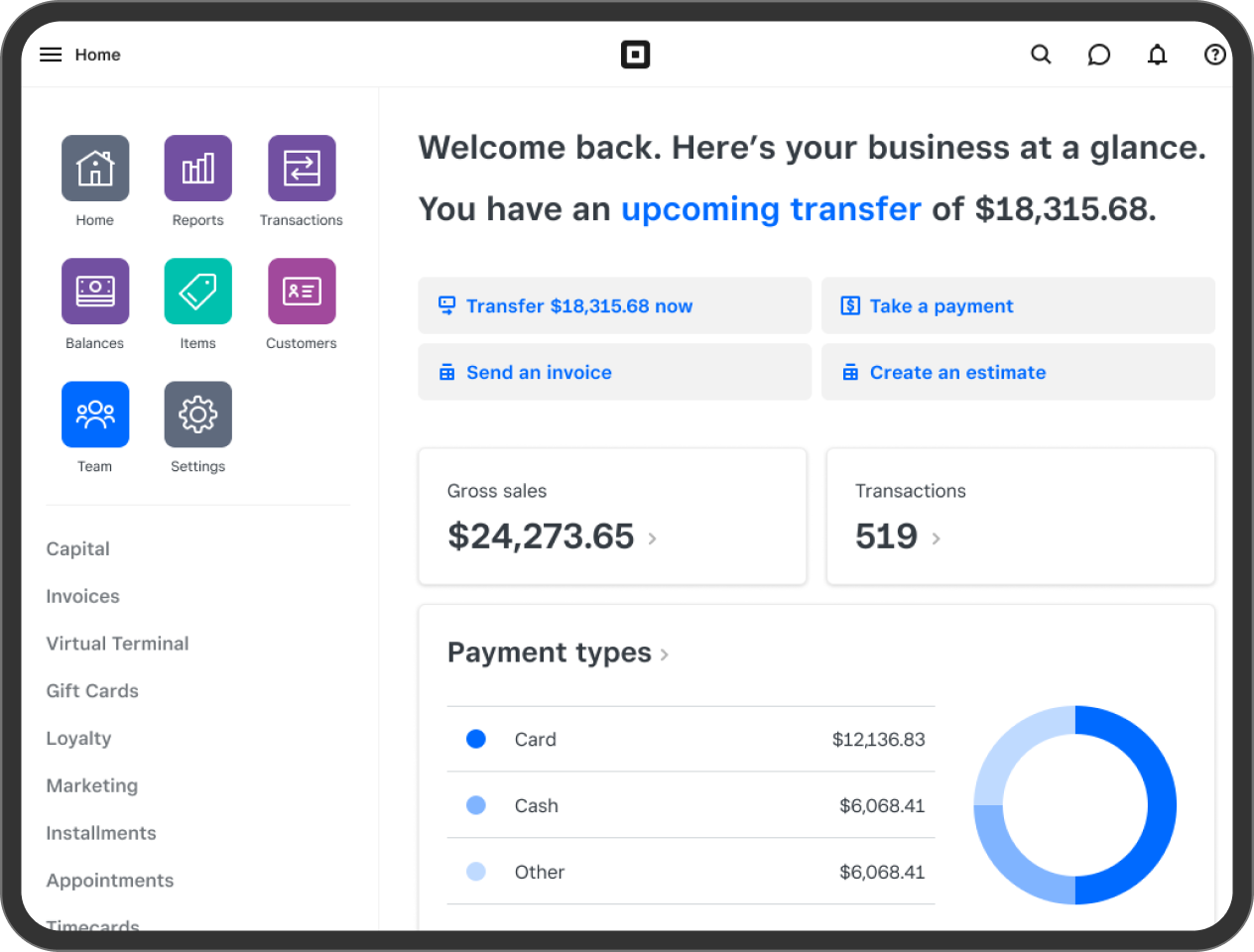

Square Dashboard provides data at your fingertips. Sign in online to view your sales history, best-selling items and more with insightful charts that help you understand your business.

-

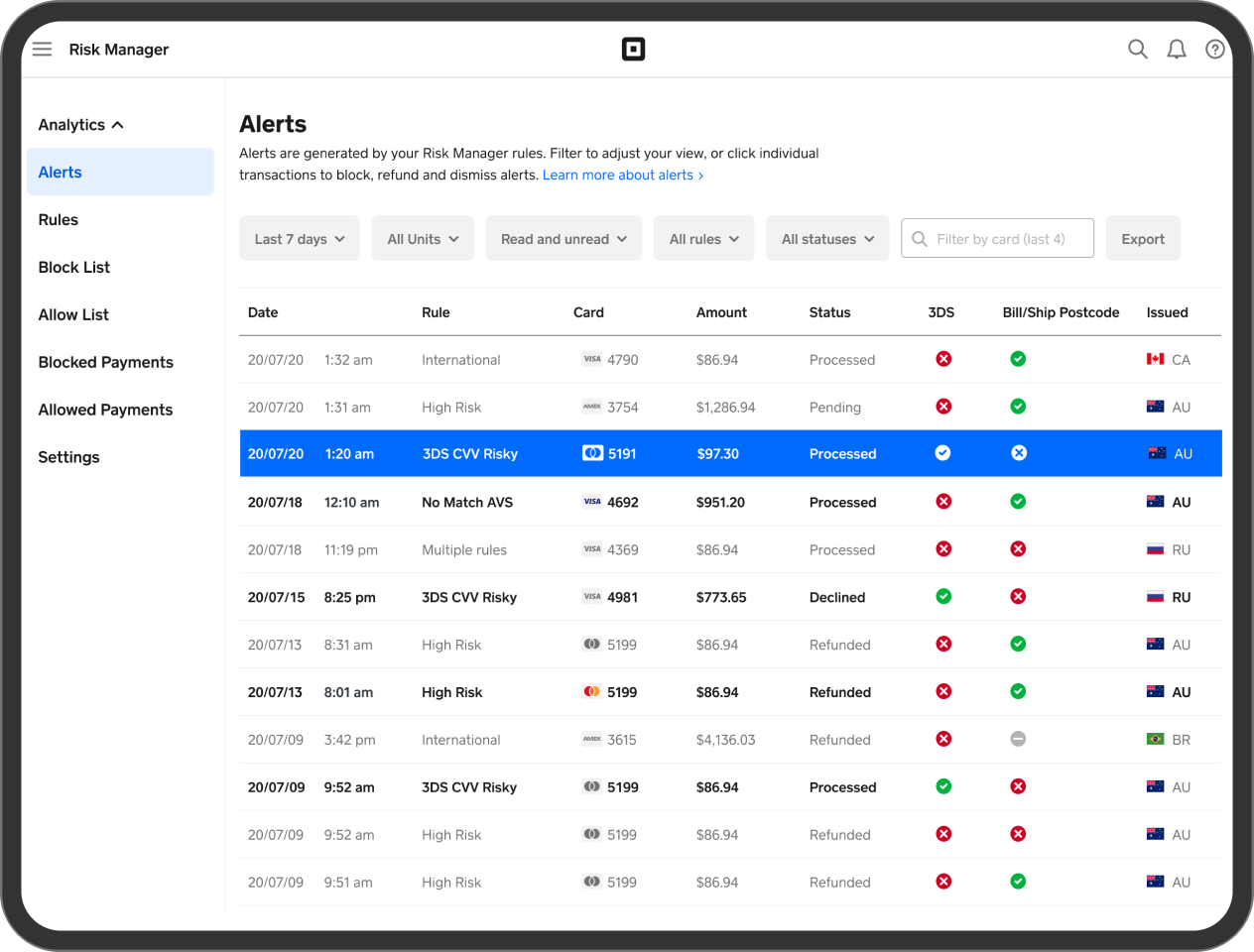

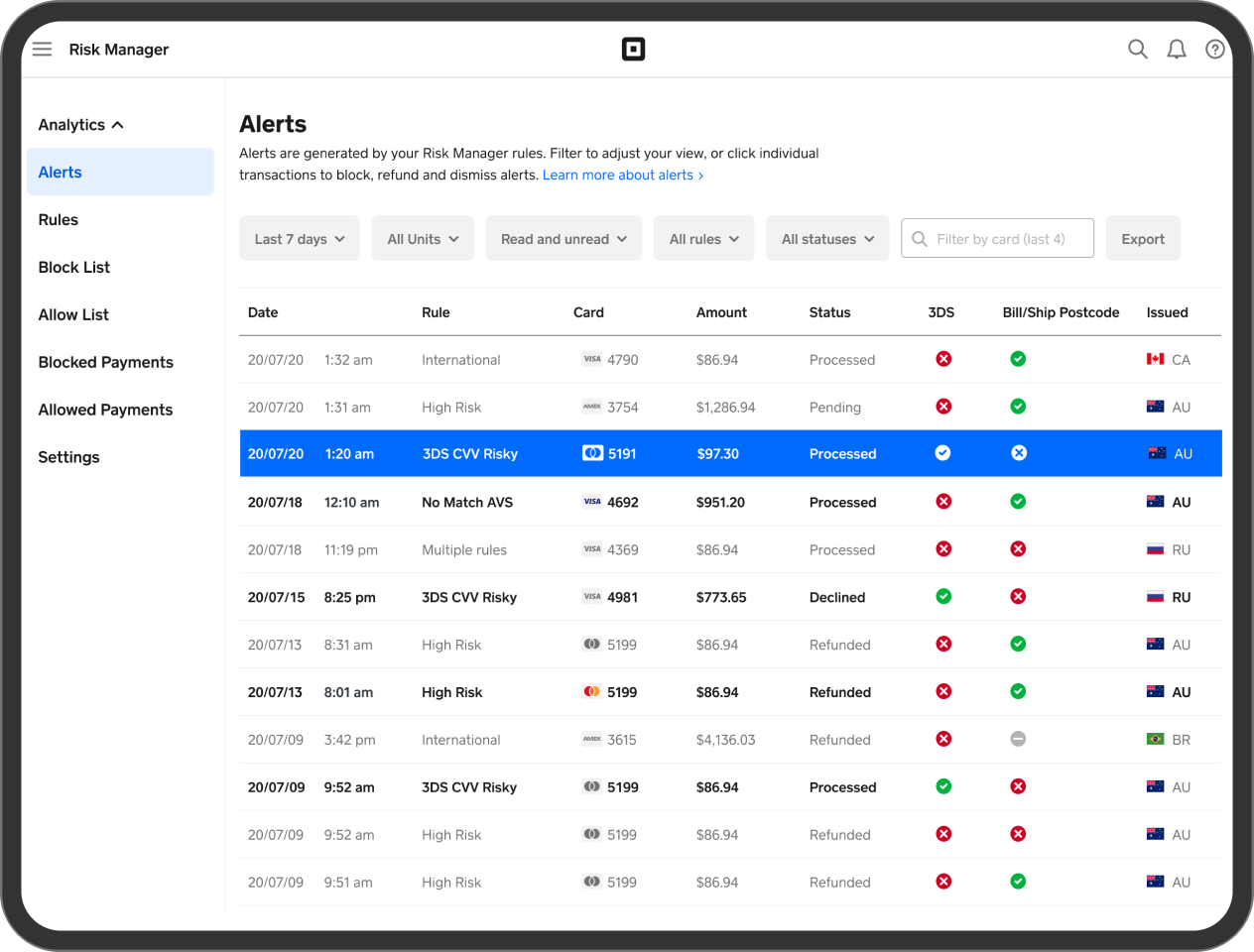

Square offers hardware, software and services built with security in mind. We provide active fraud protection, assist with dispute management, encrypt payments and ensure all our products are PCI-compliant.

Hear from businesses in growth mode

‘Square helped us grow because we could have two terminals running at the same time. Our business multiplied by two.’

Juan Lozano and Elena Pastor,

‘Square has fundamentally helped my business because it improved my cash flow dramatically.’

Alex Kelly,

Owner, Skinny’s Garage

Start taking payments today

Accept payments quickly. Get paid fast.

Get business insights by signing up for marketing from Square

Subscribe to our email list to receive advice from other business owners, support articles, tips from industry experts and more.

FAQs

-

EFTPOS generally refers to any card machine that will accept debit and credit card payments. It is a globally recognised term. The Australian brand eftpos makes it possible for businesses to accept payments from a customer’s bank account through their debit card.

-

Australian consumers prefer credit and debit card payments over all others. By accepting eftpos credit and debit card payments, you broaden your audience and help ensure that your business never misses a sale.

-

Just like Visa and MasterCard, eftpos is a payments network – an Australian network that only works for debit cards issued in Australia.

-

You can start accepting eftpos, Visa, Mastercard, American Express and JCB cards using the Square Reader, Square Terminal or Square Register. Check out these tips on choosing the right EFTPOS machine for your business .

-

With Square hardware and software, you can accept any EFTPOS payment that comes your way in person, online or remotely. Use Square Terminal, Square Reader, Square Stand and Square Register to accept EFTPOS credit and debit cards, Chip + PIN cards and contactless devices, such as smartphones and watches. Try Tap to Pay on Android to take contactless eftpos payments with just your Android phone. No hardware required. Use the Square Point of Sale app for remote EFTPOS payments.

-

With Tap to Pay on iPhone and Tap to Pay on Android, you can start taking payments with just your phone right away. If you’d like to use hardware, you may purchase a card reader for as little as $59 and start taking payments once it arrives. With Square, you only pay processing fees for what you process.

-

It’s as simple as creating an account with Square, purchasing the Square Reader, Square Terminal or Square Register and letting your customers tap or insert away.

Android is a trademark of Google LLC. Tap to Pay on Android is available on compatible Android devices . Available on iPhone XS or above running the latest version of iOS. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

¹ Instant transfers require a linked, eligible bank account and cost a fee per transfer. Funds are subject to your bank’s availability schedule. Up to $5,000 AUD per day. The minimum you can transfer is $5.

² Limitations apply. Surcharging available on Square POS, Square for Restaurants and Square for Retail. Surcharge must not be higher than your cost of acceptance. See our Payment Terms for more details.

³ For Square Reader and Square Stand, you can process transactions through offline payments for up to one hour in a single offline session, and will be declined if you do not reconnect to the internet within 24 hours of the start of your offline payment session. For Square Terminal and Square Register, offline payments will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. eftpos-only cards, Square Gift Cards and Afterpay transactions do not work with offline payments.

⁴ Excluding Plus or Premium software subscriptions.