Square Teams up with Sysco, Delivers New Features to Save Restaurants Time and Smooth Cash Flow

Strategic partnership with top foodservice provider and new product features bring more time-saving and easy-to-use tech to restaurants

Today, Square announced a new partnership with Sysco, a leading global foodservice distributor, along with a number of new features to help food and beverage sellers run their businesses with ease.

With new strategic partnership, Square and Sysco bring better technology to more restaurants

For more than a decade, Square has delivered innovative products to help food and beverage operators streamline operations and grow their businesses. Now, in partnership with Sysco, Square aims to bring the company’s powerful, intuitive technology solutions to more restaurants worldwide.

Sysco, a trusted leader in foodservice, supports and enhances their customers’ success with a range of services, including top-tier technology recommendations through their Sysco Restaurant Solutions program. Now, as a Restaurant Solutions partner, Square’s technology suite will be promoted, co-marketed, and sold to Sysco’s customers.

“Sysco is committed to helping our customers succeed through innovative solutions and technology,” said Neil Russell, Chief Administrative Officer at Sysco. “Square’s technology is comprehensive and easy-to-use for operators and workers alike, and we know that their solutions can help food and beverage businesses work smarter, operate more efficiently, and find new avenues of growth.”

Square brings new and highly requested features to food and beverage businesses to save time, improve cash flow

Beyond the strategic partnership with Sysco, Square also announced new features to help restaurants run their businesses easily and efficiently. These features are currently rolling out to sellers, with full availability in early 2025.

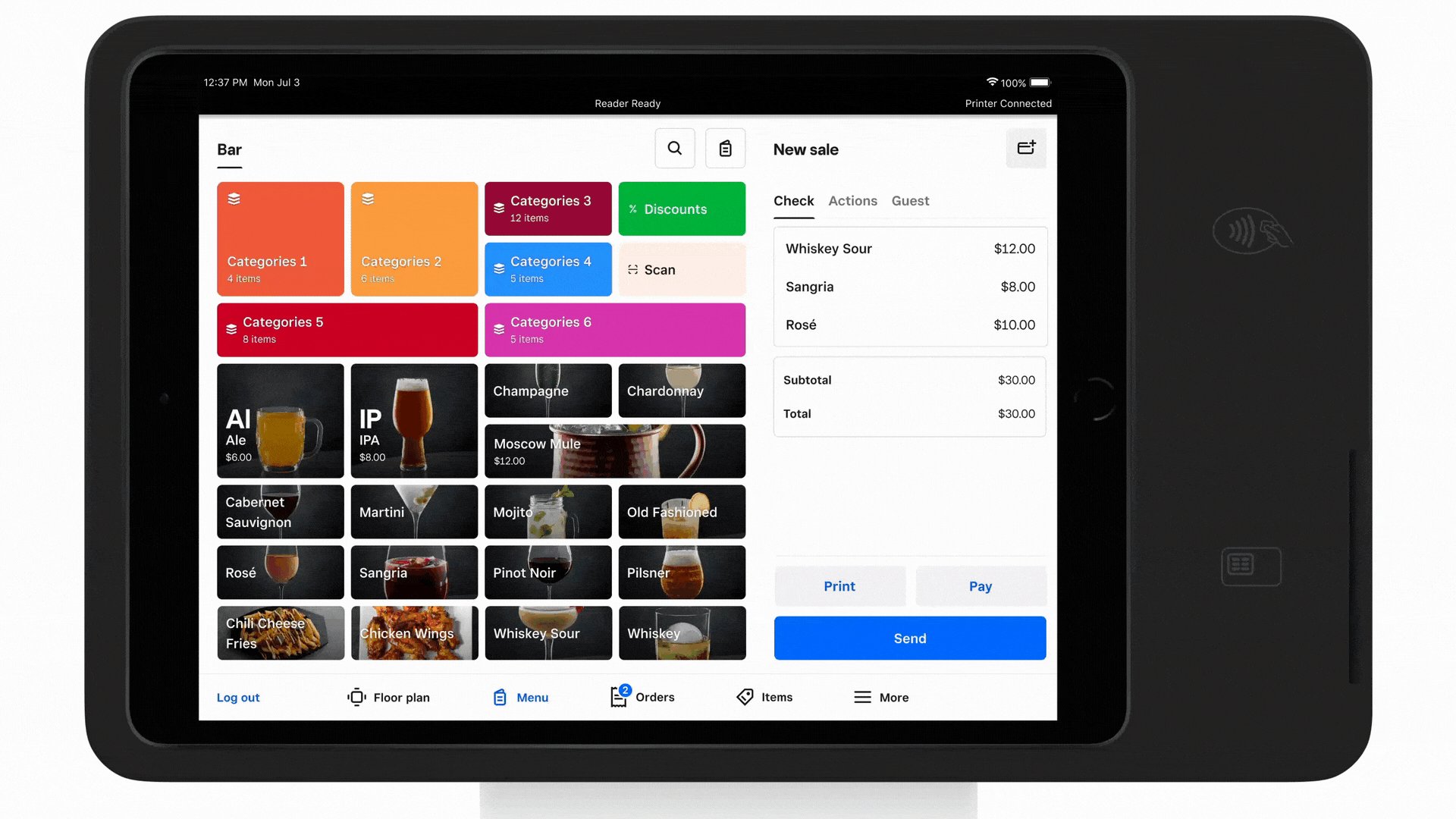

- Restaurants and bars can now preauthorize Bar Tabs for customers paying with credit card or digital wallet, improving the guest experience by speeding up ordering and simplifying checkout while also providing businesses with a secure payments experience. This feature is especially critical for bars and breweries, allowing these sellers to streamline service and start tabs without holding onto guests’ cards, all while protecting their bottomline.

- With Instant Payouts^, restaurants using Square Checking can receive funds for orders made through third-party delivery platforms instantly and without additional fees, giving sellers immediate access to their earned revenue. Cash flow is a major pain point for restaurants, particularly as margins get tighter, and with third-party delivery platforms continuing to grow in popularity, the delay in time-to-money for the orders they fulfill – up to 11 days in some cases – can be extremely challenging. Instant Payouts addresses this challenge for sellers, helping them worry less about their liquidity and giving them the means to more quickly restock inventory, pay their teams, and get orders out the door. Instant Payouts is currently available to Square for Restaurants Plus and Premium sellers that have integrated DoorDash or Uber Eats into Square, with more third-party providers coming in 2025.

- Sellers can now set up House Accounts for regulars or large institutional clients they know and trust, invoicing them monthly, quarterly, or whenever’s good for the business and customer.

“Holding onto people’s credit cards at the bar – and having 20-30 people per night forget to close out their tabs – can be a nightmare, so we were eager to work with Square on testing Bar Tabs for our brewery locations,” said Eric Lurwick, General Manager at Cisco Brewers on Nantucket. “We collaborated closely with the Square team on providing feedback to help fine-tune the product, and using Bar Tabs has made the lives of Cisco employees and customers a lot better.”

Sellers on Square for Restaurants can use Square’s Release Manager to easily opt into these new features at a time that makes sense for their businesses, giving operators the opportunity to train staff on changes before rolling out new functionality and ensure service is never disrupted.

“Day in and day out, our sellers are tasked with navigating the ever-changing and increasingly complex restaurant environment. We pride ourselves on listening to their challenges and needs so that we can deliver new solutions that make their lives easier,” said Ming-Tai Huh, Head of Food and Beverage at Square. “Any leg up we can give businesses – whether that’s through time saved or quicker access to revenue without more fees – is worth it to better equip them to succeed.”

To learn more about Square’s offerings for food and beverage businesses, visit our website.

About Square

Square makes commerce and financial services easy and accessible with its integrated ecosystem of commerce solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. For more information, visit www.squareup.com.

^ Instant Payouts services require a Square Checking account. Funds provided through Instant Payouts services are generally available in the Square Checking account balance immediately after an order is processed. Fund availability times may vary due to technical issues. If an order is not paid out instantly, it will be available according to your regular deposit schedule. Payout limits, including limits on payout amounts, may apply.

Block, Inc. is a financial services platform and not an FDIC insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Square Checking account, up to $250,000 of your balance may be covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, subject to aggregation of the account holder’s funds held at Sutton Bank and if certain conditions have been met.

Other trademarks and brands are the property of their respective owners.