Helping Sellers Make An Informed Choice When Seeking Funding

Jacqueline Reses, Head of Square Capital

As a business owner, every dollar counts. Many sellers think about their cash flow in “dollars and cents,” always considering the total amount they have coming in or going out the door on any given day.

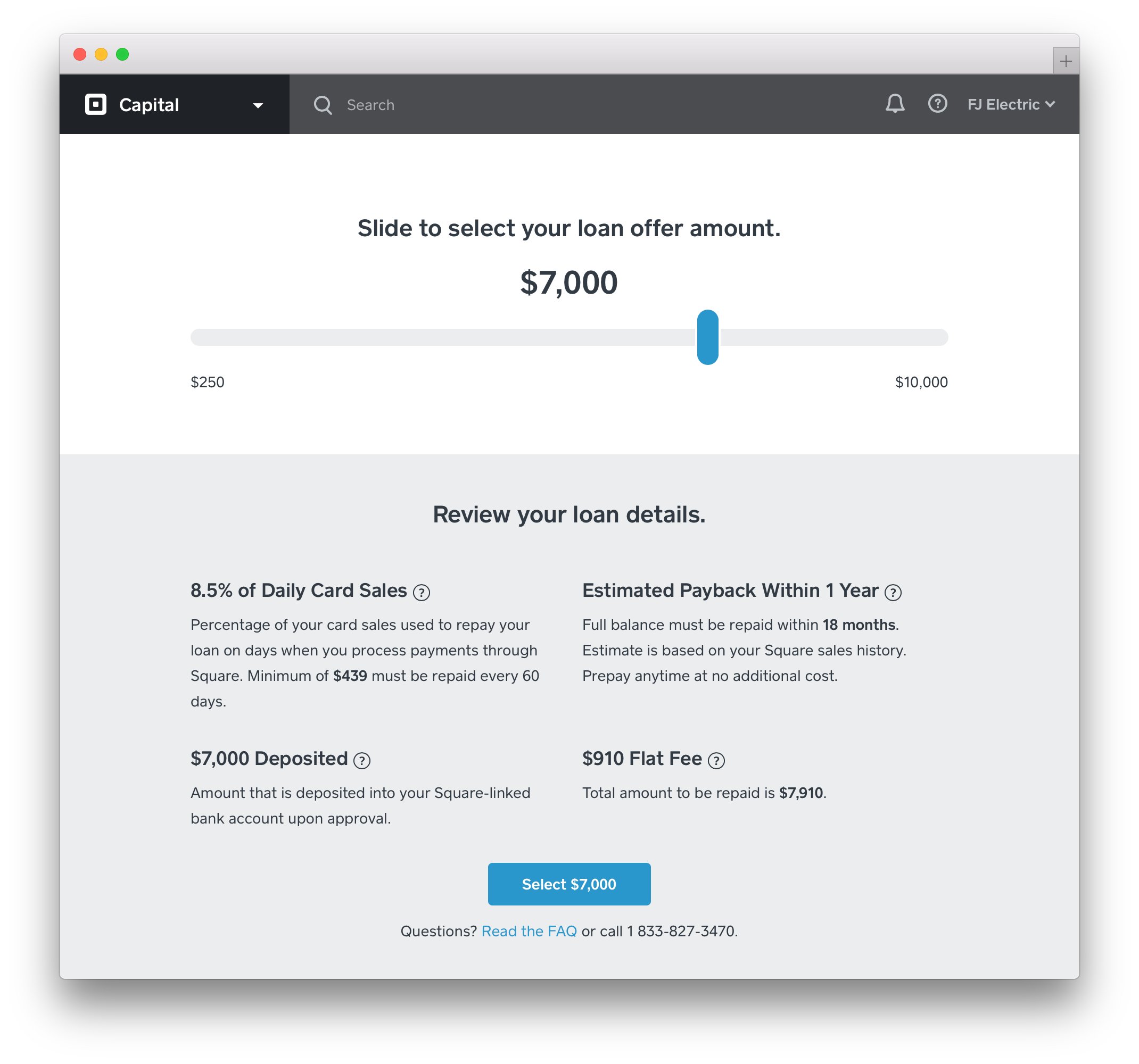

We address our sellers’ needs by applying this cash flow mindset - taking a “total borrowing cost” approach at Square Capital and prioritizing simplicity and transparency as we build financial services for our sellers. When it comes to communicating the cost of a loan through Square Capital, we present the total borrowing cost in a fixed dollar amount as an alternative to Annual Percentage Rate (“APR”) because our sellers tell us that’s what they want. This transparency provides the information that sellers need to make accurate decisions about the capital they use to grow their business

A new study conducted among over 1,600 US small businesses by economics professors from MIT, Princeton University, and UC Berkeley, reaffirmed this approach.(1) Their research suggests that total cost shown in absolute dollars is a clear and consistent way to present loan fees.

The study also provided us greater insight into metrics that prove less helpful. Notably, business owners surveyed make more mistakes when loan costs are quoted in terms of APR than when borrowing costs are more plainly cited as dollars and cents. The survey also found that borrowers more consistently identify and select the cheaper loan option when the loan was presented with its total borrowing cost.

Specifically, the study found:

- Business owners surveyed were 21.5% less likely to recognize the cheaper loan option when it is quoted as an APR as opposed to a total borrowing cost

- Two thirds of business owners chose the cheaper loan with total cost of borrowing presented

- Half of business owners will choose a more expensive loan when presented with APR over total cost of borrowing

The study also uncovered a lack of understanding around the definition of APR can lead to confusion and mistakes when borrowing. While the majority (83%) of subjects responded that “interest or borrowing costs” are included in APR, there was a significant portion of respondents who believed a variety of other fees and add-on costs were also included in the rate.

Small business owners may have varying degrees of financial expertise but all must constantly make complicated decisions about their businesses. This is why the combination of simplicity and transparency is key. By presenting the accurate cost of a loan in a way that corresponds with how business owners manage their cash flow, we can help them get the funding they need, in terms they understand.

By taking the guesswork out of the lending process, we can enable sellers to feel confident that they are making the right decision for their business. Our trusted relationship with sellers is grounded in our ability to offer products that deliver simplicity and transparency, and we will continue to maintain this focus as we work together to create a thriving small business community across the U.S.

(1) Statistics are based on a February 2018 survey of 1,703 U.S. small business owners, commissioned by Square Capital, and conducted by researchers at The Massachusetts Institute of Technology, Princeton University and UC Berkeley.