Beta

Recoup card processing fees with zero-cost EFTPOS

Automatically pass on processing fees associated with in-person card payments. Set it and forget it with auto card surcharging for every debit card or credit card transaction.

Card surcharges explained

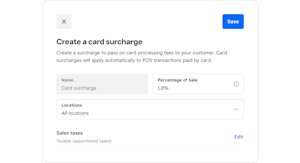

What is a surcharge? Zero-cost EFTPOS allows you to pass on processing fees to your customers. You can set it up as a dollar or percentage amount as long as it doesn’t go over your processing cost. With Square, the fee is the same regardless of card type.

How does a surcharge work?

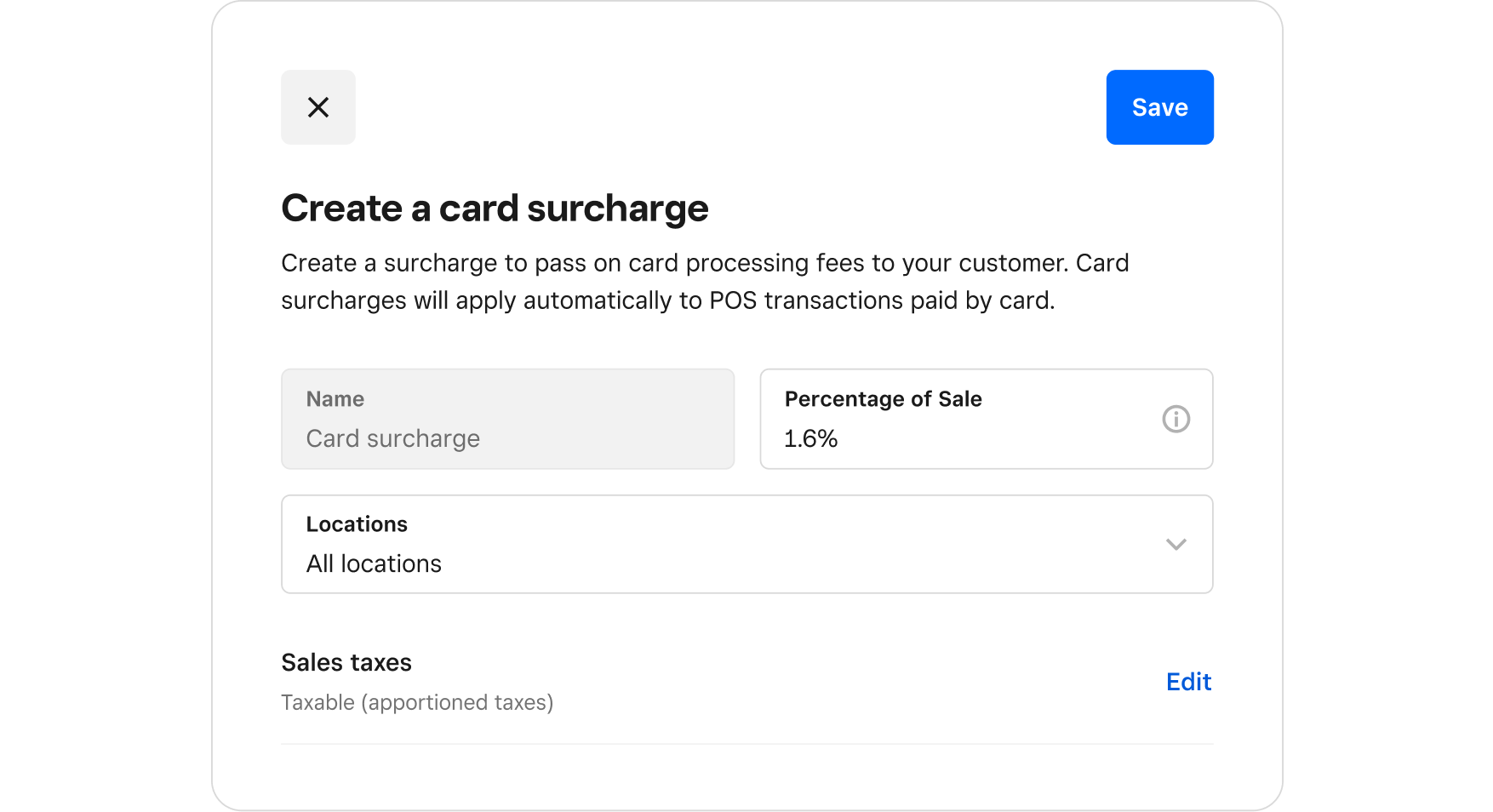

You can set up a card surcharge to be manual or automatic. For manual, you add the surcharge during the sale. For automatic, you set it up from your dashboard to automatically apply to each card sale you make. You can choose to pass on the full Square fee for zero-cost EFTPOS or select a partial amount.

In Australia, the Reserve Bank of Australia (RBA) has set rules on how you can surcharge. The surcharge rate can’t be higher than the amount you incur to process card transactions — your “Cost of Acceptance”.

Have more questions?

Check out the support article

What payments are covered?

All card transactions can be surcharged, but you can’t surcharge more for Afterpay.

- eftpos (debit and prepaid cards)

- MasterCard (credit, debit and prepaid cards)

- Visa (credit, debit and prepaid cards)

- American Express

For in-store Afterpay transactions, you can apply your card surcharge to cover the payment processing portion of the fee (that’s your Cost of Acceptance). Otherwise, you can’t impose a surcharge on a customer using Afterpay as their payment method.

Beta

Benefits of using auto card surcharging with Square.

Easy to use.

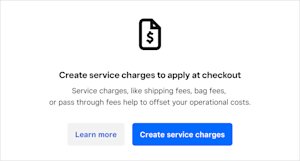

Pass on the cost associated with card payments easily. Set it to apply to every card transaction automatically.

Quick to set up.

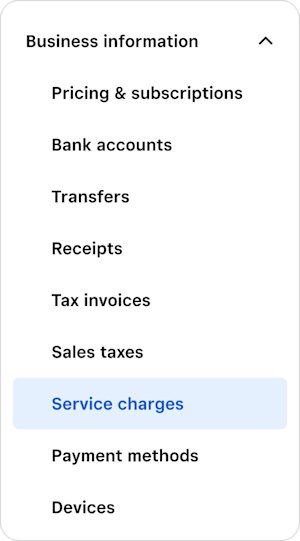

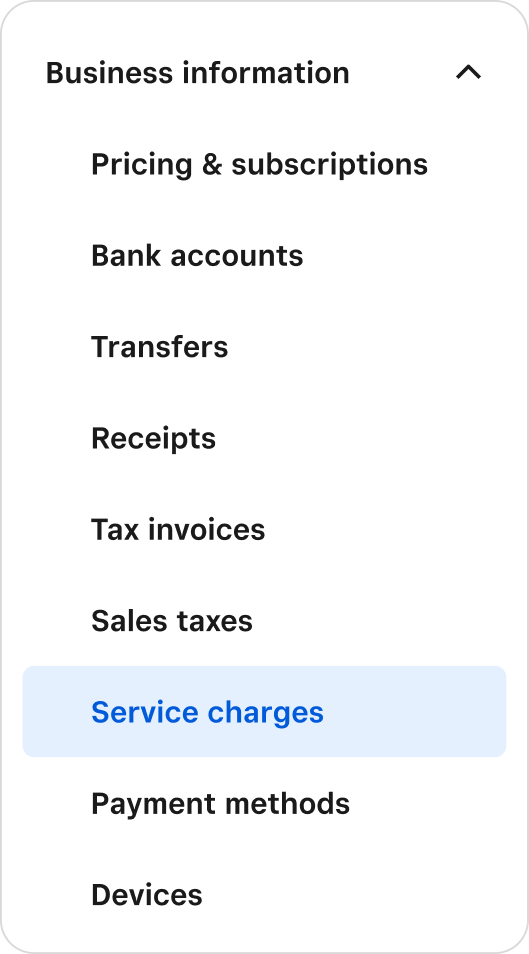

Enable right from your dashboard to apply across all your Square devices. It only takes a few steps.

Transparent for customers.

Customers are able to see what portion of the total is going towards the surcharge during a sale.

Beta

3 steps to enable zero-cost EFTPOS.

Open your Square Dashboard to get started.

Let Square support every part of your business.

Built-in security

Whether fraud protection, dispute management or PCI compliance, Square provides tools and services that are built to protect your business.

Start using Square and save.

Hardware to push your business further.

No matter where you’re selling, Square has the hardware you need to ring up items and accept payments fast. Once auto card surcharging is set up, it’ll apply to every payment taken on your hardware.

Turn your iPad into a point of sale and take every kind of payment.

FAQ

You can only charge your cost of accepting card payments - your “Cost of Acceptance”. The Reserve Bank of Australia have set out what costs can be included in the Cost of Acceptance calculation and the Australian Consumer and Competition Commission (ACCC) monitors surcharging to ensure that merchants do not excessively surcharge (that is, surcharge more than their Cost of Acceptance).

Square will provide you with your Cost of Acceptance for card transactions via Square in your monthly and annual Tax Invoice, and you can also see your card processing fee in your Square Dashboard.

Yes, surcharging is legal in Australia. You will need to ensure that you comply with the applicable regulations. See the RBA’s guidance, and the ACCC’s guidance on card surcharging for more information.

Yes, you will need to tell customers about card surcharges. See the guidelines here, which state that you need to prominently disclose any surcharge, including displaying a sign at the point of sale.

For in-store Afterpay transactions, you may apply a surcharge to recover the cost of accepting the card transaction portion of the fee, being your standard Square card processing rate.

You must not otherwise impose a surcharge on a customer for using Afterpay as their payment method.

See the ATO’s guidance on card surcharging.

These FAQ’s are for informational purposes only and do not constitute tax or legal advice. For specific advice applicable to your business, please contact a professional.