Resilience amidst challenges: COSBOA and Square release 2023 Small Business Data Report

Data reveals important insights into consumer spending, business growth, and job vacancies shaping the narrative for future policy making

The Council of Small Business Organisations Australia (COSBOA) and Square Australia have today launched their comprehensive 2023 Small Business Data Report, providing an in-depth analysis of the challenges faced by Australia’s small business sector, amid a turbulent economic landscape.

Luke Achterstraat, CEO of COSBOA, said this research underscores the harsh reality for small businesses.

“For Australian small businesses, 2023 has been a year marked by operational hurdles, dynamic market entries and exits whilst grappling with rising interest rates, inflation, and cost of living pressures impacting business and their customers.”

Small businesses play a pivotal role in the Australian economy, contributing approximately 42% of private-sector employment and adding one-third of gross value. Accounting for 97.5% of all businesses, roughly 2.5 million, they generate $500 billion of economic activity, constituting one-third of Australia’s GDP.

Achterstraat said: “If small businesses are doing well, then the Australian economy is doing well too.”

Consumer spending down

The latest report shows a slowdown in consumer spending and notable shifts in consumer behaviours. While most industries still show year-on-year sales growth, the pace has slowed compared to the post-COVID boom of 2021/2022.

GRAPH: Median Change in Industry Spend / SOURCE: Square Australia

2023 saw an inversion of the pandemic’s ‘darling’ sectors, such as home repair and home gym setups. Despite early successes in entertainment and transportation, the report provides evidence of a downturn of spending across all sectors.

“Small businesses are resilient, but the challenges are real. We must recognise the changing dynamics and consumer sentiments and work towards policies that steer Australia towards recovery and sustainable growth,” said Achterstraat.

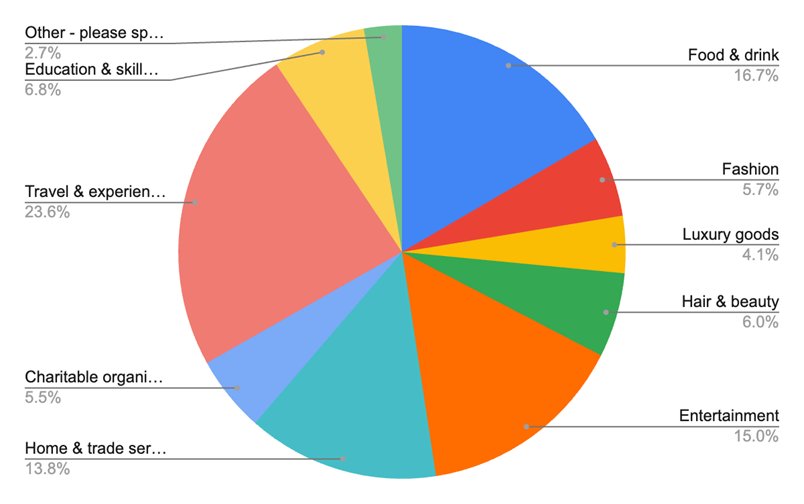

Looking to 2024, the data shows future consumer spending sentiment will be strongest across three sectors: travel and experience, food and drink and entertainment.

GRAPH: Consumer spending sentiment for 2024 / SOURCE: Pure Profile Survey November 2023, commissioned by Block

Businesses growth slowing but remains positive

Along with consumer spending, the report from COSBOA and Square also identifies how business growth data and broader macroeconomic factors, like business entries and exits, and job vacancies, are shaping the small business landscape.

“As of 30 June 2023, Australia boasts an impressive 2,589,873 actively trading businesses,” says, Achterstraat emphasising the critical role small businesses play in the country’s economic fabric.

Within the small business sector, notable changes from the research have been observed:

- 2.3% increase in non-employing businesses

- 3.5% decrease in businesses with 1-4 employees

- 1.8% increase in businesses employing between 5-19 people

“These figures suggest a noticeable shift in the small business landscape, with trends indicating either scaling down or expanding operations, which underlines the importance of adaptive business strategies,” said Achterstraat.

The report also sheds light on business growth rates, with small and medium sized businesses (SMBs) and mid-market businesses (Mid-Market), previously outperforming micro businesses during the pandemic, now approaching growth rates closer to their smaller counterparts.

GRAPH: Business growth rates / SOURCE: Square Australia

“Despite a general slowdown, all businesses regardless of size, are showing positive growth, at least for now, which highlights the resilience of businesses in Australia across various scales,” said Achterstraat.

In terms of business entries and exits, the report revealed an entry rate of 15.8% for the 2022-23 financial year, with 406,365 new businesses entering the market. The exit rate stands at 15%, representing 386,392 businesses exiting the market in the same timeframe.

“In each financial year, we witness more entries than exits, signifying a positive net change in the number of businesses. This is crucial in the context of understanding the impact of broader economic trends, such as entrepreneurial activity, market confidence, and potential influences of external factors like policy changes or economic conditions.

“I urge all small business operators to remain adaptable in the face of evolving dynamics, to stay abreast of market trends and leverage innovative strategies to navigate the changing landscape,” said Achterstraat.

Job vacancies reducing

The Australian Bureau of Statistics (ABS) recently released data indicating a 0.7% decrease (2,900 vacancies) in job openings during the three months leading up to November 2023, as per seasonally adjusted figures. This trend is in tandem with the Reserve Bank of Australia’s (RBA) findings, highlighting a decline in businesses’ intentions to expand their workforce in 2024 compared to the preceding year.

GRAPH: Job Vacancies Seasonally adjusted / SOURCE: Reserve Bank of Australia, Bulletin - September 2023, ‘Recent Development in Small Business Finance and Economic Conditions’

“While there is a decrease in job vacancies for the sixth consecutive quarter, it is crucial to note the broader context.

“Despite the recent dip, job vacancies in November 2023 remained notably elevated, demonstrating a remarkable resilience in the labour market. The data reveals that job vacancies were still 70.8% higher than the pre-pandemic levels observed in February 2020. This sustained elevation is attributed to the persistent labour shortages experienced across various industries.

“Businesses are contending with dynamic conditions, including supply chain disruptions and ongoing uncertainties, impacting their hiring decisions. The sustained elevation of job vacancies underscores the persistent challenges in matching available talent with the demands of the market,” said Achterstraat.

The current unemployment rate stands at 3.9%, indicating a relatively tight labour market.

“While the unemployment rate remains low, it is imperative for policymakers and businesses to collaborate on strategies that address the nuanced challenges faced by industries experiencing labour shortages

“In navigating the ever-changing landscape, COSBOA underscores the imperative for a comprehensive approach that fosters collaboration among the government and businesses.

“This report transcends mere statistics; it serves as a rallying cry to acknowledge the shared challenges and opportunities confronting Australian households and small businesses. As we find ourselves in the midst of economic upheaval, Australia faces a pivotal decision: Will we abandon our small business community to the mercy of the storm, or will we guide them to safer waters?” asks Achterstraat.

Reflecting on the report findings, Marco Lamantia, Executive Director of Square Australia: “Aussie businesses are showing their ingenuity and resilient best by continuing to grow, despite the challenging macroeconomic environment. They’re being proactive and turning to technology to help them do more with less.”

“But we’re not out of the woods yet,” Lamantia said. “Square and COSBOA will continue to work together to deliver actionable insights that businesses can use to help them thrive in this rapidly evolving economy.”

This collaboration is poised to provide a rapid understanding of market dynamics and the needs of small businesses, as COSBOA advocates for supportive policies to fortify the sector, ensuring its resilience in the face of ongoing economic uncertainties.

For the full data report, click here.