Get money for your business. Pay it back with your sales.

You could qualify for a loan when you switch your payment processing to Square.

Already selling with Square?

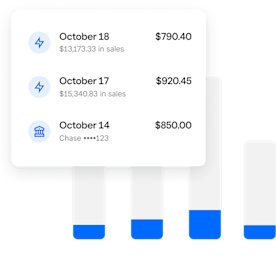

Loans and payments — all in one place

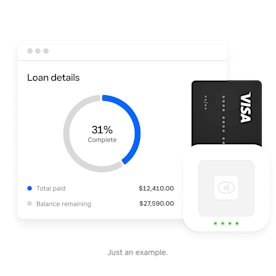

Get a business loan and automatically pay it back from your Square Dashboard. Because you repay with your daily sales, you can just do business as usual and go about your day.

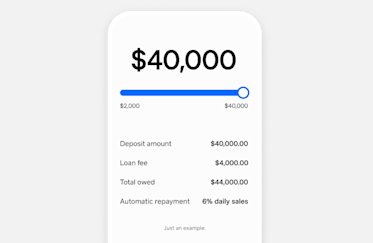

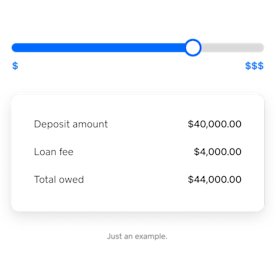

Loans from $2,000 – $250,000

Big or small, money can help move your business forward. If you’re approved, see the funds in your account as soon as the next business day.

One loan fee

Pay just one loan fee. This fee never changes and is paid back over the life of the loan. No late fees, ongoing interest, or surprises.

Automatic repayment

Your loan is repaid with a percentage of your daily Square sales — pay less on slow days, and a little more when sales are strong. It all happens automatically, so you don’t have to think about making a payment.

Business owners deserve more credit

$9B+

Funds extended*

460K+

Businesses funded

95%

Say business grew**

*Includes MCAs, SBA PPP loans, and business loans from May 2014 to March 2021.

**Based on an April 2019 survey of 5,655 respondents who have accepted a loan through Square Loans.

We make the switch simple

Our team of experts can help you set up your hardware and software, as well as connect existing apps and services, train your staff and answer any questions about loans from Square.

FAQ

We’ll let you know if your business is approved within a week.

Loan eligibility is based on a variety of factors related to your business. You need to have been in business for at least one year, make $250,000 or more in sales per location, and have a history of minimal chargebacks with your current payments processor. We’ll also look at three months of your most recent processing statements and your 1099-K from the previous year to see how much money your business is eligible for. If approved for a contingent offer, your business must process payments on Square for a minimum of 5 days before your formal offer will be available in your dashboard under the Loans tab. If approved, you’ll get the funds as soon as the next business day. All loans subject to credit approval; eligibility is not guaranteed.

Yes. Your business must process payments on Square for a minimum of five days before submitting your formal application. If approved, you’ll get the funds as soon as the next business day.

You can use the loan for any business-related expense. That could be stocking up on inventory, managing your cash flow, opening a new location, or hiring staff — anything you’d like to do for your business.

You pay one fee to borrow the loan (we call it the loan fee). This fee never changes and is paid back over the life of the loan. No late fees, ongoing interest, or surprises.

No, applying for a Square loan doesn’t affect your credit score. Additionally, we don’t require a personal guarantee for your business to take a loan.

A Square loan is designed to adjust with your daily cash flow. So, if you bring in $1,000 one day and your repayment rate is 16%, you pay off $160 of your loan. If you bring in $100 the next day, you pay off $16. And if you’re closed every Tuesday, you never make a payment on Tuesdays.

You must pay at least 1/18 of your initial loan amount every 60 days. If your daily card sales can’t cover it, we may debit the remaining minimum payment amount due from your Square-linked bank account.

It depends on your business’s sales, but most businesses pay back the loan within a year. We just ask that you hit your minimum every 60 days and that everything is paid back in 18 months.

Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Square, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Square, Inc.

All loans are issued by Square Financial Services, Inc. a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.