Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

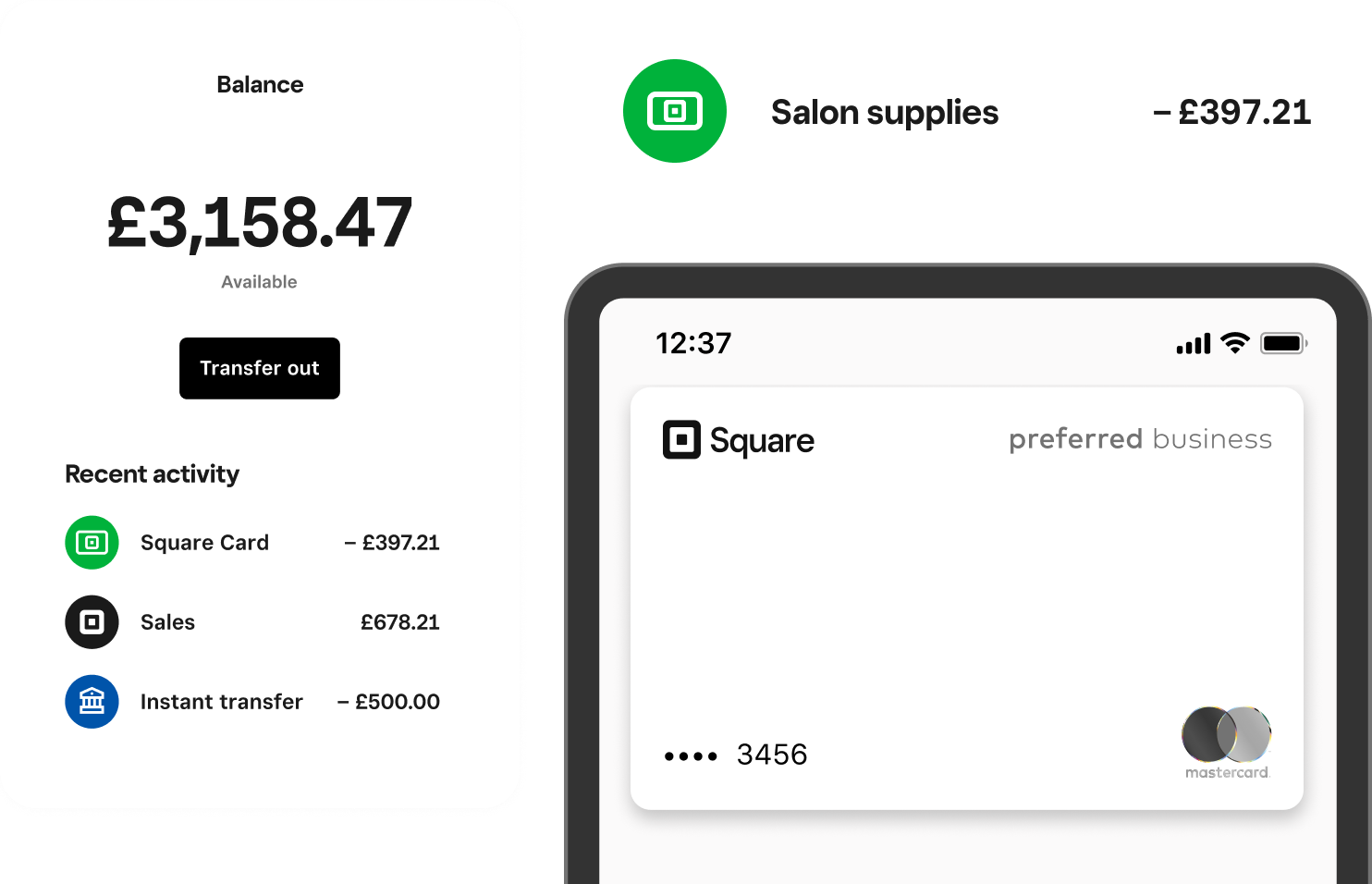

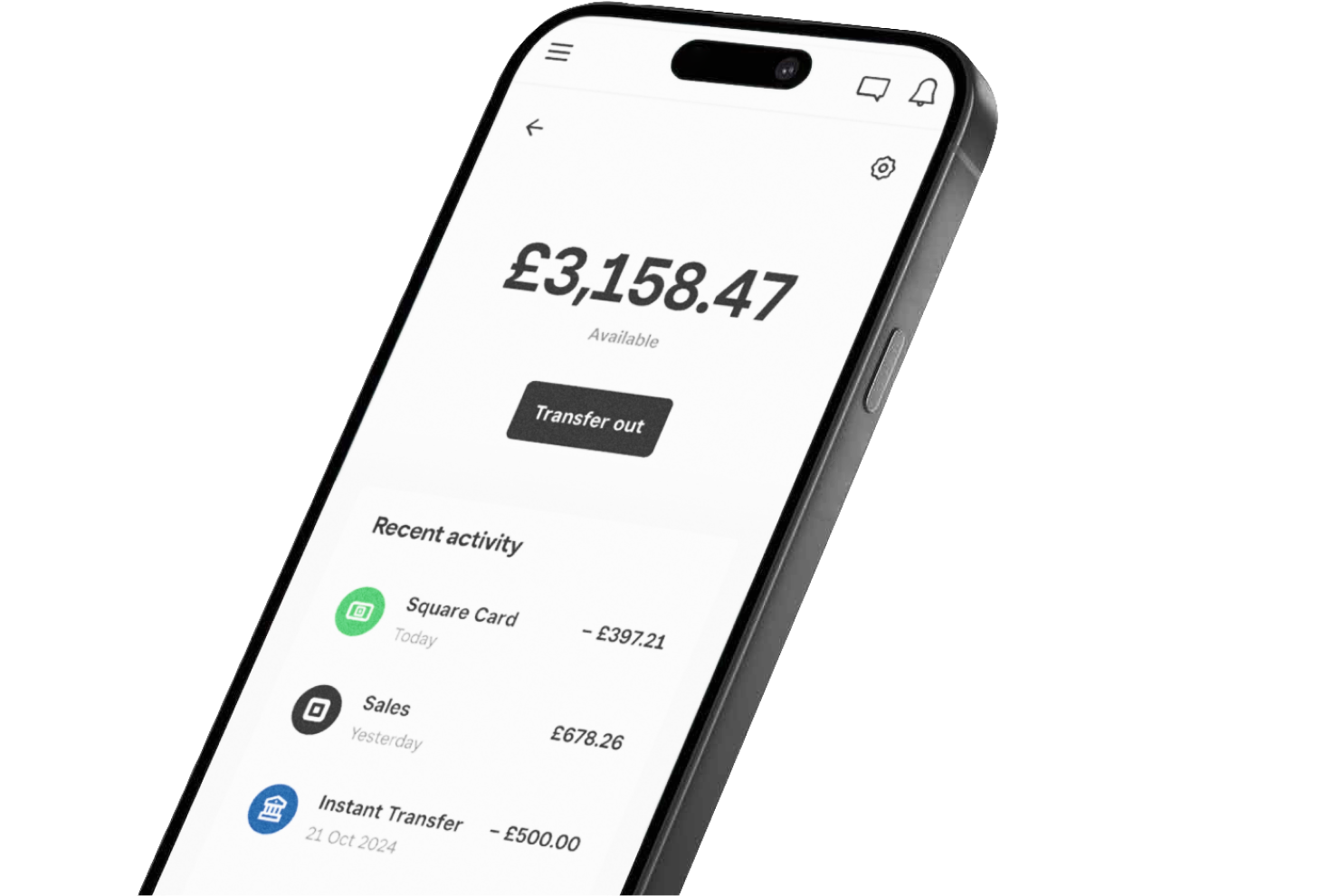

Square Card

Cash flow at your fingertips – instantly

Instantly access sales and take control of your cash flow with a free business spending card.

Instant access to sales

Sign up in minutes

No fees, 100% free

Everything in one place

Make a sale, and spend instantly

Use your Square Card to pay for new equipment, supplies, inventory or anything your business needs – anytime, anywhere.

Go contactless

Add your Square Card to Google Pay™ and use your mobile wallet to pay online, in app or in shops.

100% free of fees

Square Card has no annual fees, no hidden fees, no monthly fees and no minimum balance fees.

Stay on top of your finances

Your money is stored in your Square Balance after every sale, and can be accessed immediately with your business spending card. See your sales coming in and your money going out – all in one place.

Transfer funds

Send money to your bank when you need to. You can receive your funds the next working day for free or instantly for a 1% fee.

Help keep your hard-earned money safe

Two-step verification

Enable two-step verification to add an extra layer of security and help protect your account from unauthorised activity.

Card lock

If you ever lose or misplace your card, you can easily lock and unlock it in the Square app.

3-D Secure

Your online transactions are safeguarded against card fraud. We also protect your sensitive card information with extra customer authentication.

FAQs

Your questions, answered.

-

Square Card is a prepaid business spending card that gives you instant access to your funds from sales. No more waiting for next-business-day transfers – boost your cash flow with instant access to your earnings.

-

To sign up for Square Card, simply visit the Balance section of your Square app or Dashboard and follow the signup process. It takes just a few minutes!

-

Square Card is 100% free to order and has no monthly fees, minimum balance fees, overdraft fees or any other recurring fees. Square’s payment processing fees are separate and still apply.

-

As soon as you order your Square Card, automated transfers to a linked external bank account stop and you move to a stored balance. You can add your card to Google Pay™ to start accessing your money straight away. You can also find your card details in your Square app or Dashboard.

You can still manually transfer your funds to your external bank account in 1–2 working days for free or instantly for a 1% fee at any time.

-

You can spend funds with your Square Card anywhere where Mastercard® is accepted (including in person, online and at ATMs).

-

Square Card can be used at any ATM that accepts Mastercard®. The maximum amount which can be withdrawn at an ATM is £3,000 per day, £7,000 per week and £10,000 per month. You can view your limits from the Balance section of your Square app or Dashboard.

Note: Square does not charge you any ATM fees, but ATM providers may charge you a fee when you make withdrawals.

Get your dedicated business spending card

Square Card is issued by Squareup Europe Ltd. pursuant to a licence by Mastercard ® .

The eMoney associated with your card is issued by Squareup Europe Ltd., safeguarded, and authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (registered reference no 900846).

Funds generated through Square’s payment processing services are generally available through Square Card immediately after a payment is processed. Fund availability times may vary due to technical issues.

Square does not charge fees, but ATM withdrawal fees charged by ATM providers may apply.

Square Card is funded on a prepaid basis.