Actualiza tu navegador.

Descarga la última versión de un navegador compatible debajo para obtener el mayor beneficio de este sitio web:

Impulsa todas las partes de tu negocio.

Trabaja de manera inteligente, sé más eficaz automatizando tareas, y crea nuevos flujos de ingresos en la plataforma en la que confían millones de negocios.

Todos los tipos de negocio

Tipo de negocio ->

-

Todo

-

Restaurantes

-

Tiendas

-

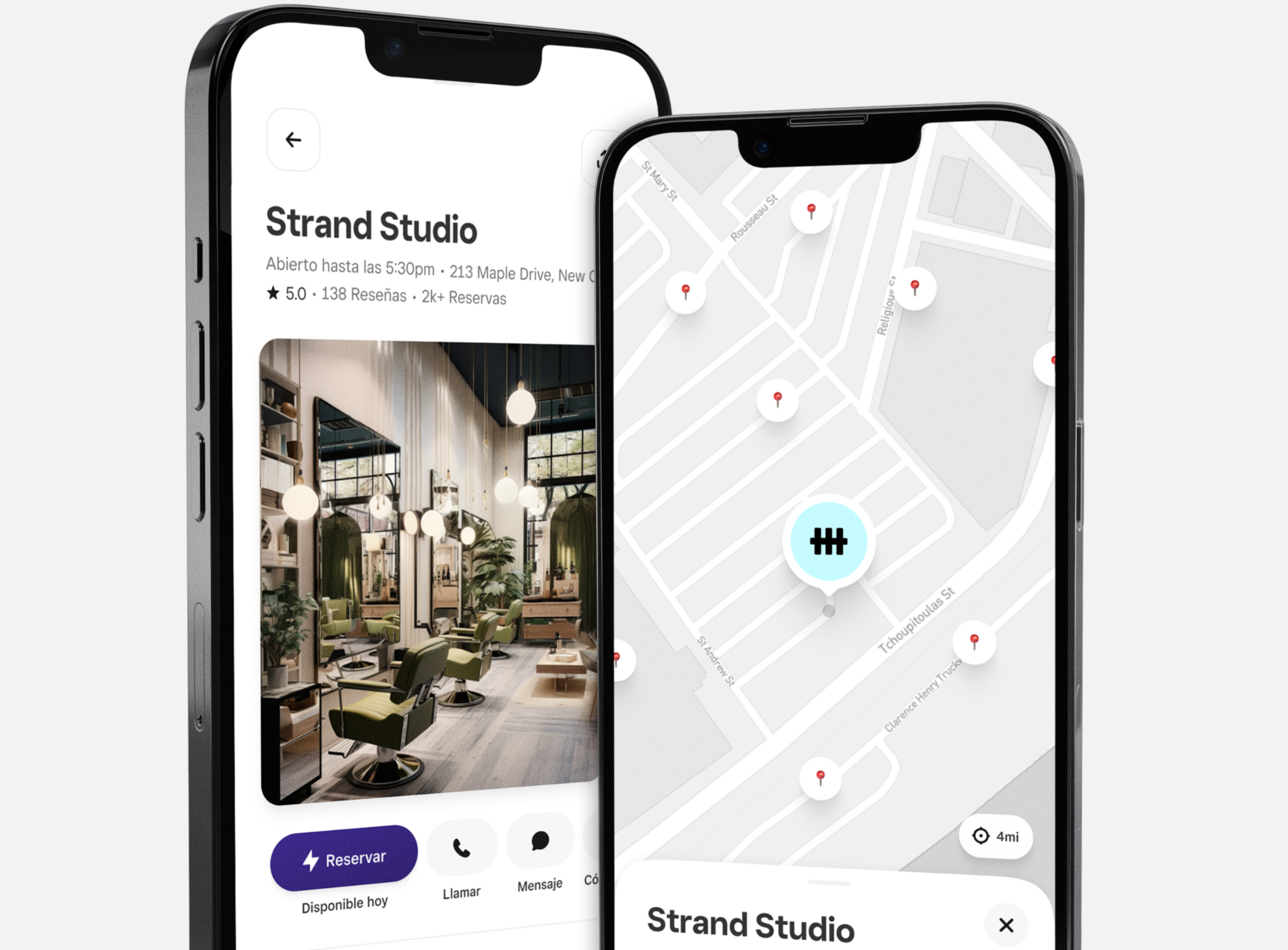

Belleza

Vende en cualquier lugar de manera sencilla, rápida y fluida.

Hardware y sistemas de punto de venta diseñados para vender en cualquier lugar.

Pagos seguros donde sea que estén tus clientes.

Opciones de recolección en la tienda, pedidos en línea , entrega y envío .

Mejora las operaciones de tu negocio.

Administra y optimiza las operaciones en múltiples ubicaciones, en los diferentes canales de venta y entre los empleados para mejorar la eficiencia y los resultados finales de tu negocio.

Tu meta comercial

Cómo lograrla con Square

((1)) Diversifica tus ingresos

Diversifica tus ingresos abriendo nuevos flujos .

Controla los márgenes con gestión de inventario y capacidades de informes.

Integra pedidos, artículos e inventario desde tu PDV a tu sitio web .

((2)) Administra el flujo de caja

Accede a tu dinero al instante con la Cuenta de cheques Square .

Reserva un porcentaje de cada venta de manera automática para impuestos o emergencias.

Obtén ofertas de préstamo según tus ventas con tarjeta mediante Square.

((3)) Conecta con tus clientes

Aumenta la fidelidad y el valor de tus clientes con información y datos centralizados sobre ellos .

((4)) Informes avanzados

Obtén datos sólidos para tomar decisiones confiables.

((5)) Administra tu equipo

Optimiza los turnos de tu equipo.

Calcula automáticamente las propinas y comisiones .

Ver más Ver más

Escucha de los vendedores de Square.

Square en cifras.

+4 millones

Con la confianza de más de 4 millones de vendedores de Square en todo el mundo *

$4k millones+

Prestados por Préstamos Square *

4B

Transacciones de ventas individuales por año *

Crea experiencias de comercio personalizadas.

API

Integra Square con el software o el sitio web de tu empresa utilizando las API de Square para pagos , comercio , clientes , personal y comercios .

Integraciones

Conecta el hardware de pago de Square al software de tu empresa mediante la API de Terminal , el SDK de Reader y la API de punto de venta .

Aplicaciones

Utiliza nuestras integraciones de socios prediseñadas y revisadas en el Mercado de Aplicaciones de Square .

Ayuda

Contrata a un especialista de Square para personalizar las funciones Square .

API

Integra Square con el software o el sitio web de tu empresa utilizando las API de Square para pagos , comercio , clientes , personal y comercios .

Integraciones

Conecta el hardware de pago de Square al software de tu empresa mediante la API de Terminal , el SDK de Reader y la API de punto de venta .

Aplicaciones

Utiliza nuestras integraciones de socios prediseñadas y revisadas en el Mercado de Aplicaciones de Square .

Ayuda

Contrata a un especialista de Square para personalizar las funciones Square .

Creado para todo tipo de restaurantes.

Creado para todo tipo de comercios minoristas.

Creado para todo tipo de servicios.

Comunícate con Atención al Cliente

Obtén más información sobre Square.

Mantente al tanto de productos nuevos, asesoramiento de expertos y más.

Encantado de conocerte.

Su negocio es tan único como usted. Cuéntenos un poco más sobre usted para obtener contenido individualizado.

Preguntas frecuentes

-

Square tiene soluciones para negocios de todos los tamaños . Nuestras herramientas conectadas están diseñadas para crecer con vista al futuro. La experiencia mejorada y sencilla para el cliente ayuda a generar datos más detallados y mejores relaciones con los clientes. Y nuestra plataforma abierta hace que puedas conectarla a integraciones prediseñadas o crear tu propia plataforma con nuestras API. Obtén información sobre cómo funciona Square con negocios más grandes y complejos.

-

Los servicios para comercios abarcan el hardware, el software y los servicios financieros que necesita un negocio para aceptar y procesar pagos (tarjetas de crédito y débito, carteras digitales con NFC y otros pagos sin contacto), tanto en línea como en la tienda. ¿Estás comenzando y necesitas una forma simple de aceptar pagos? Tu primer Square Reader para tarjetas de banda magnética es gratis si te registras para obtener una cuenta. Los lectores adicionales tienen un costo de $10.

-

Square creó un conjunto de herramientas integradas para ayudar a los negocios de servicios a ahorrar tiempo, de modo que puedan concentrarse en aumentar sus ingresos y brindar un servicio excepcional a sus clientes. Citas Square se puede usar para cualquier negocio que necesite habilidades de programación de citas y un sistema de punto de venta. Usa Facturas Square , una solución integral de facturación gratuita que ayuda a los negocios a solicitar, hacer seguimiento y administrar sus facturas, cotizaciones y pagos en un mismo lugar, a fin de cobrar más rápido. Y Mensajes Square es una plataforma diseñada para mantener la comunicación con tus clientes (mensajes de texto, correos electrónicos, recibos, facturas, comentarios, enlaces de pago contratos y más) en un mismo lugar; puedes enviar y recibir mensajes de texto en línea, y tus clientes tendrán un servicio al cliente más inmediato. Obtén más información sobre nuestras soluciones para servicios profesionales.

-

La función Compra ahora y paga después (BNPL, por sus siglas en inglés) es una opción de pago que permite que los clientes paguen una compra en cuotas mientras los comercios cobran el monto total. Con Afterpay, los comercios de Square pueden permitir a sus clientes pagar en cuatro cuotas sin interés en seis semanas.

-

El software de punto de venta y el conjunto de herramientas de Square facilitan las ventas en persona, en línea, por teléfono o en la calle. A medida que tu negocio evoluciona, puedes agregarle herramientas fácilmente, desde administrar miembros del equipo hasta agregar dispositivos y ubicaciones, todo en solo unos pasos. También puedes controlar las compras y las preferencias de los clientes para crear programas de fidelidad y de marketing más personalizados y, de este modo, lograr que regresen más seguido. Nos destacamos con el mejor hardware en su clase y una plataforma integral. Mira cómo nos comparamos con Shopify, Toast, Gusto, Vagaro y otros con una comparación función por función . O bien, escucha lo que dicen nuestros clientes sobre Square en nuestra página de reseñas .

-

Square se esfuerza por proporcionar el mejor hardware, software y recursos para brindarte asistencia en cada etapa del camino, ya sea que este sea tu primer negocio o que seas un emprendedor experimentado. Repasa los conceptos básicos con nuestro glosario de negocios , que abarca todo desde el área principal hasta la nómina . Consulta nuestra publicación para líderes de negocios modernos, The Bottom Line , para conocer las tendencias, perspectivas y estrategias más recientes. Busca consejos, trucos, videos y artículos en nuestro Centro de Atención al Cliente para ayudarte a aprovechar al máximo el hardware y software de Square. ¿Necesitas un poco más de ayuda? Nuestro equipo está preparado para ayudarte por teléfono, correo electrónico, Facebook o Twitter.

La Cuenta de cheques Square es proporcionada por Sutton Bank, Member FDIC. La Tarjeta de débito Square es emitida por Sutton Bank, Member FDIC, de conformidad con una licencia de Mastercard International Incorporated, y puede utilizarse en cualquier lugar donde se acepte Mastercard. Las cuentas están aseguradas por la FDIC por hasta $250,000.

Square, el logotipo de Square, Square Financial Services, Square Capital y otros son marcas registradas de Block, Inc. y sus subsidiarias. Square Financial Services, Inc. es una subsidiaria de propiedad absoluta de Block, Inc.

Todos los préstamos son emitidos por Square Financial Services, Inc., un banco industrial certificado en Utah. Member FDIC. La tarifa concreta depende del historial de procesamiento de tarjetas de pago, el monto del préstamo y otros factores de elegibilidad. Se requiere un pago mínimo de 1/18 del saldo inicial del préstamo cada 60 días, y la devolución total del préstamo en un plazo de 18 meses. La elegibilidad para un préstamo no está garantizada. Todos los préstamos están sujetos a la aprobación crediticia.