Taking out a loan is not a decision to be made lightly. But if you take funding and invest it wisely, it can be the secret sauce that helps your business grow exponentially. Eighty-four percent of business owners who take out loans through Square Capital say that it has helped them grow sales or revenue.

Jovanny Yu, owner of the Taylor Monroe salon, had never taken out external funding — or even thought about taking on debt. Then, about a year and a half after opening in the Hayes Valley neighborhood of San Francisco, he received a merchant cash advance through Square Capital.

He repaid the funds in a little more than six months. The growth he saw from that investment brought Jovanny back for additional funding through Square Capital.

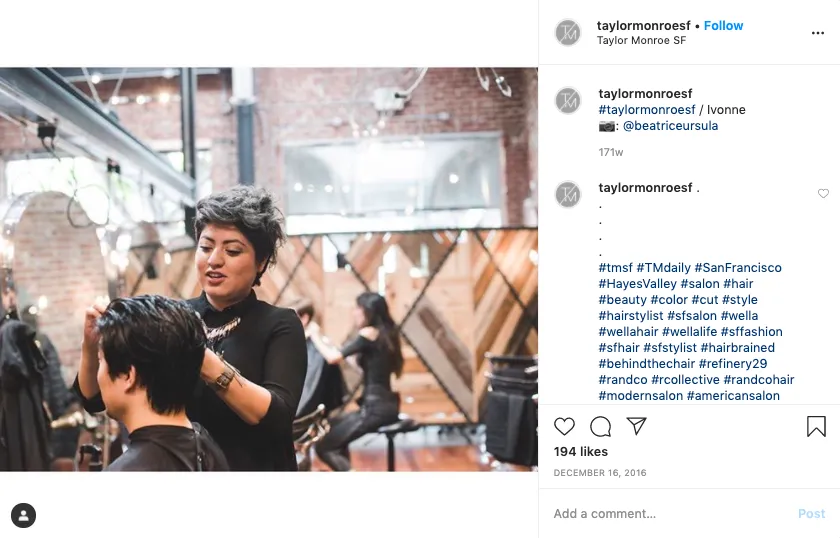

One of the biggest investments Jovanny made with his loan was hiring more staff. Whereas many salons operate on a chair rental model, Taylor Monroe is a commission-based salon (which means more overhead, but also more oversight of the business). The salon started with 14 stylists three years ago. Today it has a staff of 30 people: 22 stylists and eight other employees.

He estimates that each new stylist brings in eight to 10 clients a day and the salon has doubled the number of appointments in a month since taking funding. He’s also seen the average ticket increase by $14.

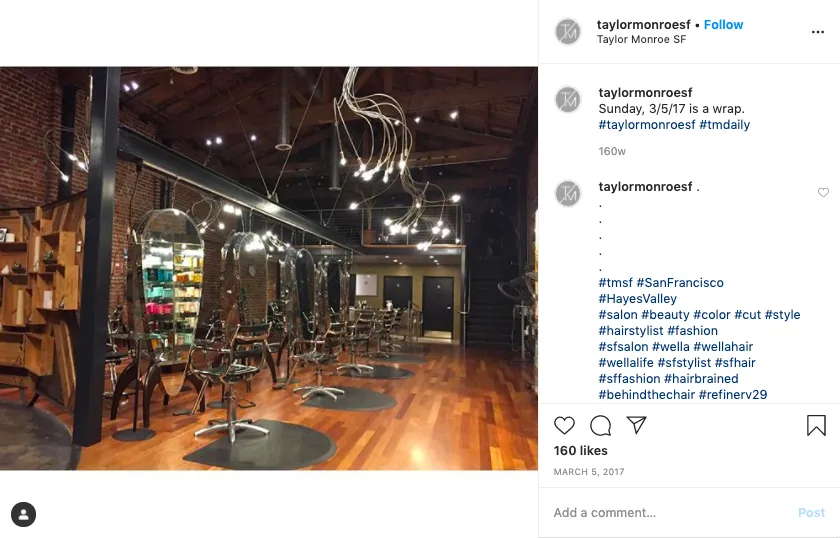

In addition to hiring, Jovanny focused on building a modern space that was comfortable for both his stylists and his clients. Jovanny renovated the store, upgraded lighting, and purchased a dishwasher so staff had to spend less time doing things other than interacting with clients. He’s also ordered new salon chairs.

With upgrades to the space and increases in staff, Jovanny estimates an increase of 41 percent in monthly revenue. In addition, he’s noticed a boost in morale amongst his stylists; a plus in an industry where he says turnover is a regular occurrence.

These investments have also helped Jovanny realize his vision for his salon and the Taylor Monroe brand — an inclusive, modern space where people come for beauty services and stay for the atmosphere. It’s a place where clients feel like more than clients; they are part of a community.

Jovanny loves the close attention Square Capital gives him. And he appreciates that payments are based on his real-time sales.

“This is perfect for a small business like myself,” he said. “It really helps me as a business owner because of the flexible repayment structure — it’s so much better than a monthly payment.”

His goal for Taylor Monroe is to open a second location — possibly in New York City — and he feels like Square makes it feel achievable. He plans to come back to Square Capital to help finance that project.

“I’d tell other businesses, if you have the opportunity, take advantage. It will help you and help your business, and give you another tool to get on your way to even greater success.”

Photos are used with permission from Taylor Monroe’s Instagram, @taylormonroesf

This online survey of 7,000 Square sellers who have accepted loans through Square Capital was commissioned by Square Capital and conducted by Qualtrics. The survey has overall margin of error of 1–2% at 95% confidence interval. Participation in the survey was optional and all data was self-reported by study participants. Responses and insights gathered were shared with Square Capital in an aggregated and anonymous manner. Respondents participated in the study between January 9–11, 2017.

Square Capital, LLC and Square Financial Services, Inc. are both wholly owned subsidiaries of Square, Inc. Square Capital, LLC d/b/a Square Capital of California, LLC in FL, GA, MT, and NY. All loans are issued by either Celtic Bank or Square Financial Services, Inc. Square Financial Services, Inc. and Celtic Bank are both Utah-Chartered Industrial Banks. Members FDIC, located in Salt Lake City, UT. The bank issuing your loan will be identified in your loan agreement. The individual authorized to act on behalf of the business must be a U.S. citizen or permanent resident and at least 18 years old. Loan eligibility is not guaranteed. All loans are subject to approval.

![]()