Accept Payments with Afterpay on Square Payment Links FAQ

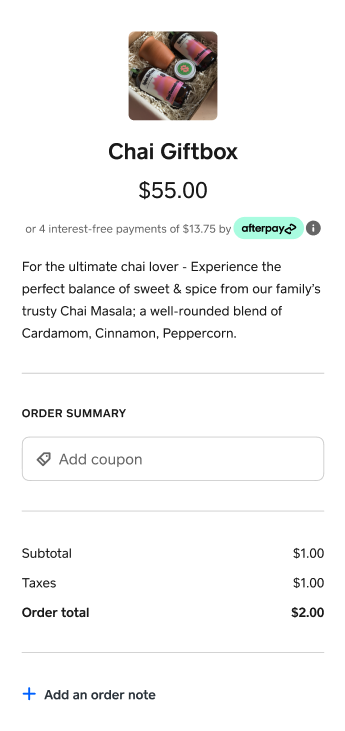

Afterpay is a buy now, pay later (BNPL) service that allows customers to pay for online orders in four interest-free payments over six weeks. You get the full amount—up front.

Eligible sellers are automatically able to use Afterpay when they create a Square Payment Link, allowing customers to select Afterpay as a payment method at checkout. Sellers will receive the full amount up front. Learn more about how Afterpay works on their website.

Pricing

Enabling Afterpay with Square is free—there are no monthly fees or startup costs. The Afterpay processing fee is 6% + 30¢ per Afterpay sale.

Square sellers using Afterpay get paid the full amount at the time of purchase, minus a processing fee on the total order.

You only pay when you make a sale—there are no processing fees charged on the remaining installments or if your customer makes a late payment.

Afterpay rates are fixed and do not vary by subscription type, hardware, or custom pricing.

Enable or Disable Afterpay

To enable or disable Afterpay payments on your Square Payment Links:

From your Account & Settings page, go to Business information > Payment methods.

Under Afterpay, select ••• > Edit settings.

Toggle the Online option on or off, then select Save.

When enabled, the Online option ensures you can offer Afterpay to customers on your Square Payment Links. If disabled, customers can’t use Afterpay to check out.

Note: The setting for online payments with Afterpay is global and applies across all Square products that can also take Afterpay payments online. This includes other online platforms such as Square Online and Virtual Terminal. There isn’t a way to disable Afterpay only for Square Payment Links at this time.

Eligibility

Eligibility for Afterpay is dependent on several factors, including how your business is structured and what you sell. Here are some notes to keep in mind:

Sellers must be in an approved merchant category

Sellers must be based in the United States

Restricted digital goods or services are not eligible at this time

Your primary language must be set to English. To verify your location’s language, go to Account & Settings > Business information > Locations from your online Square Dashboard. We look forward to adding Spanish support for Afterpay in the future

Item or cart totals outside of the eligible purchase range not supported

Custom pricing not supported

Cross-border orders not supported

Review our Afterpay Merchant Terms for more information on eligibility, merchant categories, and more.

FAQ

There is no additional charge for your customers to buy now, pay later — they make four interest-free payments over 6 weeks, the first payment being due at time of purchase. You get paid the full amount at time of purchase, minus the processing fee on the total order.

The Afterpay processing fee is 6% + 30¢ per transaction. There’s no additional setup cost or monthly fee.

Note: Afterpay rates are fixed and do not vary by subscription type, hardware, or custom pricing.

Afterpay is a separate payment option working with Square, and this is the standard BNPL rate that Afterpay charges merchants. In addition, Square and Afterpay assume BNPL risk on behalf of the merchant together, including chargebacks and fraud.

You’ll get paid the full amount at time of purchase, minus the processing fee on the total order. There are no processing fees charged on the remaining installments, and no other monthly fees or activation costs.

Once Afterpay is enabled in the Payment methods section of your account, your customers will see the option to pay in four interest-free installments with Afterpay on your Square Payment Links and buy buttons.

Your customers can sign up for an Afterpay account through the Afterpay app. The app is free, and they’ll know instantly if they’re approved. Once customers are ready to pay, they can choose Afterpay as their payment method at checkout.

They will be asked to make the first payment at checkout and pay the rest over six weeks. You will receive the total order amount up front, only the processing fee is deducted. Fraudulent charges and chargebacks are completely covered by Afterpay.

Learn more about how Afterpay works for buyers on their website.

All remaining payments are handled entirely by Afterpay. If your customer is late or misses a payment, it doesn’t affect your business. Find out more about how payments work with Afterpay and the consequences of late or missed payments on the Afterpay website.

Regardless of whether or not your customer has paid the full balance, orders can be refunded from the Order Manager in your online Square Dashboard, just like any other order. The amount will be refunded to the customer on the Afterpay side. Learn more about Afterpay refunds in their support center.

Note: A refund can only be processed for an Afterpay payment taken within 120 days.

Afterpay takes on the risk for the sellers that use it, including chargebacks and fraud. If one of your customers disputes a payment, Afterpay will reach out to you for more information and any documentation on proof of delivery, and a dispute decision will be made.

If the customer wins the dispute, Afterpay covers any dispute losses entirely. At no point are funds held from your Square account.

This may be due to a few reasons:

- Afterpay is toggled off in the Payment methods section of your Account & Settings.

- The customer’s cart total is outside the eligible purchase range you set up or the Afterpay default purchase ranges.

- Your location’s language setting is a language other than English.

Eligible purchase range refers to the prices for which Afterpay is available to buyers. There’s an eligible purchase range for order totals and one for individual items. The default ranges in your account are based on what type of business you have.

Not at this time. However, we look forward to introducing more control of Afterpay availability in the future.

Yes. The tipping settings you have in place will appear as normal for Afterpay transactions.

Note: Tips can push cart totals into or out of the order thresholds. Additionally, the Afterpay processing rate applies to the entire sale.

Yes, Afterpay is also available on other products such as Square Online, Square Invoices, Virtual Terminal and all Square apps. Learn more about accepting payments with Afterpay on other Square products.

- You can order a free marketing kit via Square Shop which includes stickers and a table tent that you can display at your point of sale. You can also download a free retailer kit from the Afterpay website.

- Using Square Marketing, you can send a free Square Marketing email to your subscribed customers.

- Tell customers your business offers Afterpay on your website and social media. Visit Afterpay’s marketing assets for helpful tips.