Transfer Options with Square

Find a POS designed just for your business.

Download the Square Point of Sale app free today, directly on your phone or tablet.

Once you’ve accepted payment with Square, you can choose to receive your funds through one of our three transfer options. There are no transfer limits with our default, next day transfer schedule.

Transfer Options Comparison

| Default Transfer Schedule | Instant Transfer | Manual Transfer | |

|---|---|---|---|

| Speed of Transfer | Transfer initiated next working day around 16:00–arrives in account within an hour. | Transfer sent instantly–arrives in 20 minutes. | Transfer sent within 24 hours of being initiated. |

| Transfers on weekends or holidays? | ❌ No | ✅ Yes | ❌ No |

| Action required? | ❌ Default option–no action required | ✅ Yes–manual action required | ✅ Yes–manual action required |

| Price | Free | 1% of transfer amount | Free |

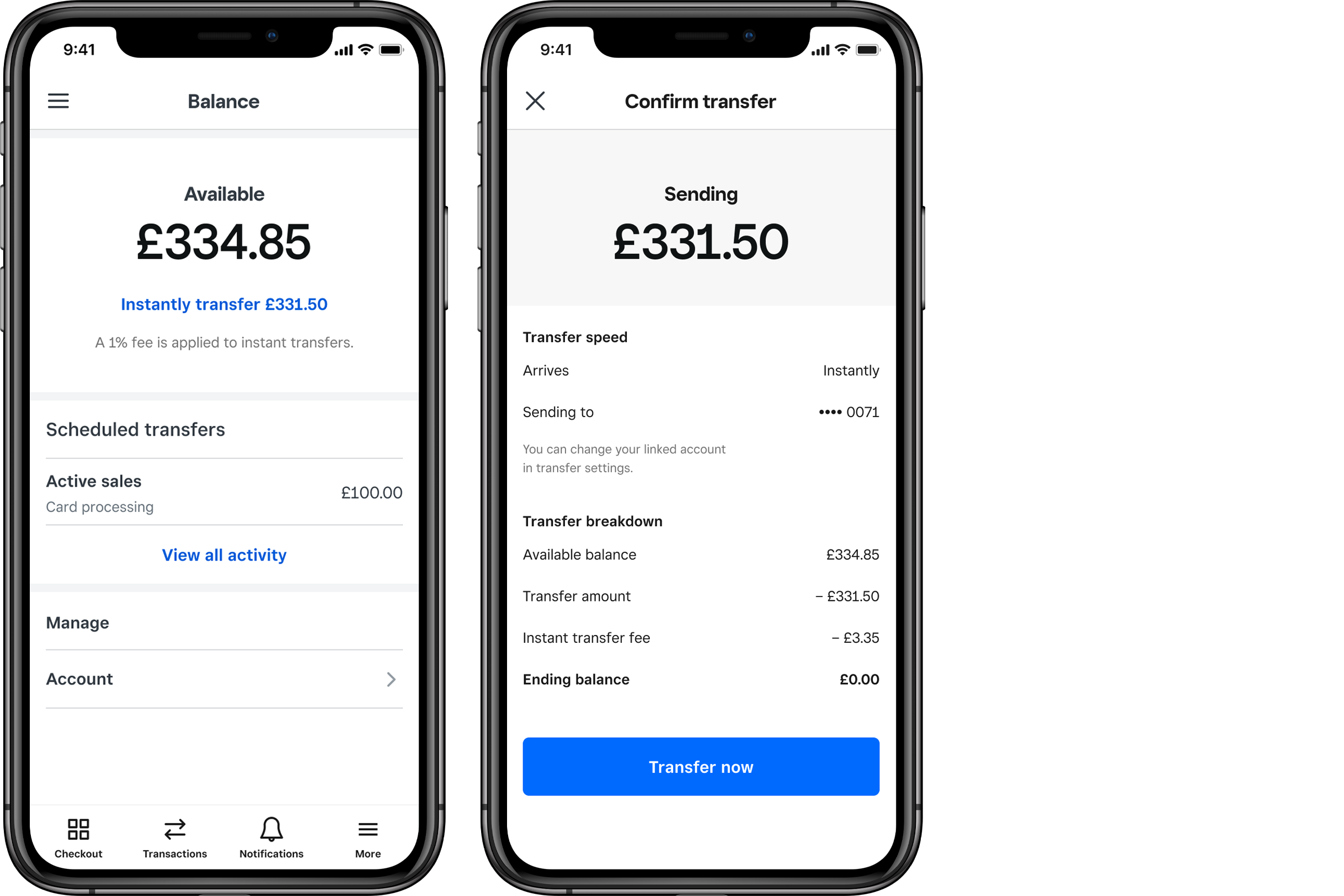

Instant Transfers

The quickest way to get your money is to take advantage of Square’s Instant Transfer feature.

Sometimes you need your money immediately – that’s when Instant Transfers can help. If Instant Transfers are available on your account, you can instantly send funds to your linked bank account 24 hours a day, seven days a week, for a fee of 1% of the transfer total.

Requirements and Limitations

To send an Instant Transfer, you must have at least £15 (after processing fees) in your Square balance.

The maximum payment size you can Instant-Transfer is £3,500 per 24-hour period to your bank account. The funds will arrive in your bank account within 20 minutes.

Learn more about sending an instant transfer.

Note: New Square sellers start with a limit of up to £750 per day. As you run and grow your business with Square, a higher daily transfer amount may become available.

Next Working Day

After you activate a Square account and verify your bank account, funds are automatically sent to your linked account per Square’s standard transfer schedule.

For sales that are processed before Square’s payment cutoff time at 00:00, transfers are initiated the following working day. For sales that are made after midnight, transfers are initiated in two working days.

Transfers are initiated at approximately 16:00, Monday through Friday. Once your transfers have been sent, they should be available in your bank account within an hour.

|

• Transfers are not initiated on Saturdays or Sundays.

• Bank holidays may affect transfer timelines. • Transfer cutoff and initiation times will adjust accordingly with British Summer Time. |

You’ll receive an email notification when your transfer is initiated by Square. While some banks post transfers immediately, others may take longer. You can visit Balance in your online Square Dashboard to confirm when Square initiated a transfer to your linked bank account.

You can also customise your close of day schedule.

Note: For Square’s standard Next Working Day transfers, transfers to your bank account are capped at £250,000 per day. If you accept over £250,000 in card payments in a single day, your next transfer will be for £250,000, with the remaining balance of payments delivered in a second transfer on the next working day.

Manual Transfers

By default, your funds will be transferred to your bank account every night, from Monday to Friday.

Instead of automatic transfers, you can enable manual transfers to choose when to transfer your money. Your funds will be available in your Square balance, and you can decide when to transfer them to your linked bank account. Your funds will then arrive in your bank account the next working day – at no extra cost.

You’re able to pause automatic nightly transfers and change to manual transfers directly from your online Square Dashboard, or from the Square app.

From your online Square Dashboard:

From the main menu, select Balance in your online Square Dashboard .

Select a location and click Transfer settings.

Under Transfer Schedule > select Manual.

From the Square Point of Sale app,

From the main menu, tap More > Balance and select Transfer to bank.

To initiate a manual transfer from the Square app:

Open your Square app on a mobile device or iPad and select More > Balance.

Tap Transfer out.

To initiate a manual transfer from your online Square Dashboard:

Log in to your online Square Dashboard and go to the Balance tab.

Select one of your locations under the Locations section.

Click Transfer out.