Square Card FAQ

Review answers to commonly asked questions about using Square Card.

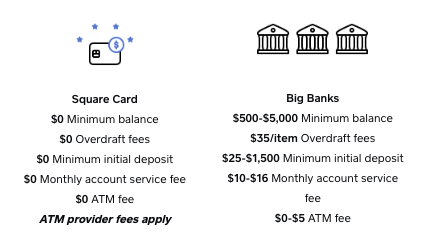

Square Card is free to order and has no monthly fees, minimum-balance fees, overdraft fees or any other recurring fees. Read more about Square Card.

Square’s payment processing fees are separate and still apply.

To start using Square Card, you first need to order the card through your Square app. To order your card, visit the Balance section in your Square app.

Once you receive your physical Square Card in the mail, you can activate the card from the Square Point of Sale app, from your online Square Dashboard or by scanning the QR code mailed with your card with a mobile device.

Read more about how to activate your Square Card in our Support Centre.

You can spend funds with your Square Card internationally anywhere Mastercard® business expense cards are accepted (including in person, online and at ATMs).

When making purchases online with your Square Card, you may be asked to confirm your transaction in your Square Dashboard or the Square app before it can be completed. This extra authentication step helps safeguard against fraud and keep your money secure. Learn more about using you. Learn more about using your Square Card for online purchases.

You can only use a Mastercard® credit card. An Interac card cannot be used as Square Card.

Square Card can be used at any ATM that accepts Mastercard®. The maximum amount which can be withdrawn at an ATM is CAD $500 per day, $1000 per week and $2000 per month. Learn more about spending limits.

Note: Square does not charge you any ATM fees, but ATM providers may charge you a fee when you make withdrawals.

If you update your business name prior to ordering your Square Card, your new, updated business name will appear on your Square Card. If you’ve already ordered a Square Card and need to change your business name, you can do so if you cancel your current card and re-order a new card.

You can change your business name in your Square app by going to Settings > Account and tap on Business Information. Under Basic Information update your Business Name to 26 characters or less.

From your online Square Dashboard on a computer, navigate to Account & Settings and select Business > Locations. From here, select the location associated with your Square Card and update your Business Name to be 26 characters or less.

Note. The maximum business name length the manufacturer can print on the Square Card is 26 characters.

The Square Card is issued to the Square account owner. While we’re not able to change the name associated with your Square account, you’re able to create a new Square account with the name of the person you’d like to have on the Square Card.

As soon as you order your Square Card, automated transfers to a linked bank account stop since you’ll automatically have access to your virtual card. You are still able to initiate a transfer at any time with next-day transfers for free or instant transfer for a fee.

Transactions can be declined for a number of reasons. Some of the most common reasons are: insufficient funds in your Square Balance, ATM limit reached, suspected fraud payment, unactivated Square Card or incorrect billing postal code or CVC.

Some businesses (e.g. gas stations and hotels) will place a temporary charge on your payment card to ensure that your Square Balance has enough funds to cover your purchase.

This pre-authorization happens the moment you use your card and will be reflected on your balance and card spend report until the merchant clears the pre-authorization. Most pending authorizations clear within three days, but in rare cases it can take up to 14 days to clear.

You can view your Square Card activity from your online Square Dashboard by going to the Balance section and selecting a location. Then, from the Recent activity section, select View all activity.

From the Square app, tap More > Balance > View all activity.

Balances will reflect available funds on your Square Card along with recent activity from Square payment processing, card spend, transfers and any other credits or debits.

Before you file a claim:

- Ensure the payment has posted to your account and isn’t pending or voided.

- Some merchants (e.g. gas stations) will place a temporary hold on your Square Card to authorize your purchase. This temporary hold will be higher than the actual transaction amount, typically CAD $75 or $100. We call these transactions pending authorizations. These pending authorizations can take up to 14 days to clear.

- Contact the merchant to try and resolve your concerns. We aren’t able to pursue a claim if you haven’t attempted to resolve the issue with the merchant directly.

If you notice a transaction you didn’t make or have a question about a transaction in your history, you’ll need to report a claim. Find out how to file a claim on your Square Card.

Refunds can take up to 10 business days to post to your account from the date the merchant issues the refund. As soon as Square receives the refund, the funds will automatically appear in your available Square Card balance.

If the credit does not post to your Square Card balance within 10 business days from when the merchant issues the refund, please contact Support with documentation of the merchant’s issued refund.

The billing address associated with your Square Card is the personal home address you provided when you signed up for a Square account. Or, if you were asked to designate a preferred billing postal code when you ordered a Square Card, the information you entered will be your Square Card billing postal code.

You are able to view your billing postal code from the Square Point of Sale app by navigating to Deposits > Square Card and tapping Billing Address.

You can edit the billing address associated with your Square Card from the Balance tab of your online Square Dashboard, then click Square Card. Click Card Management > Billing Address and select Edit Billing Address. From here, make your edits and click Save.

Eligibility for Square Card requires verification through our banking partner. If your information cannot be verified, you won’t be able to use Square Card, but you can still take advantage of

Square’s other transfer options.

You can deactivate your Square Card directly from the Square app. To do so, tap the three horizontal lines to open your app menu and select the Balance tab > Square Card. Tap Get help with card > I’d like to cancel my card > select Deactivate Card. Tap Okay or Switch Back to Regular Transfers if you’d like to return to Square’s standard next-day transfer schedule.

You can leave feedback on the following screen and press Send, or tap X on the top left to exit the menu.

In case you need to, you can order a new card by selecting I lost my card, My card was stolen or I never received my card.

Square may sometimes decline suspicious transactions in order to protect your account. When this happens, Square will reach out to you to request additional information. We’ll review it and get back to you within two days. During this time, your card may be locked from making further transactions.

In order to keep your Square account safe, our team ensures detecting any suspicious account activity. If we determine a suspicious account activity, we will reach out to you via SMS notification to your registered phone number with Square. Once you receive our SMS notification, you’ll need to

contact us at your earliest convenience to proceed with the account review.

Yes, you can opt in to receiving SMS notifications when certain types of transactions occur on your account. Qualifying transactions include international purchases, online card not present purchases or declined transactions, and the notification will contain transaction information along with the option to lock your card directly from the SMS message. Once you’ve viewed the transaction information, you can unlock your card at any time.

You can update your notification preferences or unlock your card from the Balance section of your online Square Dashboard or the Square app at any time. Unlocking your card via SMS isn’t currently available.

| Read More about Getting Started with Square Card. |