Table of contents

Businesses often think in terms of financial years. But it can be advantageous to refresh your financial goals in the new calendar year. It can help reduce stress about tax returns, GST, BAS, and all those other headaches that June 30 brings.

It also offers all the psychological benefits of a fresh start. So let’s look at seven ways you can set some positive financial goals for your business this year.

SWOT up on your business plan

Do you already have a business plan? If not, here’s our guide to creating one. If you do have one, awesome! But you should update it each year so its insights and targets remain current.

Writing for Forbes, Melissa Houston recommends creating “a 12-month operating forecast that breaks down month-over-month revenue growth and expenses and ensures that you either maintain your profit margins or increase them”.

You’ll also need to update your business plan’s SWOT (Strengths, Weaknesses, Opportunity, Threats) analysis. Consider the successes you’ve had in the past year and the areas where you know you have an advantage. Account for any new competitors or changes to your particular market, positive or negative.

1. Stay SMART

We’ve talked about SMART (Specific, Measurable, Achievable, Relevant, and Timely) goals before, but they really are important if you’re going to achieve your aims and make a difference. It’s not enough to say, “This year I want to be more profitable.” You need a specific target and ideas for how to get there. Here’s an example:

Specific: This year we’ll increase our revenue by 15%

Measurable: We’ll track total revenue on a monthly basis and compare it to the previous year to make sure we’re on target.

Achievable: We increased revenue by 8% last year and have some great ideas for better marketing some of our most popular products – we know that, with a bit of effort, we can do this.

Relevant: The goal fits with our overall business objectives of increasing profits and expanding our customer base.

Timely: We’ll achieve this 15% revenue increase this calendar year.

If you’re not yet sure what your major goal should be this year, this article includes a handy list of 10 financial goals. The crucial thing is to identify the most important objectives for your business and prioritise them accordingly.

2. Grow sustainably

Are you growing your business sustainably? Increased sales normally need to lead to increased profits, otherwise, it’s more work for the same return.

Houston says that “an excellent way to monitor if you are growing your business profitably is to monitor your profit margin”. To do this, calculate your net income (revenue minus all expenses) and divide it by your total revenue. For example, if your company made $100,000 in sales last year and had $85,000 in total expenses, your company’s net income would be $15,000 and your profit margin would be 15 percent.

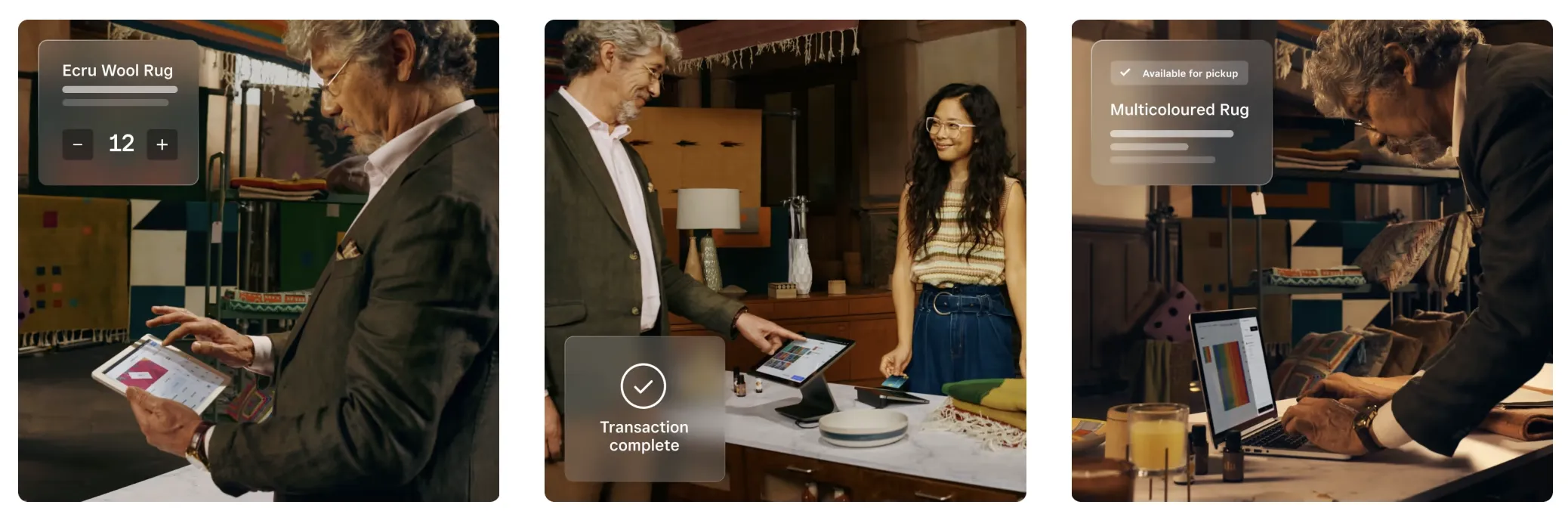

Square for Retail’s reporting helps you keep an eye on your profit margin by keeping your topline metrics – cost of goods (COGS), total revenue, profit, and profit margin – front and centre. This article will help you understand your overhead costs and this one can help you determine your breakeven point – both metrics are critical for ensuring you have positive cash flow and are building on your revenue goals.

As Houston says, “profit margins vary significantly by industry, so it is essential to benchmark your business against others in your industry. You want your company’s profit margin to be equal to or above average (compared with your competitors).”

3. Dream a giant dream

Now, we said that your goals should be measurable and achievable. But it helps to have a “big, hairy, audacious goal” (BHAG for short, pronounced Bee-Hag). This is one that fires up your engines and sets your course for that 10+ years horizon. You’ll need a clear and compelling destination in mind, something that inspires you and your team to push beyond your limits and achieve something truly remarkable.

Your BHAG should be challenging and slightly out of reach, something that cannot be accomplished in a short period of time but is achievable in the long run. This is important because, while the sceptics might dismiss your easily attainable short-term goals, longer-term BHAGs drive you and your team forward. Elon Musk had a pretty bad year, but he’s still going to Mars.

4. Communicate your goals

Your team needs to live and breathe both your SMART goals and your BHAG. Book a team-building meeting where you can communicate the ‘why’ of your goals, (how they fit with your business’s mission and purpose), relate them meaningfully to each individual’s day-to-day work and how this contributes to the larger objective, and get buy-in by encouraging everyone to share their feedback and ideas for reaching your targets.

Where appropriate, share how hitting the goals will benefit your staff. You could say that if the business increases revenue by 15% over the year you’ll be able to offer a pay rise or bonuses, or you might be able to put on more staff to make the job easier.

Communicate regularly throughout the year. Keep the team updated on progress and provide regular feedback. Share successes and challenges and adjust the plan as needed.

5. Make it happen

Once everything else is in place, you’ll need an action plan. Here you allocate resources like personnel and budgets, track spending and create a framework for accountability.

Tip: You may have already come up with many of these inputs as you created your 12-month operational business plan.

Be clear about ‘how’ you’ll achieve your objectives. For the example goal of increasing revenue by 15% you might devise new tactics for boosting sales, explore selling on social media, rework your pricing strategy, or improve your customer service.

It’s important to be clear on who’s responsible for meeting each target, who they report to and how often they’ll check in. Monthly meetings go a long way in keeping everyone accountable. Or, if it’s just you, make looking at how you’re tracking something you do in the last week of each month.

6. Be flexible and adjust your goals accordingly

Of course, the best-laid plans often go awry. Unexpected circumstances may require adjustments or changes within your strategy.

Realistically, no one is exactly sure what will happen in the Australian economy in 2023. Speaking to four leading economists, the ABC says it’s unlikely we’ll enter a technical recession (defined as two consecutive quarters of negative growth in real GDP) this year. The economists predict inflation will slowly ease, we can expect a couple more RBA rate rises before that too levels off, property prices will keep falling, unemployment rates will rise (which may have a silver lining for employers) and we’ll continue to be affected by global factors like the war in Ukraine.

Whatever happens, building in the flexibility to adjust your plans will allow you to remain competitive and respond to any opportunities that arise this year.

This article is for informational purposes only and does not constitute professional advice. For specific advice applicable to your business, please contact a professional.

![]()