Square Checking

Instantly access, spend, and manage your sales.

Not on Square yet? Join today to start a checking account.

Cover business expenses, access funds, and move money whenever you need to.

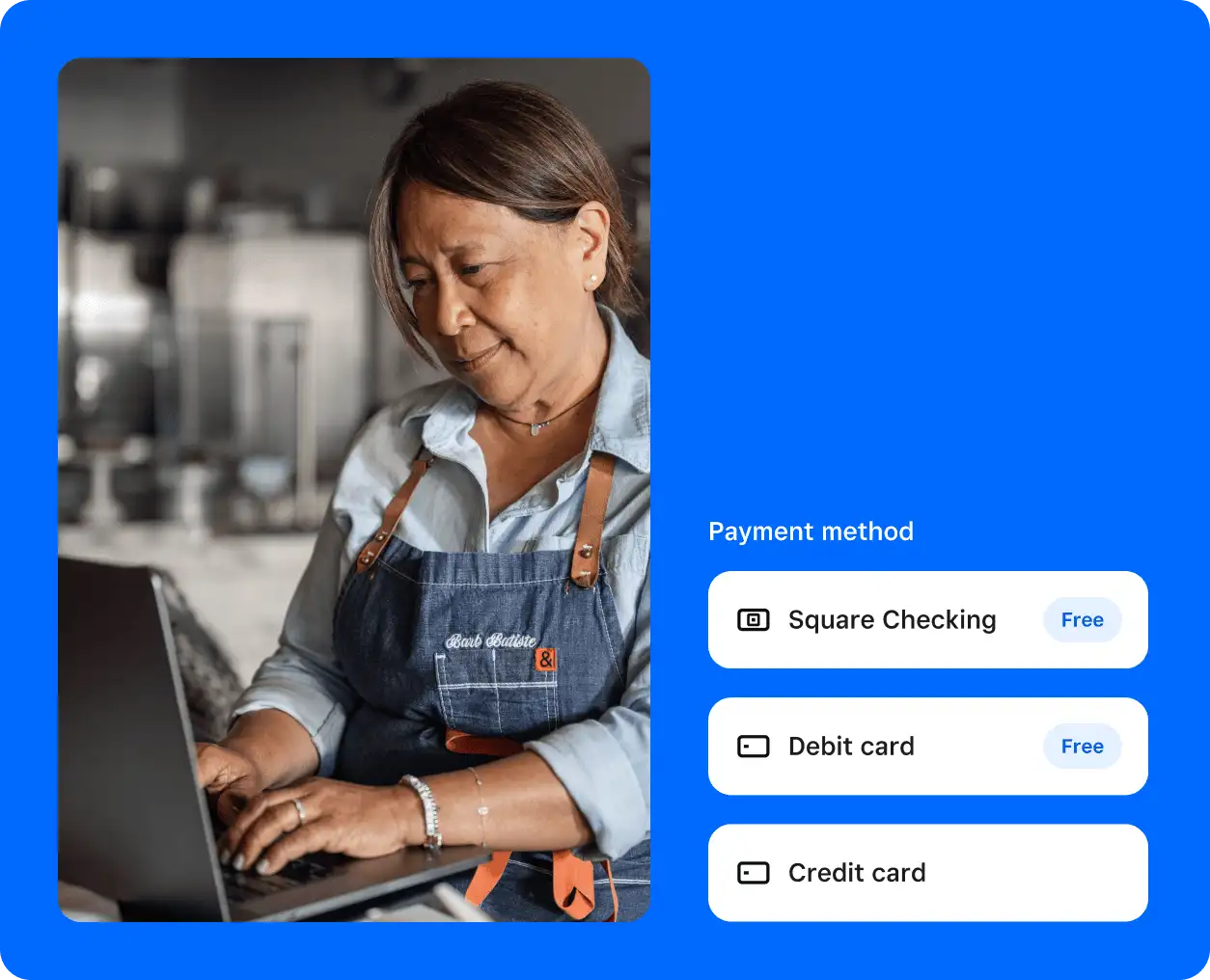

Ways to pay

With Square Debit Card, your Square sales are automatically ready to spend — digitally or in person.

Learn more

Get up to 5 debit cards for your business to share spending power with your team.

Add your Square Debit Card to Apple Pay® or Google Pay™ and use your digital wallet to pay online, in app, or in person right away.

Learn more

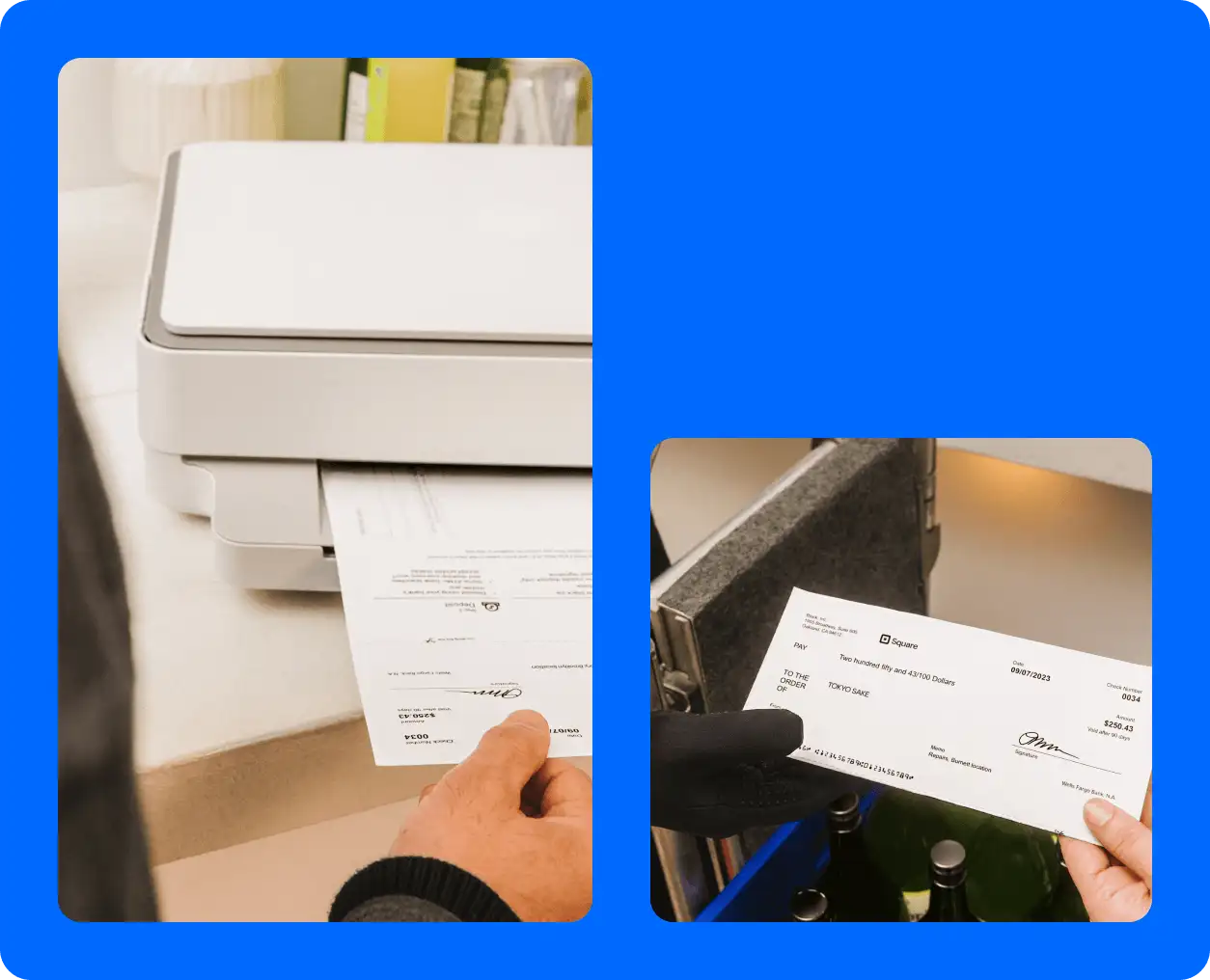

Pay bills with your debit card, via account and routing numbers, bank transfer, or send payments for expenses with Square Bill Pay.

Learn more

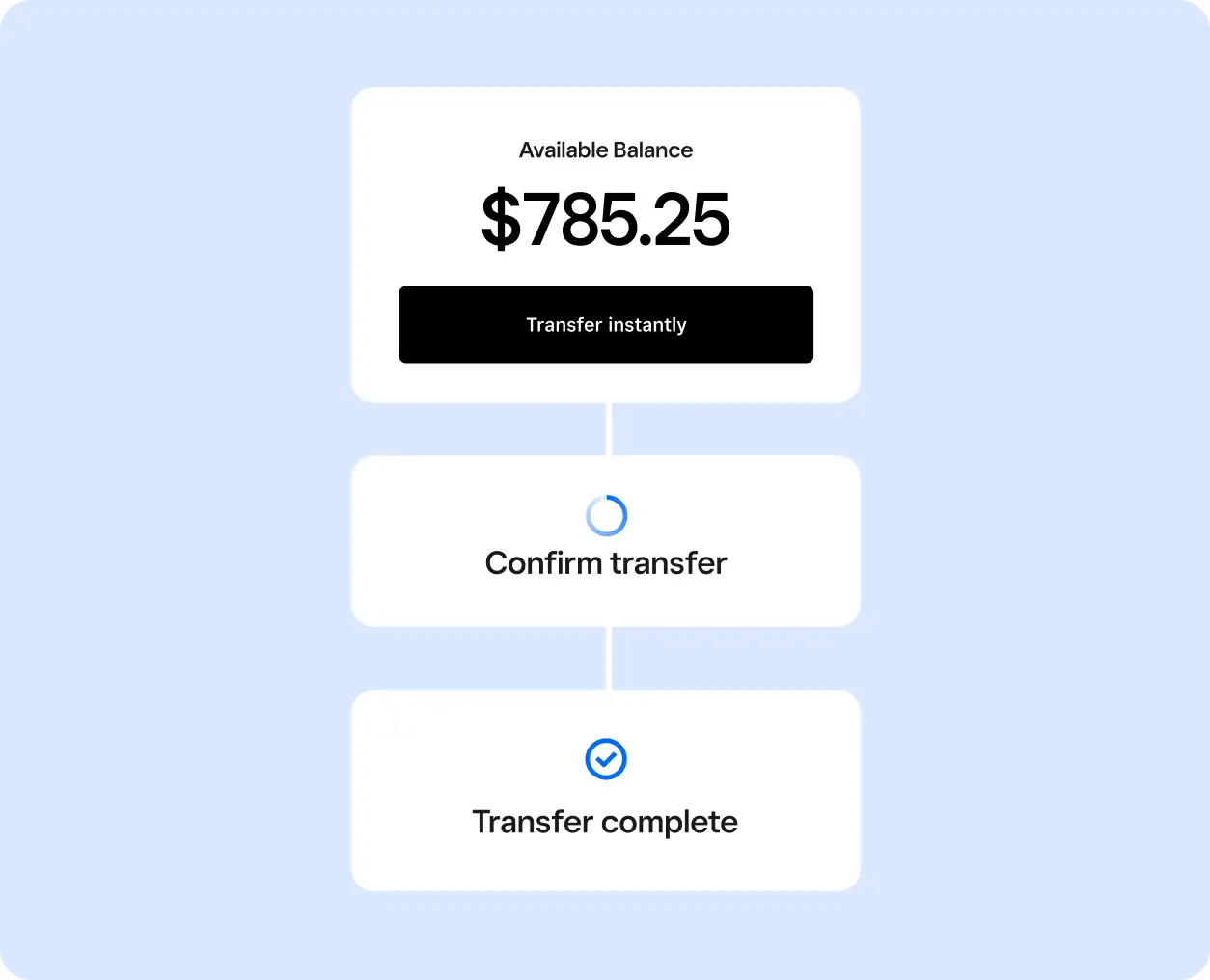

Transfer funds instantly to an external bank account for a 1.75% fee — even on weekends and holidays.¹

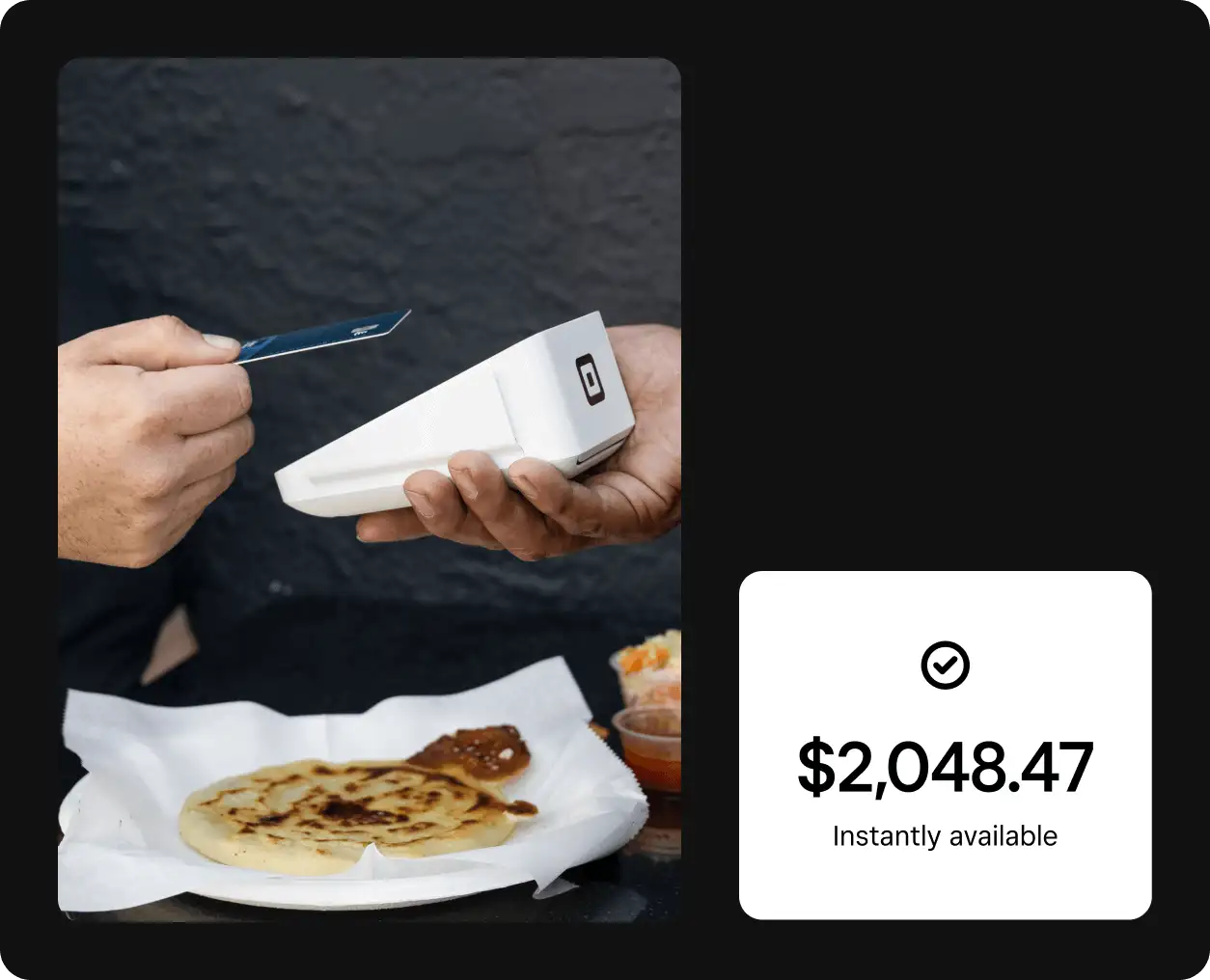

Learn moreAs soon as you make a sale, the money hits your account — you also get accelerated access to earnings made outside of Square.²

Ways to add funds

Instantly access the sales you make with a Square Checking account — no waiting.

Earn money outside of Square? Automatically receive deposited funds up to 2 days faster.²

Learn more

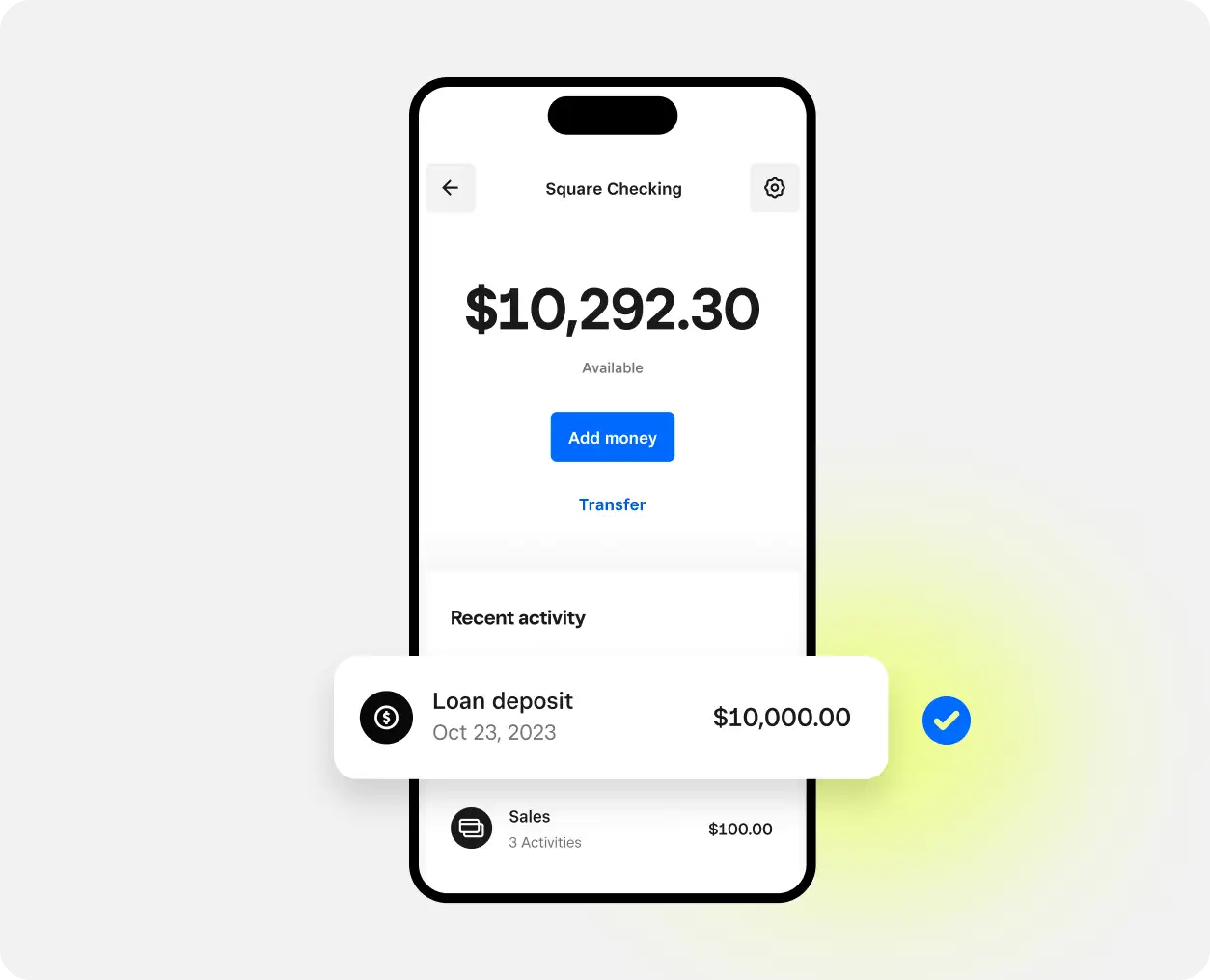

Once approved for a Square loan, access it in your Square Checking account instantly.

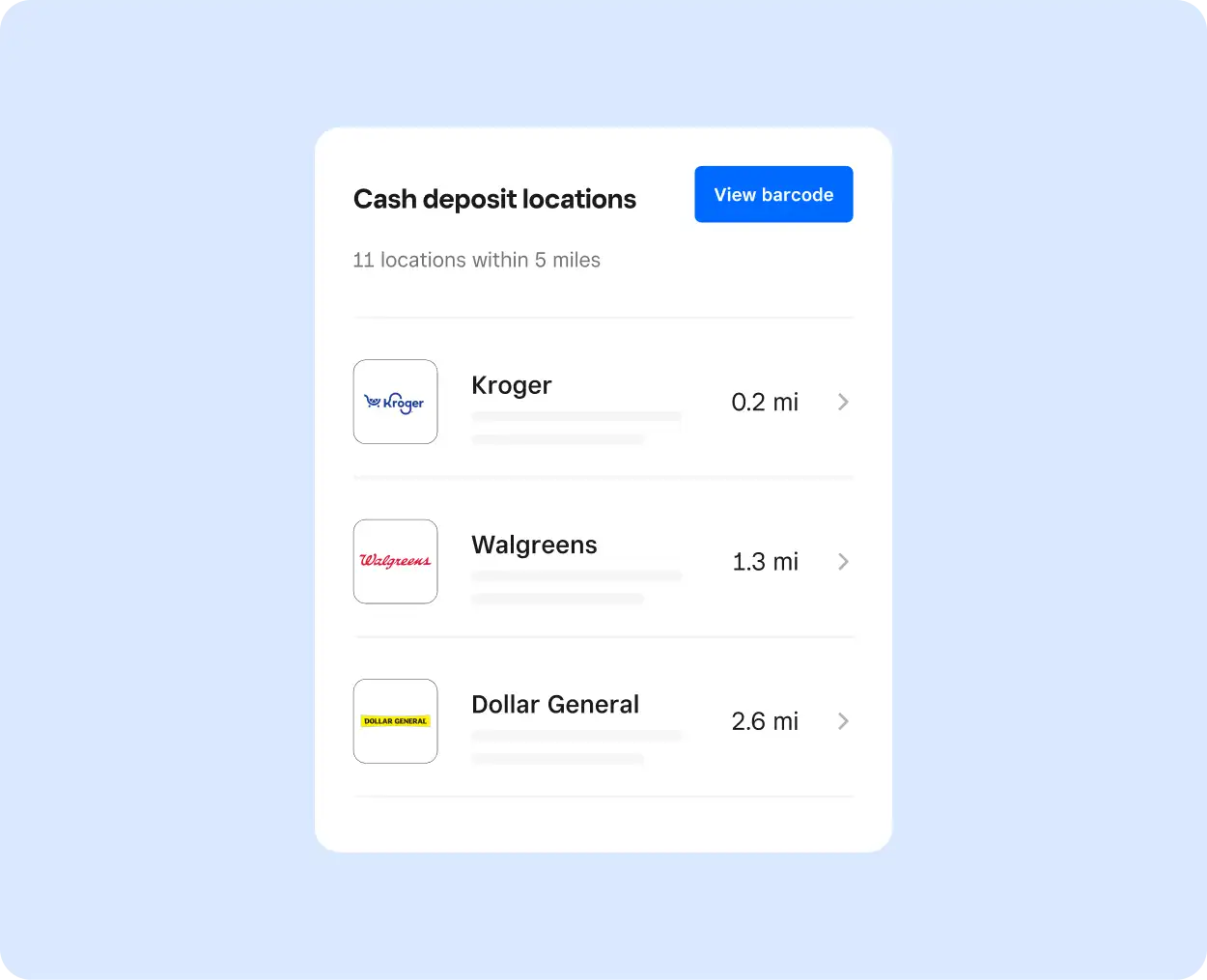

Easily add cash to your account for free at nearby stores, like Kroger®, Walgreens, Dollar General, and more. Deposits are available in minutes.³

Learn moreGet access to reports that break down sales and visibility into spending from your Square dashboard and POS.

Make the best decisions for your business

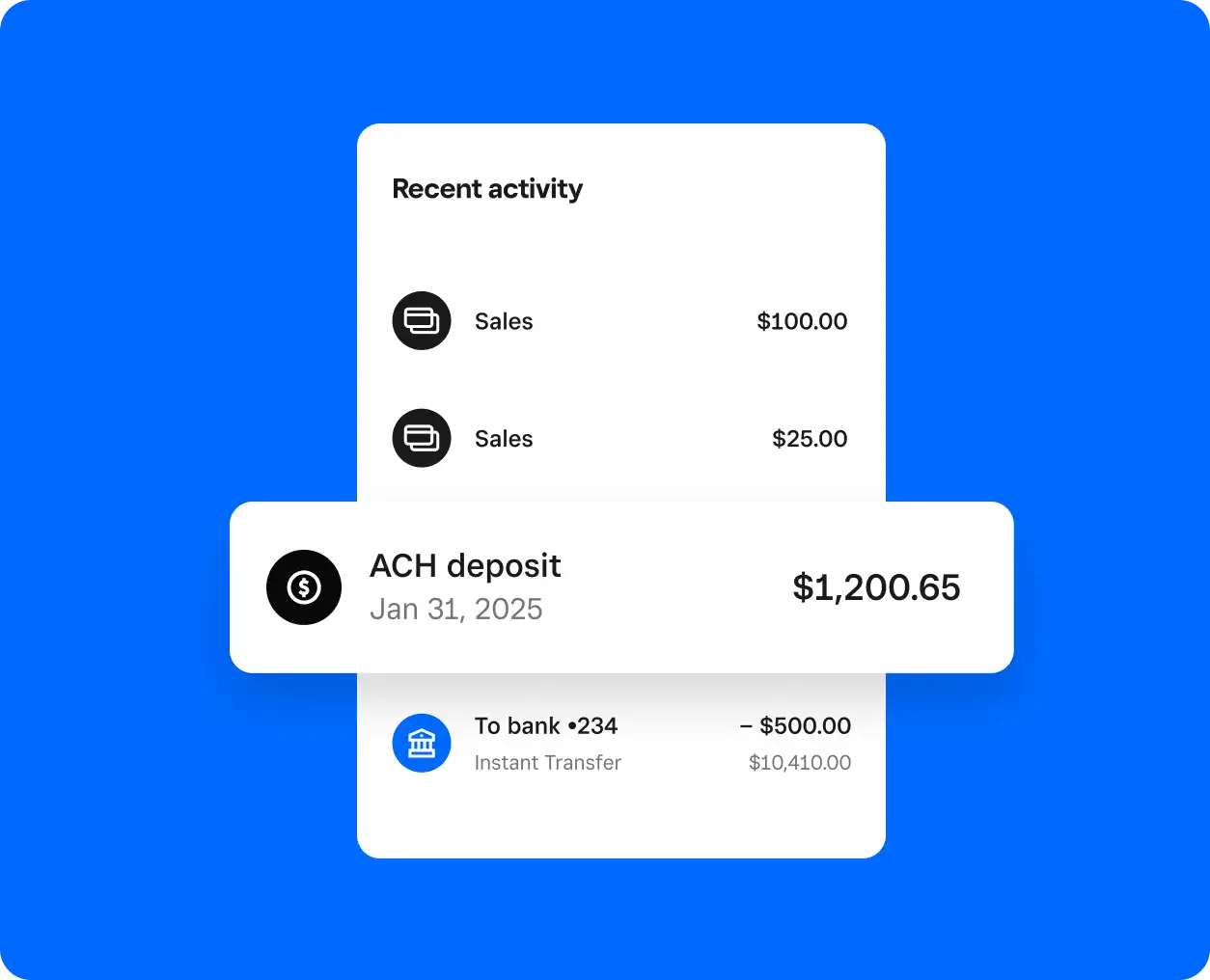

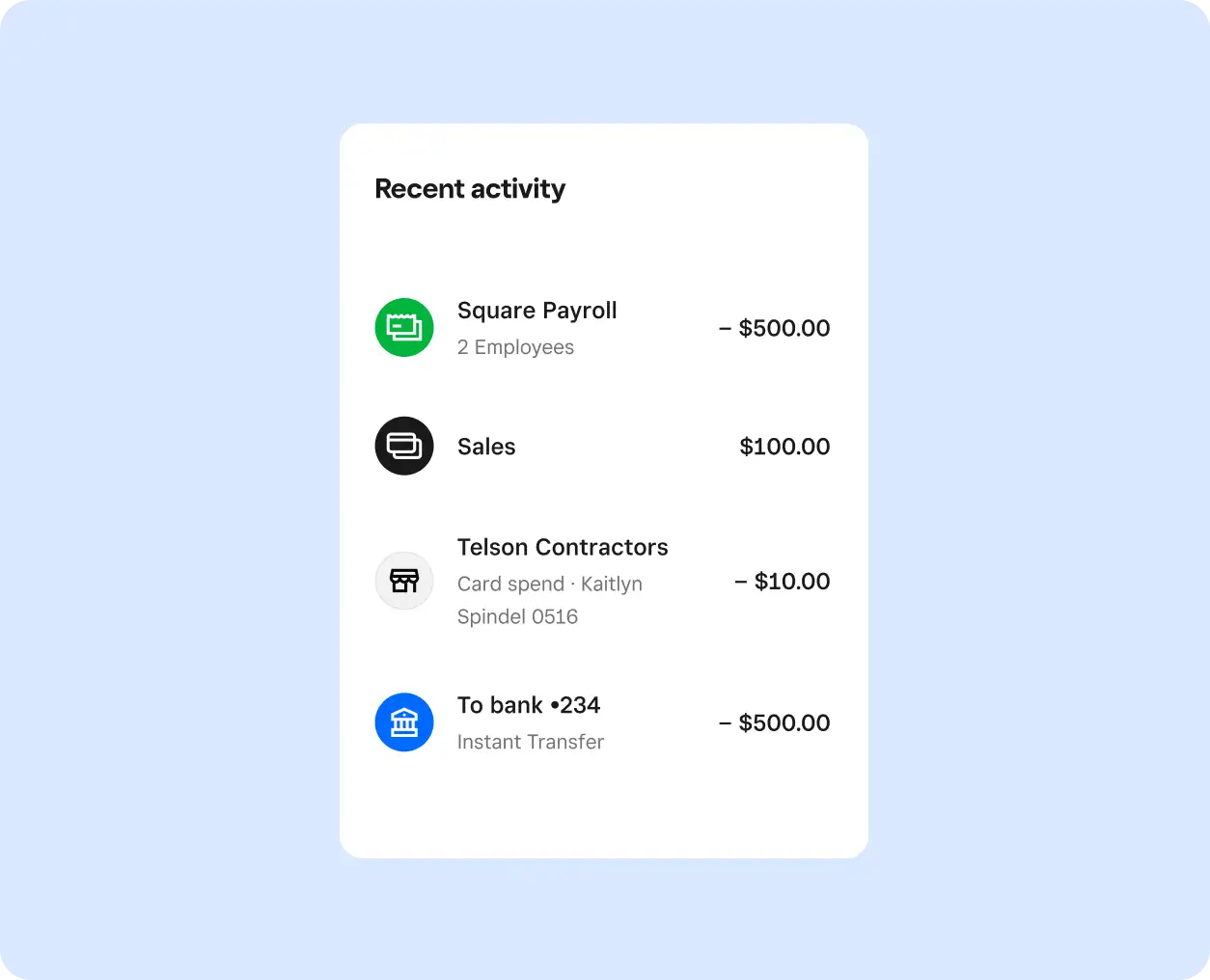

View sales and spending all in one place with simplified in-app and dashboard banking reporting and activity.

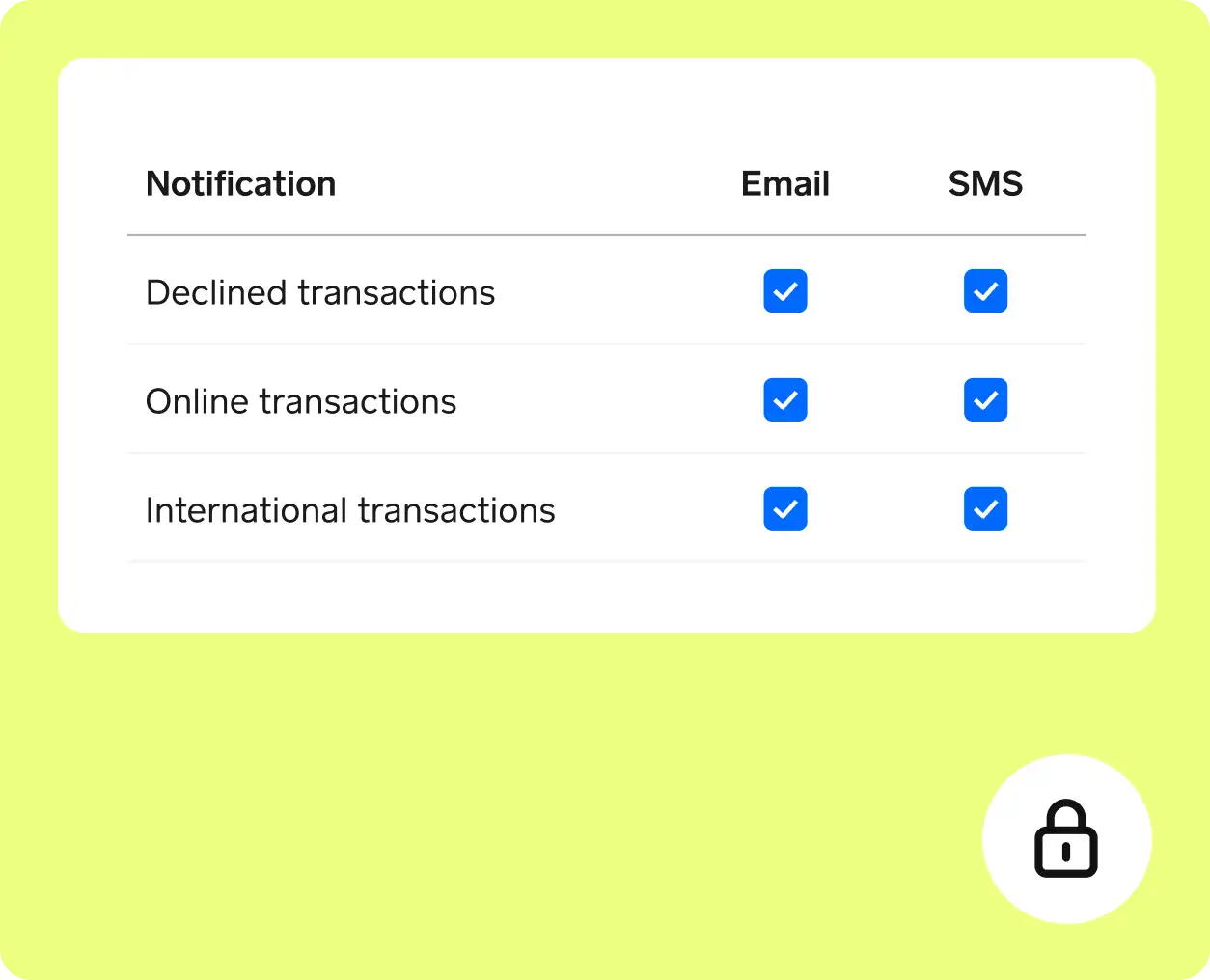

Help safeguard your funds with high-risk spend alerts, SMS alerts, 2-step verification, and card lock.

Learn more

Your deposits are FDIC-insured up to $250,000.*

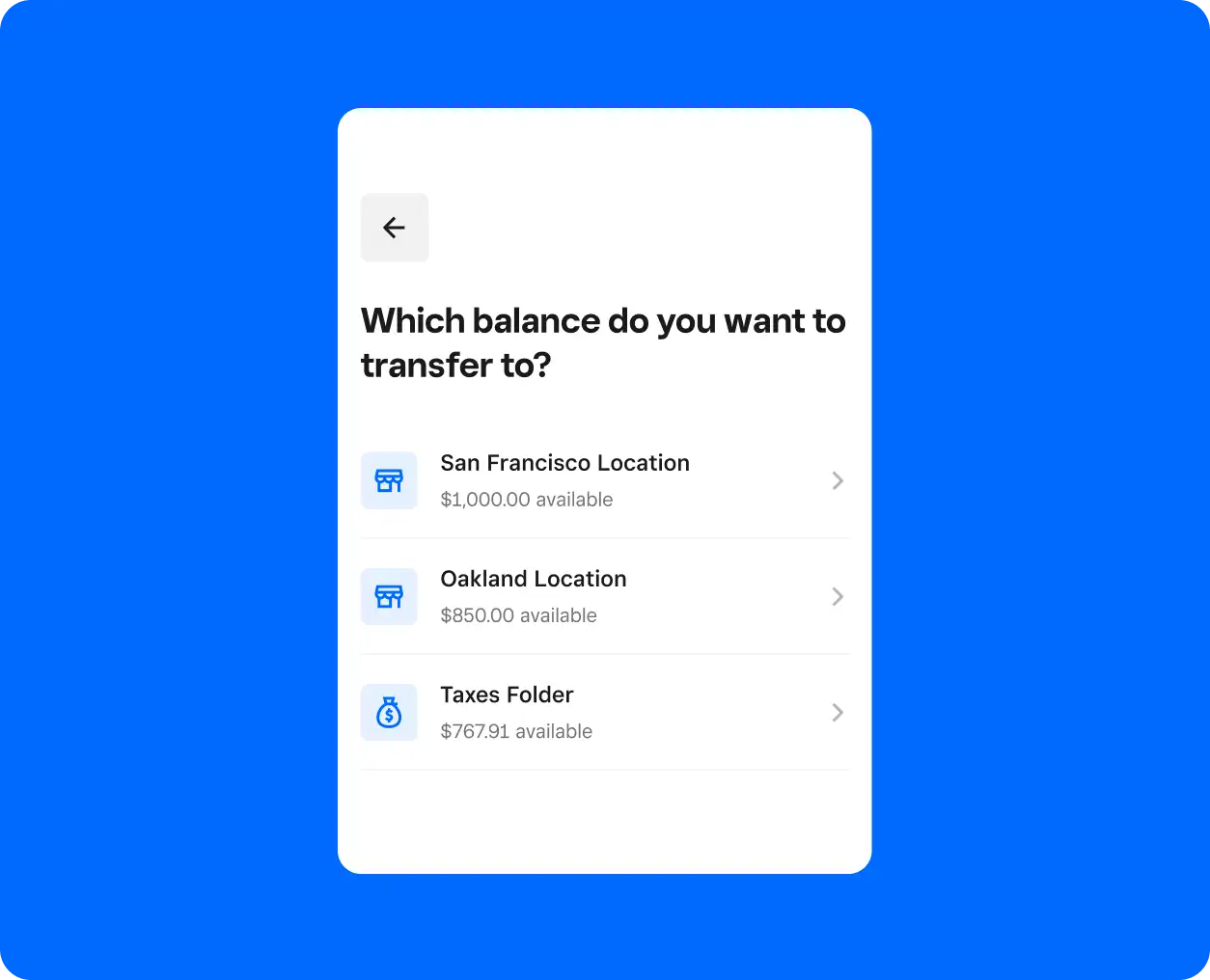

Easily transfer funds instantly across multiple Square Checking and Square Savings⁴ accounts for better budgeting and control over cash flow.

With Square Debit Card, your Square sales are automatically ready to spend — digitally or in person.

![checking-2023-q4 money-out - Square Debit Card image]()

Get up to 5 debit cards for your business to share spending power with your team.

![PD06198 Features MoneyOut DebitCardsForYourTeam US-EN-US-ES]()

Add your Square Debit Card to Apple Pay® or Google Pay™ and use your digital wallet to pay online, in app, or in person right away.

![checking-2023-q4 - money-out - digital wallet image]()

Pay bills with your debit card, via account and routing numbers, bank transfer, or send payments for expenses with Square Bill Pay.

![checking-2023-q4 - money-out - Pay Bills image]()

Transfer funds instantly to an external bank account for a 1.75% fee¹ — even on weekends and holidays.

![PD06198 Features MoneyOut 4InstantTransfers US-EN]()

Instantly access the sales you make with a Square Checking account — no waiting.

![checking-2023-q4 - money-in - InstantAccess image]()

Earn money outside of Square? Automatically receive deposited funds up to 2 days faster.²

![checking-2023-q4 - money-in - EarlyDepositAccess image]()

Once approved for a Square loan, access it in your Square Checking account instantly.

![checking-2023-q4 - Money In - Square Loan image]()

Easily add cash to your account for free at nearby stores, like Kroger®, Walgreens, Dollar General, and more. Deposits are available in minutes.³

![checking-2023-q4 - Money In - CashDeposits]()

View sales and spending all in one place with simplified in-app and dashboard banking reporting and activity.

![checking-2023-q4 - Manage - CashFlowActivity image]()

Help safeguard your funds with high-risk spend alerts, SMS alerts, 2-step verification, and card lock.

![checking-2023-q4 - Manage - SecurityFeatures image]()

Your deposits are FDIC-insured up to $250,000.*

![checking-2023-q4 - Manage - FIDCInsurance image]()

Easily transfer funds instantly across multiple Square Checking and Square Savings⁴ accounts for better budgeting and control over cash flow.

![checking-2023-q4 - Manage - TransferBetweenAccounts image]()

Free of the usual account fees

| Square Checking | Other banks | |

|---|---|---|

| Square sales instantly funded | Yes; free | Not offered |

| Monthly service or maintenance fees | $0 | $10-$16 per month or min. deposit required |

| Minimum opening deposit | $0 | $1-$1,500 |

| Overdraft fees | N/A | $35 per item |

| Minimum balance requirement | $0 | $500-$5,000 |

| Foreign transaction fee | $0 | 1%-3% |

| ATM fees | $0 charged by Square. ATM operator fees may apply | $3-$5 plus ATM operator fees |

Cash flow at your fingertips

Make purchases for your business and cover expenses with Square Debit Card. Your Square sales are automatically (and immediately) ready to spend with your card — digitally or in person.

Your sales and banking. Working in harmony.

When you process payments and bank with Square, cash flow management is simplified and seamless.

Hear from business owners like you

FAQ

Signing up for Square Checking and Debit Card is easy and takes less than two minutes! First, you need to sign up to sell with Square. Then, opening your checking account is only a few more steps.

- Go to the Balance applet in your Square Point of Sale app or Dashboard and select Square Checking

- Select Open account

- Verify your information

- Personalize your business debit card

- Confirm the shipping address for your business debit card

We recommend that you add your debit card to Apple Pay® or Google Pay™ as soon as you open your checking account, so you can start using your money while you wait for your physical card to arrive. Add your debit card to Apple Pay or Google Pay

No, we do not charge any recurring fees for Square Checking — no minimum balance fees, no services fees, no monthly maintenance fees, no overdraft fees. Square does not charge ATM fees, but third-party ATM operator fees may apply.

No, we do not have any account minimum balance requirements. There are no account opening minimum balances and no ongoing monthly balance requirements.

As soon as you finish opening your account, you can start using it right away on your Square Point of Sale app or Dashboard.

Square, Inc. is a financial services company, not a bank. Square Checking is provided by Sutton Bank, Member FDIC.

Get the checking account made for Square business owners

Sign up for Square Checking in just 2 minutes.

Skip the daunting paperwork.